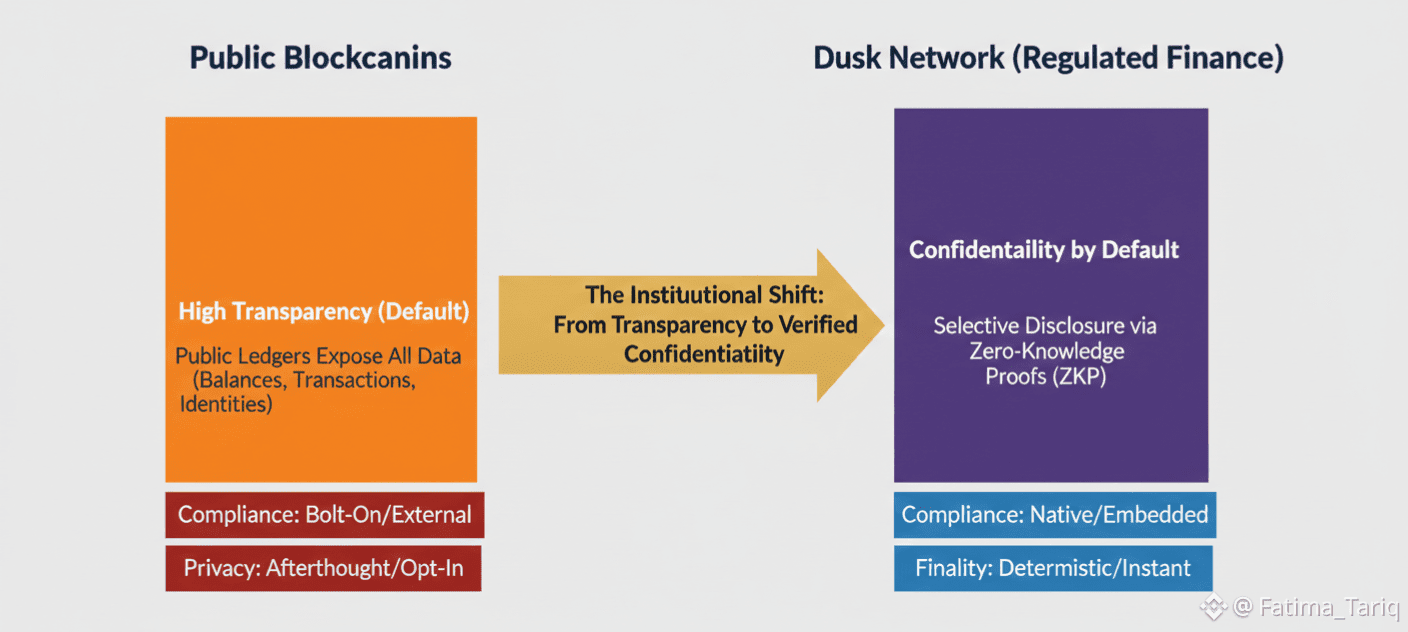

The moment I realized that “regulated DeFi” isn’t just a buzzword didn’t come from a whitepaper. It came from watching how quickly things fall apart when real money crosses borders. A trader friend once tried to settle a straightforward private deal using a stablecoin. The logic was simple: instant transfer, no banks, no friction. In practice, it stalled immediately. The recipient couldn’t accept the funds without answering uncomfortable questions—where did the money come from, was it compliant, and how would they later justify it to a bank? In the end, they routed everything through traditional rails anyway.That’s the reality most crypto narratives gloss over. Speed alone isn’t enough. Regulated finance needs privacy, rules, proofs, and accountability—simultaneously. That tension is exactly where Dusk Network positions itself, and it’s why the project attracts a different kind of attention from traders and long-term investors.Dusk isn’t trying to be a generic Layer 1. It’s positioning itself as infrastructure for regulated financial markets, where privacy isn’t about evading oversight but about protecting sensitive financial activity while still meeting compliance requirements. That distinction matters. Most people hear “privacy” and think of anonymity. Dusk’s version of privacy is closer to how traditional finance actually works: disclosure on a need-to-know basis.At the heart of the problem is a contradiction baked into public blockchains. Transparency is a feature—but financial markets aren’t built on radical transparency. Your bank balance isn’t public. Your portfolio isn’t public. Your trade sizes aren’t public. Even in heavily regulated systems, information is compartmentalized. Auditors, regulators, counterparties, and institutions see what they’re entitled to see—no more, no less. Public blockchains flipped that model by exposing everything to everyone. That worked for early crypto culture, but it breaks down the moment you talk about tokenized securities, bonds, or institution-grade settlement.Dusk’s core bet is that the next phase of on-chain finance won’t be fully public DeFi—it will be regulated markets moving on-chain with privacy embedded at the protocol level.

