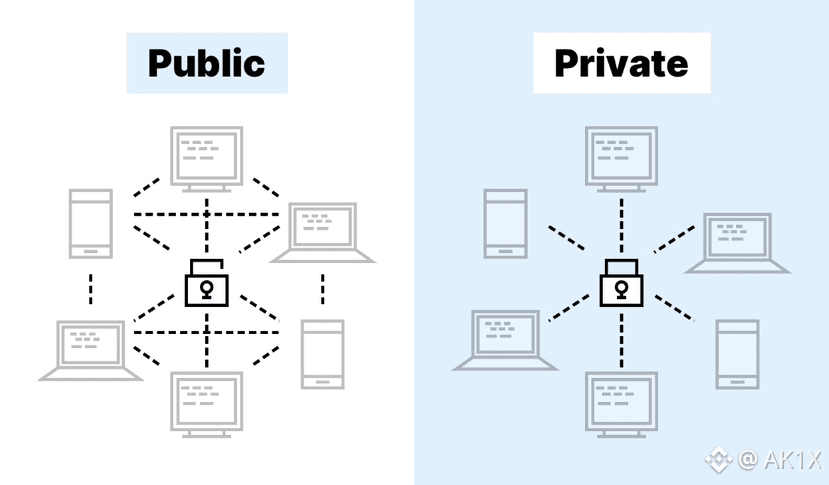

Blockchain technology promised a future where financial systems are faster, cheaper, and fairer. But most public blockchains show everything transactions, balances, and contract logic to the whole world. While this works for retail users, it creates serious problems for real finance. Banks, funds, and regulated institutions cannot expose private data publicly. This is where Dusk Network comes in.

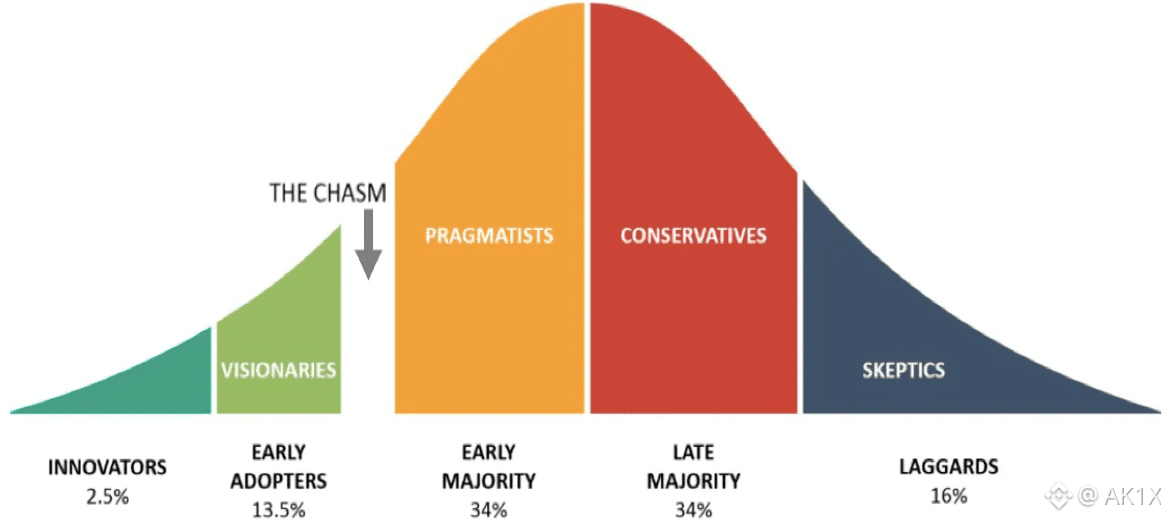

Dusk is a Layer-1 blockchain built specifically for regulated finance. Its goal is to let institutions issue, trade, and settle real-world assets like securities, bonds, and other financial instruments on the blockchain while still following the law. This means it helps financial players adopt blockchain without sacrificing privacy or compliance.

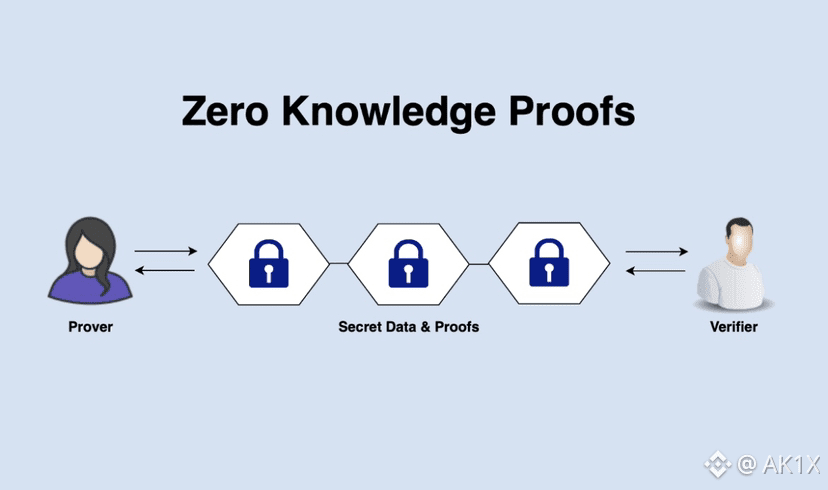

One of the major ways Dusk does this is through advanced privacy technology. It uses zero-knowledge proofs (ZKPs) so that transactions and smart contracts stay private, yet the network can still prove that all rules were followed. In simple terms: the blockchain can confirm that everything’s valid without showing the details to everyone. This is essential for regulated environments where data must stay secure but verifiable.

