Picture this: stablecoins are trying to make it in a world where a single misstep with regulators can bring everything crashing down. Most projects are busy just trying to keep their heads above water, but Plasma? It’s not just staying afloat—it’s actually steering toward mainstream acceptance. Plasma was built with regulation in mind from the start. It wants stablecoins to be the reliable, transparent backbone of digital finance. And with the right backers and some clever features, it manages to combine the flexibility of crypto with the discipline that institutions want.

From the get-go, Plasma understood what regulators would demand. It puts transparency and accountability first, but doesn’t squash creativity in the process. The system is set up so stablecoins run inside a framework that’s easy to audit. Transactions settle on-chain, leaving a clear, verifiable trail for anyone who needs to check. None of this is by accident. Plasma’s got some heavy hitters in its corner—Chris Giancarlo (former CFTC Chair and a guy who’s actually written the rules on digital assets), U.S. Treasury Secretary Scott Bessent, and tech leader David Sacks. These aren’t just names on a website—they’re real advisors who’ve shaped U.S. financial policy. They help Plasma stay ahead of new regulations, whether it’s Europe’s MiCA rules or the U.S. drive for clearer stablecoin guidelines. Then there’s Tether CEO Paolo Ardoino, which ties Plasma directly to the top stablecoin issuer. Tether just shrugged off an S&P Global rating change by showing off its strong reserves—exactly the kind of transparency Plasma is built for.

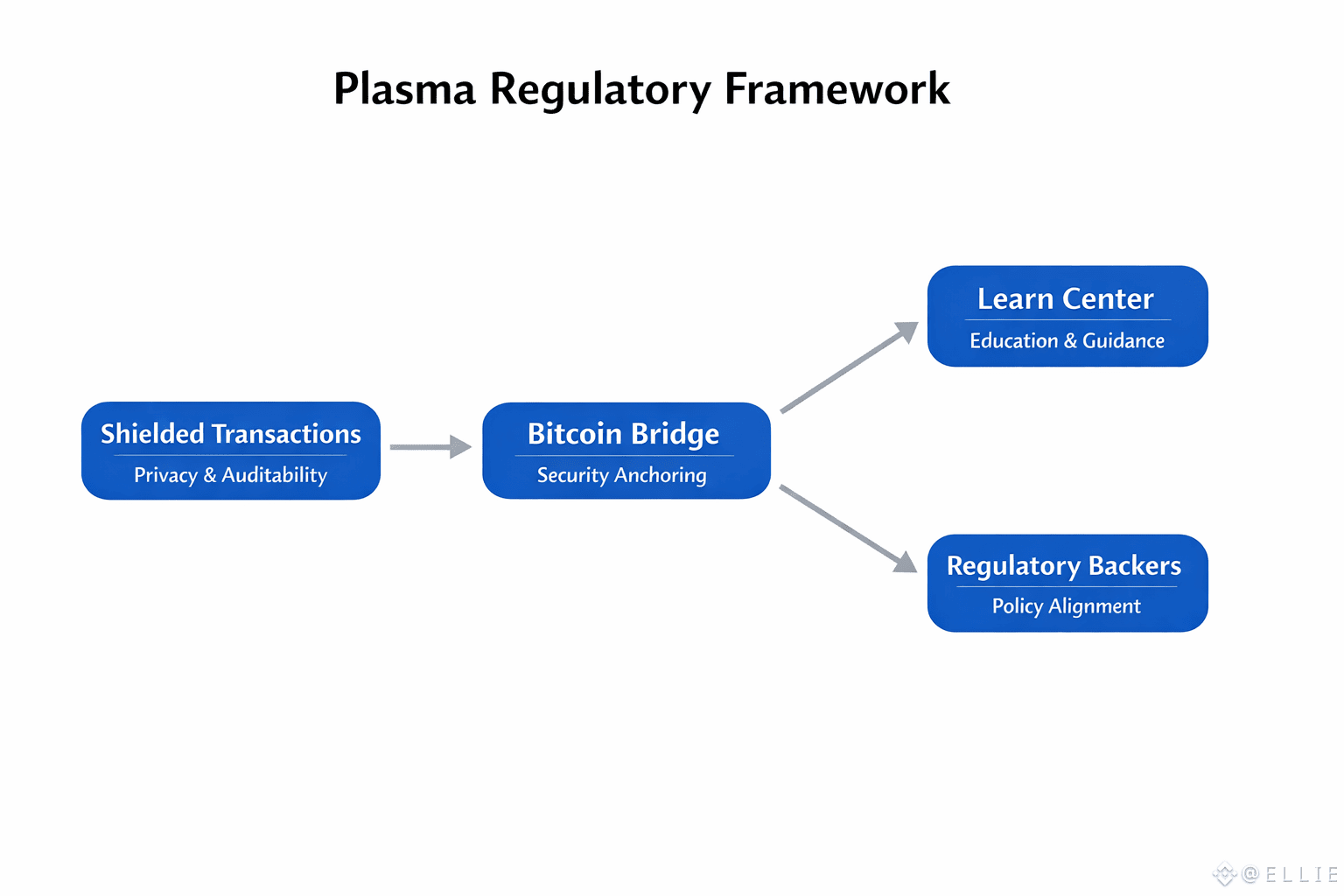

One of Plasma’s strongest moves is its shielded transactions. This gives companies real privacy—hiding sensitive details like transaction sizes or partners—while still letting regulators confirm everything checks out, thanks to zero-knowledge proofs. So, you get the best of both worlds: data stays protected (hello, GDPR), but anti-money laundering rules are still enforced. If you’re running a hedge fund, that means you can settle big trades without showing your hand. If you’re in remittances, you can prove your business is clean without exposing your customers. The custom gas model helps too, making fees predictable and often subsidized, which is a big deal if you’re trying to stay compliant in high-stakes finance.

