By mid-2026 stablecoins have crossed the line from niche experiment to genuine infrastructure. The numbers tell the story plainly: monthly transfer volumes routinely hit the multi-trillion mark, remittances flow faster through digital rails than legacy wires, corporate treasuries experiment with on-chain dollar holdings, and payment companies quietly settle invoices in tokenized USDT rather than waiting days for correspondent banks. The shift is no longer hypothetical. When the dominant use case becomes moving stable value quickly, cheaply, and reliably at global scale, the blockchain that solves that problem best starts looking like the next logical layer of money itself. Plasma is making a serious case that it could be that layer.

Let us break it down for anyone still getting comfortable with the basics. Layer 1 means the foundational blockchain where blocks are produced, transactions are finalized, and the rules of the game are enforced Plasma chooses proof-of-stake, so people who believe in the network lock up tokens to run validators Those validators propose and attest to new blocks, earning rewards when they behave correctly and losing stake when they do not. The native token $XPL is the fuel for staking, the currency for non-sponsored fees, and the mechanism that keeps the whole system economically aligned. What separates Plasma from dozens of other chains is the single-minded focus on stablecoins as the primary workload.

Fees are the first place the difference shows up. Sending a few hundred dollars of USDT on many networks means first buying a handful of the chain's native coin to pay gas. Miss that step and the transaction fails. Plasma flips the script with a protocol-native paymaster that automatically covers the cost for standard USDT transfers. The user sees zero extra balance requirement and zero extra steps. Behind the scenes, core contracts enforce strict eligibility rules, apply rate limiting, and lean on efficient verification so the sponsorship cannot be gamed at scale. For someone new to crypto this removes one of the most frustrating onboarding hurdles. You hold stablecoins, you send stablecoins, end of story. Builders love it too because they can design wallets, merchant tools, and remittance apps where the end user never thinks about gas at all.

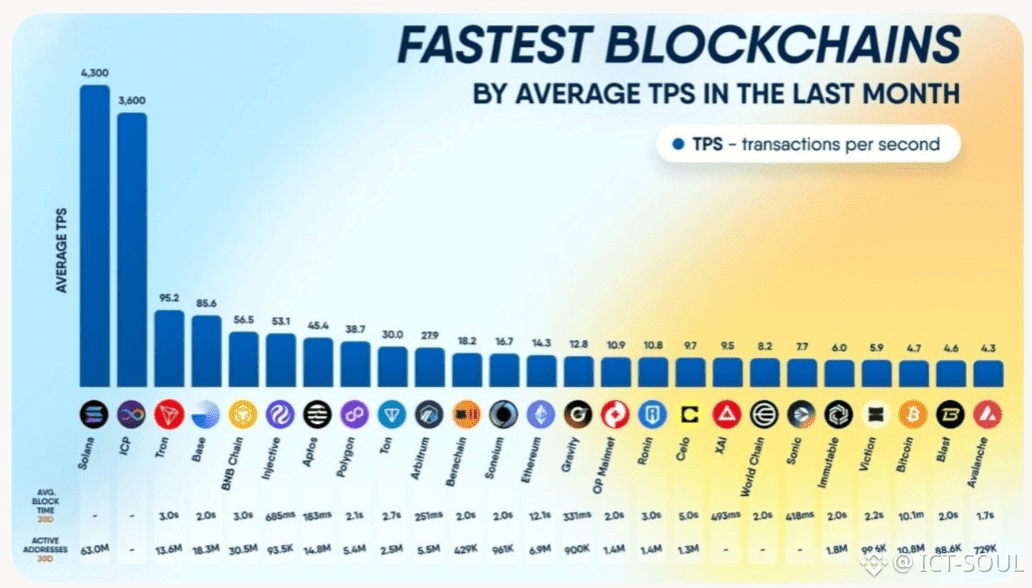

Speed matters just as much when money needs to move like money. PlasmaBFT is the consensus heartbeat. It takes the core ideas of high-performance BFT protocols and squeezes extra efficiency by overlapping phases that older designs handle sequentially. The practical result is finality landing in less than one second and consistent throughput north of a thousand transactions per second even under realistic network conditions. Beginners hear finality and think "once it says confirmed, it really is done." More technical readers understand the importance of liveness and safety guarantees under partial synchrony, the way the pipeline keeps latency low without sacrificing fault tolerance. In a world where payment finality directly affects business cash flow, that kind of performance stops being a nice-to-have and starts being table stakes.

Developer experience keeps the flywheel turning. Plasma uses a Reth-based execution engine that delivers full Ethereum Virtual Machine compatibility. If you have ever deployed a contract on Ethereum mainnet or any EVM sidechain, you already know the toolchain. Solidity, Vyper, Hardhat, Foundry, ethers.js, all of it works without modification. The stablecoin optimizations live underneath that familiar surface, so you get the best of both worlds: proven developer ecosystem plus purpose-built economics. Payment aggregators, automated treasury bots, yield-bearing stable wrappers, cross-border payroll engines, all of these become easier to ship because the chain already speaks fluent stablecoin.

