Imagine trillions of dollars in real-world assets—stocks, bonds, even infrastructure—just sitting around in old, clunky systems. They’re stuck, waiting for something better. Dusk Network is stepping up, not with empty promises, but with real, proven tech that’s already helping institutions turn traditional portfolios into digital tokens. Right now, everyone’s talking about real-world assets as the next big thing in crypto, and Dusk’s approach actually delivers. They’ve built a system that moves fast, stays secure, and scales easily, completely changing how asset management works in the digital era.

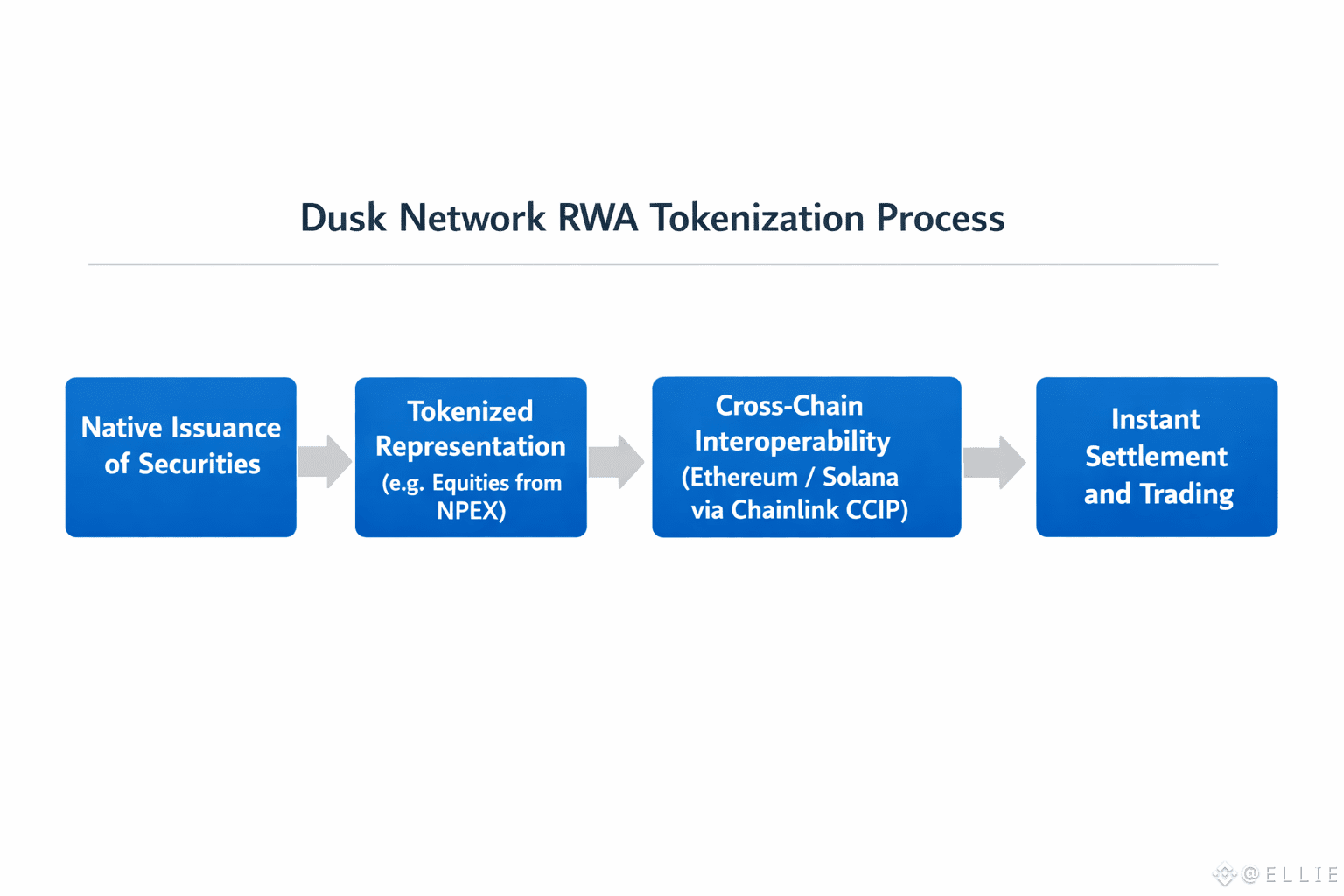

Since 2018, Dusk Network has been quietly building a Layer-1 blockchain that’s made for tokenizing real-world assets. The idea: create digital twins of things like stocks and bonds, so people can own and trade them on-chain without losing their rights or liquidity. This isn't some synthetic workaround—Dusk lets you issue securities natively on the blockchain. Stocks, bonds, whatever, start their life directly on-chain, with built-in tools for trading and settling. By cutting through the mess of legacy financial markets, Dusk opens up global capital to more people, especially smaller companies who’ve always been boxed out. Their design makes these new digital assets move as quickly as crypto, but with the trust and structure that regulated finance demands.