The real glue holding it all together is Plasma’s native Bitcoin bridge. Here’s how it works: you lock up real BTC on the Bitcoin network, and Plasma mints equivalent tokens on its own chain. This way, you get Bitcoin’s legendary security and decentralization, right inside Plasma. Validators run the bridge directly, so you avoid the third-party risks that have tripped up other projects and attracted regulatory headaches. It’s a setup that builds trust and lines up with what regulators want—especially now that Tether holds more gold than any central bank, showing just how big stablecoins have become.

Plasma isn’t just building tech—it’s teaching, too. The new Plasma Learn Center is packed with guides on everything from how stablecoins are issued and backed, to how on-chain settlement works and what’s happening in the regulatory world. It breaks down the nuts and bolts, explains custody of fiat reserves, and even compares stablecoins to CBDCs. The goal? Make sure everyone from regulators to businesses to ordinary users actually understands what’s going on. You can see this shift across the industry—just look at Klarna’s new Klarna USD on Stripe’s blockchain, which is all about compliance from day one.

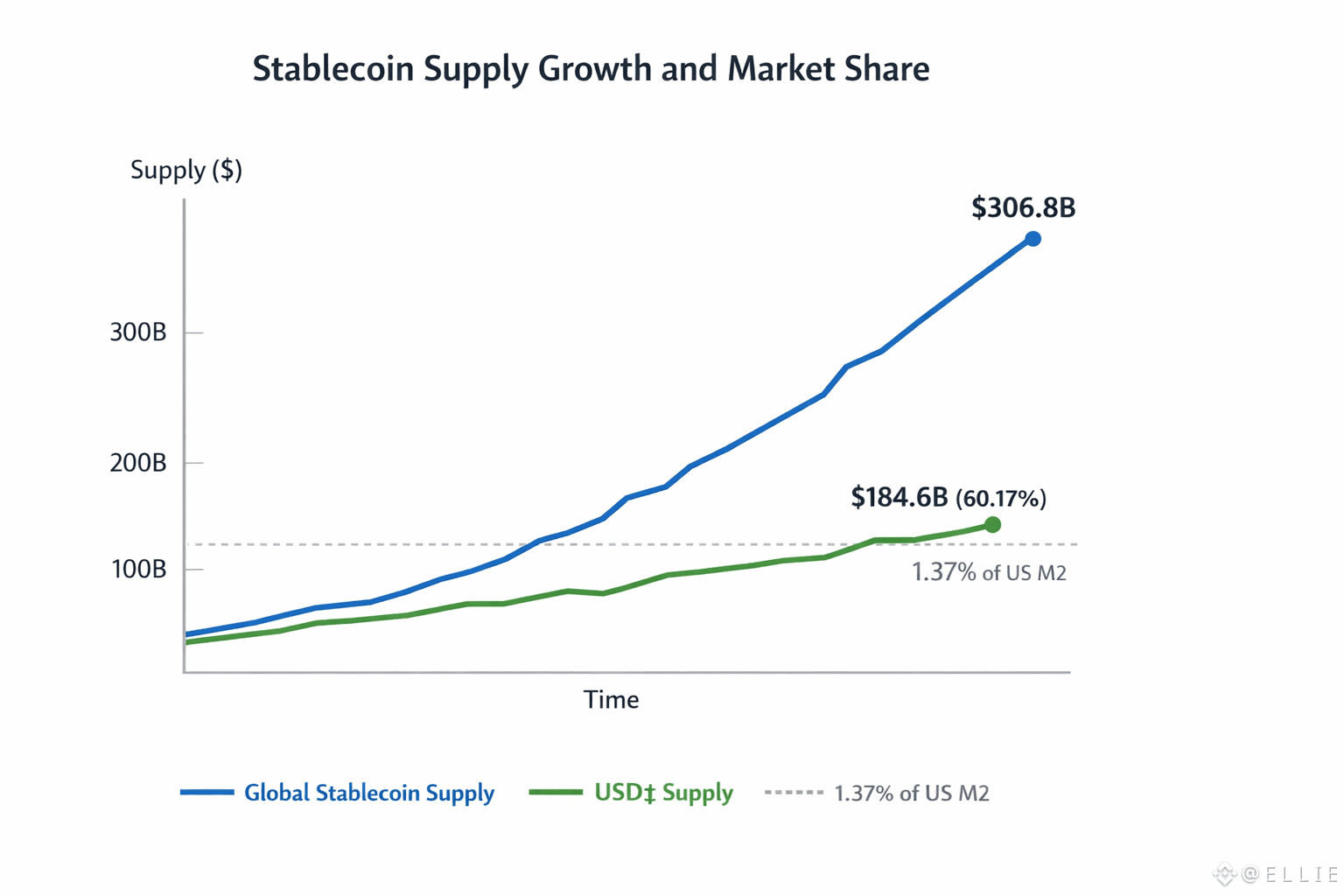

The numbers back this up. Plasma’s focus on regulation isn’t just talk—it’s driving real growth. It’s partnered with more than 100 custodians, exchanges, and fintechs, operating in over 100 countries, supporting 100+ currencies and 200+ payment options. There’s $7 billion in stablecoin deposits on Plasma across 25+ assets, making it the fourth largest network by USD₮ balance. The bigger picture? Global stablecoin supply is $306.8 billion, with Tether (USD₮) holding more than 60% of that—$184.6 billion, which is over 1.37% of the entire U.S. M2 money supply. Every month, stablecoins see $2.9 trillion in volume across 1.5 billion transactions, with 205.7 million wallets out there—120.8 million just for USD₮. Plasma’s regulatory-first approach isn’t just smart, it’s working.