Security gets a unique boost from Bitcoin anchoring. Every so often the Plasma state root is committed to Bitcoin through a decentralized set of verifiers that monitor both chains. Because Bitcoin remains the hardest target in crypto, rewriting Plasma history would require rewriting Bitcoin history, an astronomical lift. On the asset side, a trust-minimized bridge brings real BTC into the EVM environment without handing custody to anyone. That opens doors to BTC-collateralized loans, hybrid stable instruments, and other primitives that mix the oldest and newest layers of crypto. Institutions that care deeply about censorship resistance and decentralization find this combination reassuring.

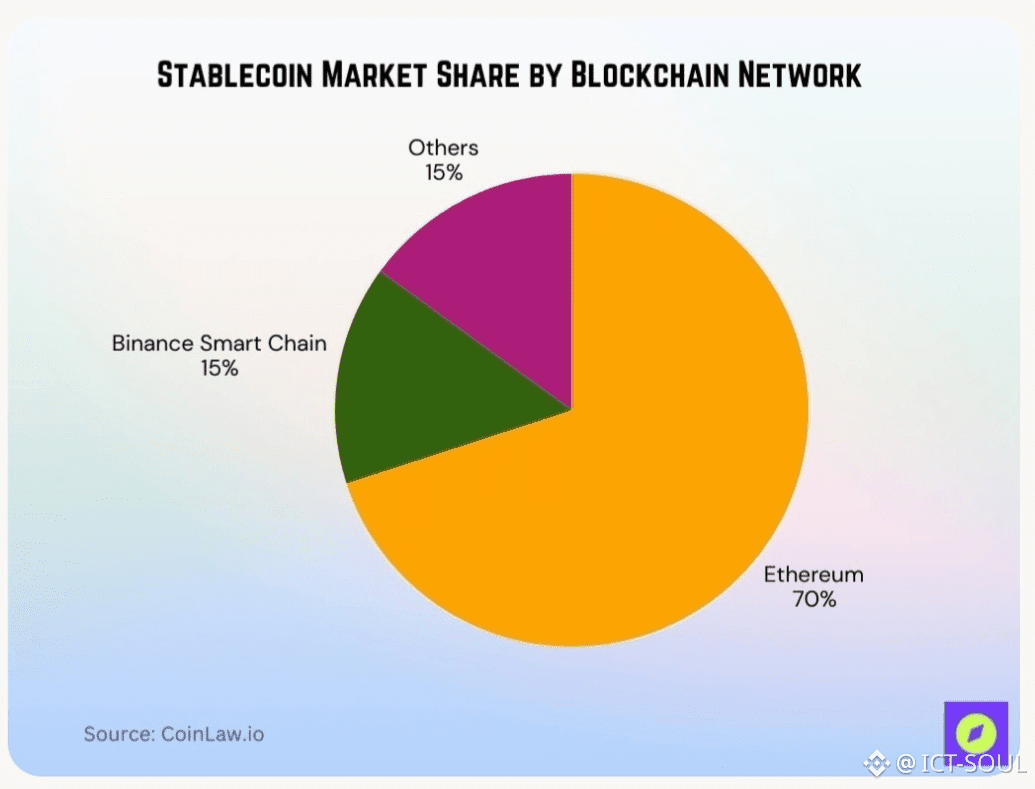

The macro environment in 2026 has turned favorable. Regulatory frameworks in major jurisdictions have clarified stablecoin issuance and operation, giving banks and fintechs more room to integrate tokenized cash into their stacks. Plasma launched with meaningful liquidity already in place billions in USDT and USDC depth across lending markets, automated market makers, and stable swap pools. That immediate liquidity means products can go live with real usage potential from day one instead of praying for organic depth to appear later. On-ramps and off-ramps through regulated partners further smooth the path between fiat and chain.

Privacy is the next frontier being tackled. Most blockchains expose every transfer amount, sender, and receiver to the public ledger. Plasma is building optional confidentiality directly into the stablecoin transfer path using techniques that stay within the standard smart contract model. Users can choose shielded transactions for personal privacy while retaining the ability to generate selective proofs for audits or compliance It is a measured approach that respects both individual preferences and regulatory realities in a maturing market.

Real activity is visible across the ecosystem. Wallet integrations are widespread, major centralized exchanges support the chain with healthy stablecoin pairs, and payment service providers run pilots for settlement. Stablecoin supply grows steadily without heavy reliance on short-term farming rewards. Lending protocols show consistent borrow demand, signaling genuine economic use rather than incentive chasing In places where currency volatility remains a daily concern, stablecoins have become a practical alternative, and Plasma's near-frictionless transfers make that alternative feel native rather than bolted on.

Economically $XPL draws strength from its utility role More stablecoin volume means more staking demand to secure the network, which tightens available supply and reinforces security Fee accrual from non-sponsored activity adds another layer of value capture. The design stays focused on sustainable usage rather than speculative narratives.

The bigger picture is a gradual realization that different workloads deserve different infrastructure. General-purpose chains are powerful but they spread their attention across countless use cases. When the overwhelming majority of on-chain economic activity is stable value transfer, a chain engineered specifically for that purpose gains structural advantages. Lower predictable costs, faster reliable finality, simpler user onboarding, deeper native liquidity, stronger institutional alignment. Plasma is not trying to be the chain for everything. It is trying to be the chain for the thing that matters most right now. That focused ambition may prove to be exactly what the next chapter of global finance requires. Keep watching @Plasma as the story unfolds. #Plasma $XPL