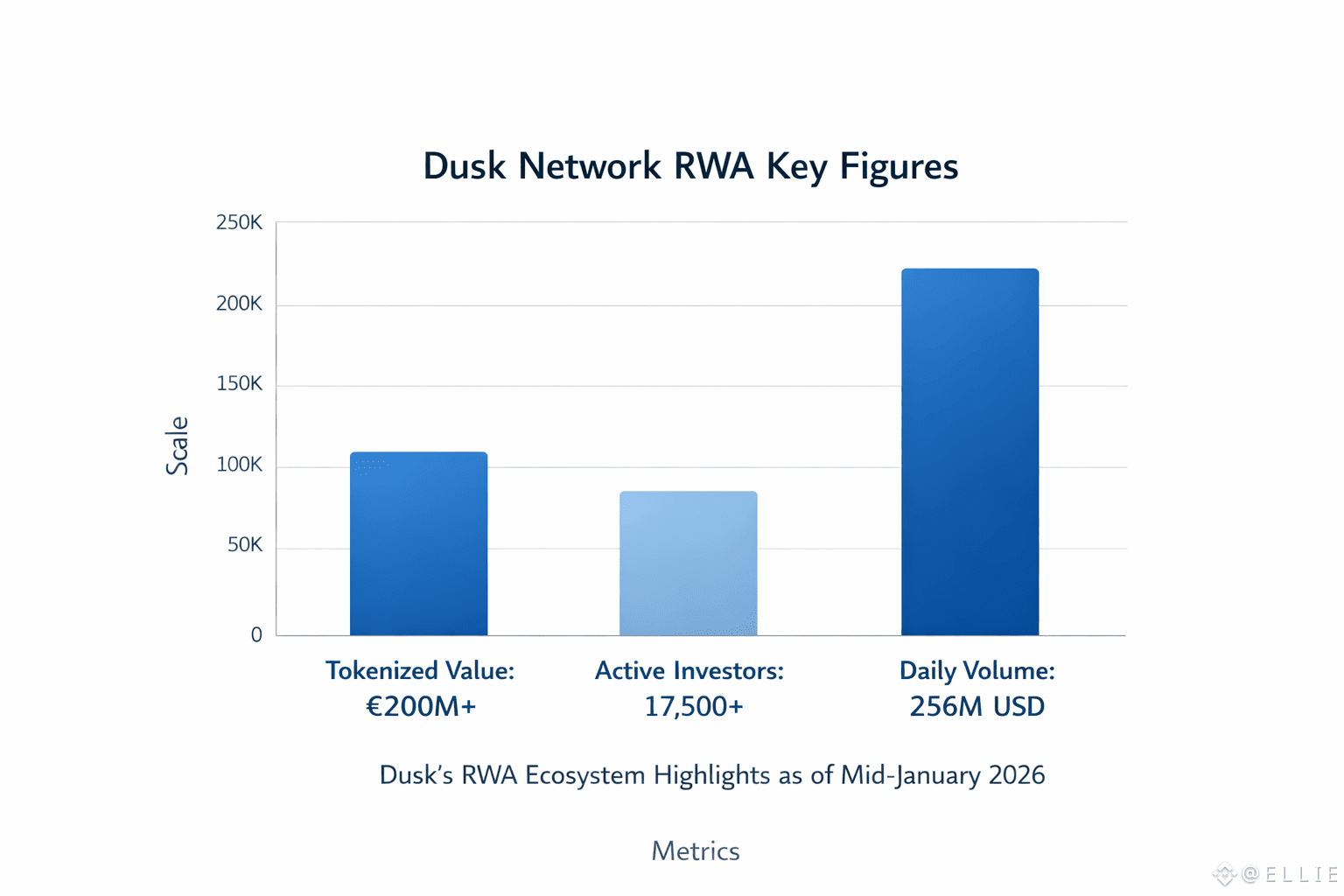

A big part of Dusk’s success comes from its partnership with NPEX, a Dutch stock exchange focused on small and mid-sized businesses. This isn’t a “maybe someday” use case—it’s already working. Together, Dusk and NPEX have put more than €200 million worth of securities on-chain, backed by over 17,500 investors who’ve raised real capital. They’ve built a marketplace where traditional assets get tokenized and plugged right into decentralized systems, making settlements almost instant. No more waiting days for trades to clear. Institutions get less risk and smoother clearing, and regular investors finally get to own slices of valuable assets without all the usual red tape and high minimums.

Dusk didn’t stop there. By teaming up with Chainlink, they’ve made sure their tokenized assets can move across different blockchains. Chainlink’s Cross-Chain Interoperability Protocol (CCIP) acts as the bridge, letting Dusk assets travel between Ethereum, Solana, and beyond. Meanwhile, DataLink brings in verified exchange data, delivering real-time price updates straight to the chain. This matters for institutional buyers who need accurate, up-to-the-second info to price and trade these assets. For securities coming from NPEX, it means high-quality data feeds for everything from pricing to cross-chain settlements. Dusk is basically building the pipes for a world where traditional and decentralized finance finally connect, so assets can move freely instead of getting stuck in silos.

On the user side, there’s DuskTrade—a flagship app built on DuskEVM. It handles everything: issuing, managing, and trading regulated assets like money market funds or bonds. Ownership gets transferred on-chain, not just as another derivative or IOU. Thanks to Dusk’s fast consensus tech, transactions confirm in seconds, making the app suitable for high-volume action. And Dusk isn’t just sticking to securities. They’re teaming up with groups like the XDC Foundation and Camino Network to explore new use cases, like tokenizing plane tickets for easy, global transfers. It shows how flexible the tech is—moving beyond finance into areas like travel and logistics.

From an economic standpoint, Dusk’s setup is designed to last. As of January 2026, there are about 490 million DUSK tokens in circulation, with a hard cap of 1 billion. That scarcity keeps demand strong as the ecosystem grows. Daily trading volume has shot up to around $256 million, mostly because institutions want in on tokenized assets that offer better returns and easier access. The DUSK token is at the heart of it all, securing the network through staking and powering transactions for real-world assets. It’s a system built for scale, ready to bring billions in traditional value onto the blockchain.