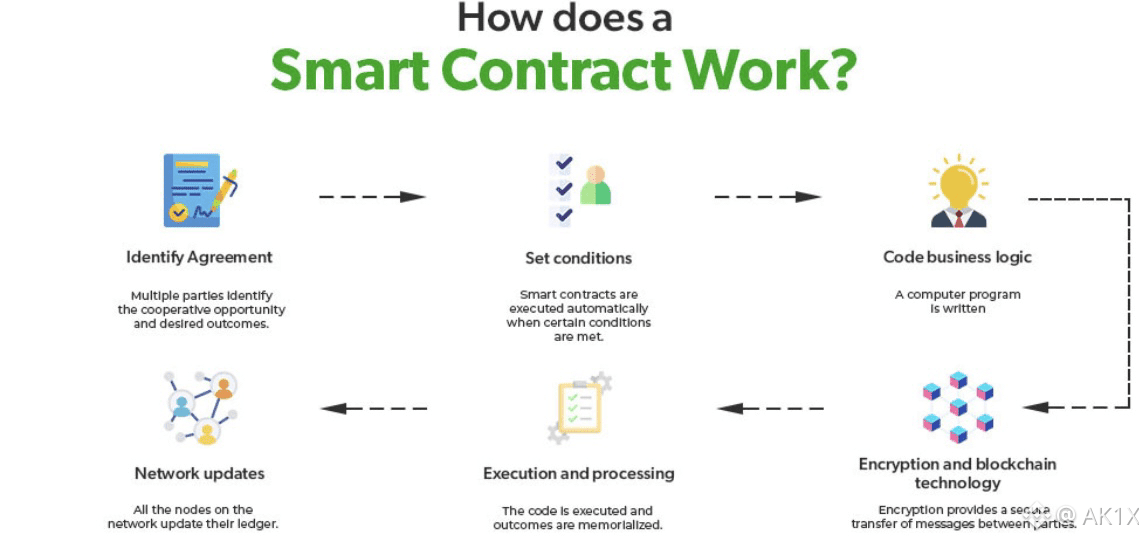

Another unique feature is Dusk’s Confidential Smart Contracts (XSC). These are contracts that can execute complex financial logic such as issuing tokenized securities without revealing sensitive data to the public. Traditional smart contracts expose all information, but Dusk’s confidential standard lets institutions automate compliance, trading, and corporate actions privately and securely.

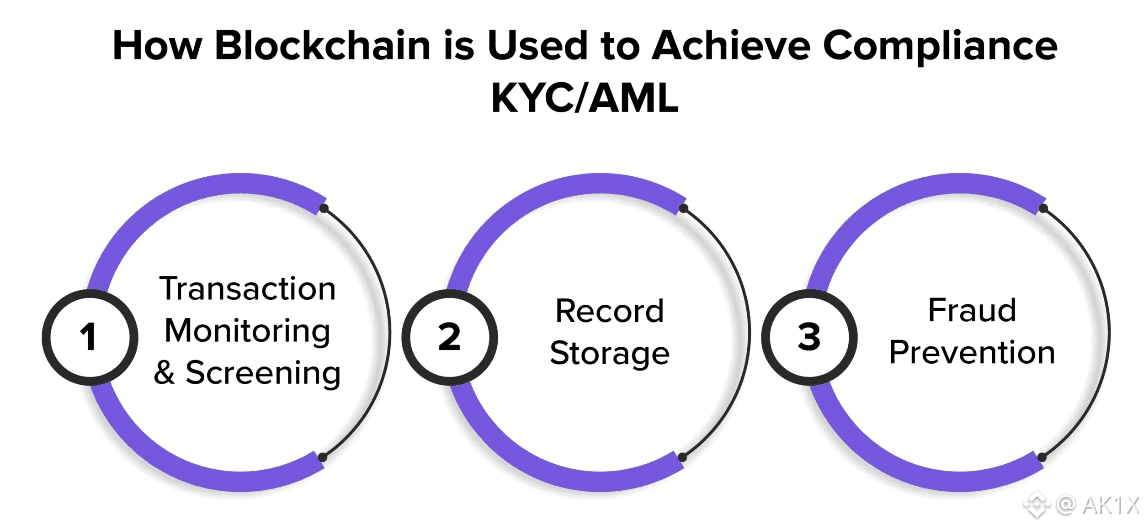

Dusk also supports on-chain compliance with real regulations like MiFID II and MiCA, especially in Europe. This is important because most financial markets have strict rules about reporting, transparency, and fraud prevention. Dusk’s protocol is built so these rules can be embedded directly into the system, rather than added on later.

A major problem in finance today is that systems are slow and siloed. For example, settlement in traditional markets can take days and involve many intermediaries. Dusk’s blockchain enables faster, final settlement that is auditable yet private, reducing cost and risk. Because everything is done on a shared ledger with clear rules, institutions can operate with more efficiency and trust.

Beyond privacy and compliance, Dusk also aims to make real-world asset tokenization practical. Tokenization means representing real assets like corporate bonds or property on the blockchain. Dusk’s architecture supports this by enabling regulated issuance, transfer, and lifecycle management of such assets in a compliant way. This opens up the possibility of broader participation in financial markets, increased liquidity, and new financial products that were previously difficult or costly to manage.

In summary, Dusk is not built for generic crypto use or quick speculation. It is crafted to bridge the gap between traditional finance and blockchain technology. By prioritizing privacy, compliance, and real financial needs, Dusk helps institutions adopt blockchain while meeting legal requirements and protecting sensitive data.

This combination of privacy, regulatory readiness, and real finance tools makes Dusk a unique project with the potential to transform how institutions interact with blockchain technology.