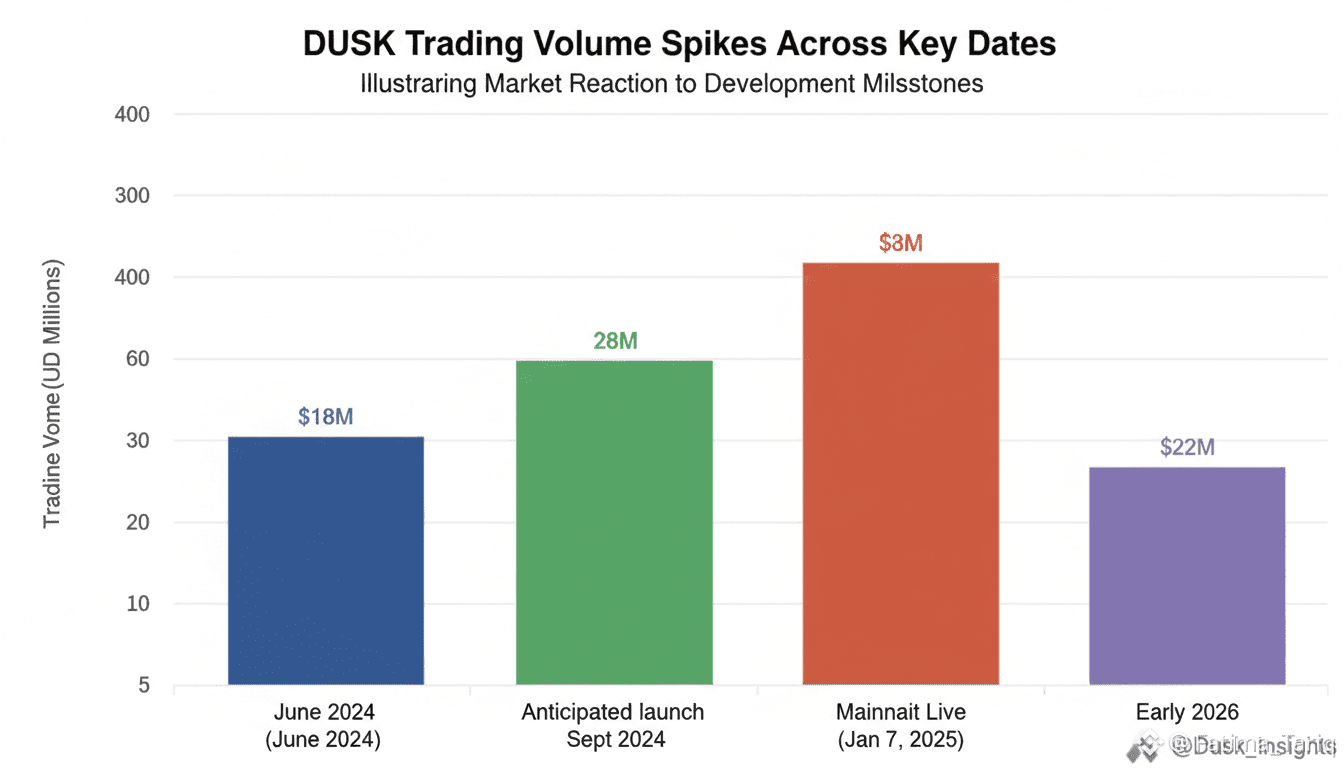

The key concept here is selective disclosure. Instead of treating privacy as total secrecy, Dusk focuses on confidential transactions that remain provably valid. Participants can demonstrate compliance without revealing sensitive data like identities, balances, or trade sizes. In other words, you can prove the rules were followed without exposing the underlying details.This framing becomes increasingly relevant as regulation matures. Regulation isn’t disappearing—it’s becoming clearer. In Europe, the MiCA framework has pushed projects to confront the reality that privacy and compliance must coexist. Dusk has openly argued that regulated DeFi requires KYC—but enforced cryptographically, not through public exposure. Identity checks happen, but the data itself stays private. That’s not an ideological compromise; it’s a practical requirement if institutions are ever going to use blockchain rails.Dusk’s development path reflects that reality. This hasn’t been a fast sprint from idea to production. In June 2024, the team confirmed a mainnet date of September 20, positioning it as a major milestone for a protocol designed around privacy and compliance. The rollout later evolved into a phased approach, with reporting in early 2025 pointing to January 7, 2025 as the moment the network began producing immutable blocks. Regulatory considerations played a visible role in pacing that transition.From a trader’s perspective, this kind of timeline is revealing. Many crypto projects rush to mainnet to capture hype. Dusk can’t afford that approach because regulated finance doesn’t move on crypto time. Adoption is slow, gated, and relationship-driven. But if it works, the payoff isn’t speculative—it’s structural. Becoming the settlement and issuance layer for compliant, private financial assets creates stickiness that hype-driven ecosystems rarely achieve.That’s why Dusk keeps showing up in conversations around RWAs and tokenized securities. Tokenization is gaining momentum, but institutions don’t want their flows broadcast on a public ledger. They want confidentiality with auditability.

Dusk’s approach—confidential transactions with verifiable compliance—targets that exact requirement, allowing validators to enforce rules without learning sensitive details.Partnerships matter here, but they need to be interpreted carefully. Collaborations involving Dusk, NPEX, and Cordial Systems—aimed at bringing stock exchange infrastructure on-chain—fit the thesis. Whether these efforts scale into production markets or remain pilot programs is the real question investors should track. In regulated finance, pilots can take years to mature. Still, the direction is consistent: Dusk is building for infrastructure, not retail narratives.From a market standpoint, DUSK remains a relatively small-cap asset compared to major Layer 1s, which naturally makes it volatile. As of early 2026, it has traded around the mid–$0.10 range, with market cap estimates hovering roughly in the $80–$90M range depending on timing and source. Supply metrics and volume spikes suggest that DUSK can become highly tradable when attention returns—but price action alone doesn’t capture the full story.The real investor question isn’t whether DUSK will pump. It’s whether its niche expands. Regulated private finance sounds narrow until you remember how large the regulated world actually is. Crypto culture often treats regulation as an obstacle. In practice, regulation determines where serious capital is allowed to flow. If tokenized assets and compliant on-chain markets are inevitable, then platforms built around privacy plus compliance start to look less like edge cases and more like foundational middleware.My view is straightforward. Dusk is one of the few projects whose thesis doesn’t rely on retail excitement. It relies on whether institutions actually want blockchain settlement without sacrificing confidentiality. That’s a slower path, and it won’t satisfy traders looking for constant catalysts. But if you evaluate it honestly, you should think of Dusk as infrastructure. Progress shows up in integrations, pilots, and market structure shifts—not just in hype cycles.