BNB has evolved beyond a simple exchange token into the backbone of a massive DeFi and RWA (Real World Asset) ecosystem.

Key Growth Drivers for 2026:

Institutional Adoption: With the "industrialization" of crypto in 2025, BNB Chain has become a primary hub for tokenized assets.

Burn Mechanism: The continuous "Auto-Burn" program keeps BNB deflationary. By 2026, the reduced supply against rising demand creates a "supply shock" scenario.

Ecosystem Expansion: BNB’s daily transactions now average between 15–18 million, cementing its place as the most used retail chain.

0G Price Outlook for 2026:

Recent technical analysis shows 0G stabilizing after its initial 2025 surge.

Short-term (Q1 2026): Consolidating around the $0.85 – $1.10 range.

2026 Target: Analysts project a potential move toward $2.35 – $2.70 as the "AI + DePIN" narrative matures and the 0G Mainnet ecosystem expands.

3. Strategic Summary for Binance Traders

To maximize gains in 2026, the play is a "Core and Satellite" strategy:

Core (BNB): Hold BNB to benefit from ecosystem growth, launchpool access, and reduced trading fees.

Satellite (0G): Allocate a portion to 0G to capture the high-beta upside of the Decentralized AI sector.

Risk Note: As of January 2026, Binance has shifted support for certain 0G network versions (specifically ERC-20). Ensure your assets are on the BNB Smart Chain to maintain full liquidity and avoid deposit issues.

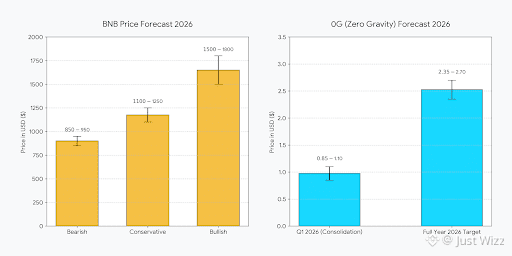

Chart Breakdown:

BNB (Binance Coin): The chart illustrates three distinct scenarios. The Bearish floor is set at $850–$950, while the Conservative growth target settles between $1,100–$1,250. In a Bullish breakout scenario—fueled by ecosystem expansion and the token burn mechanism—targets reach as high as $1,800.

0G (Zero Gravity): The forecast shows a two-stage trajectory. Following a Q1 Consolidation phase between $0.85–$1.10, the asset is projected to climb toward a 2026 Target of $2.35–$2.70 as its decentralized AI infrastructure gains mainstream enterprise adoption.

This data-driven outlook positions both assets as pillars of a diversified 2026 portfolio, balancing the high-utility stability of BNB with the aggressive growth potential of the AI-focused 0G network.$BNB $0G

#Write2Earn #Altseason #priceprediction #MarketRebound #TrendingTopic