Not moving in sync with any other coin on the long-term timeframe, yet not acting as a lone contrarian on shorter timeframes either, BNB has consistently carved its own path. In uptrends, it has continuously set new all-time highs. In downtrends, throughout four negative months for the broader market, BNB contracted its volatility range, becoming one of the best price-preserving assets in the entire market. Its price action has moved almost in a 1:1 correlation with King Bitcoin. The ruler of the crypto world—when BTC coughs, the altcoin market catches a collective fever. Only BNB merely sneezes, with the same intensity 😄 #Fualnguyen

The key transition point marking the shift into a long-term uptrend for BNB—the Golden Cross—appeared back in April 2024. Since then, it has been extremely rare for BNB’s price to fall below the medium-term moving average (MA50) on the weekly chart. Fifty weeks—roughly one year—is a timeframe short enough for holders to enjoy strong rallies, yet long enough to nurture expectations for the next milestones on BNB’s upward journey.

Given current market conditions, BNB is not experiencing rushed or impulsive price surges, as there is no clearly committed capital flow confirming a broad market return. However, pushing BNB’s price significantly lower, or into a zone that signals distribution or panic selling, is simply unrealistic.

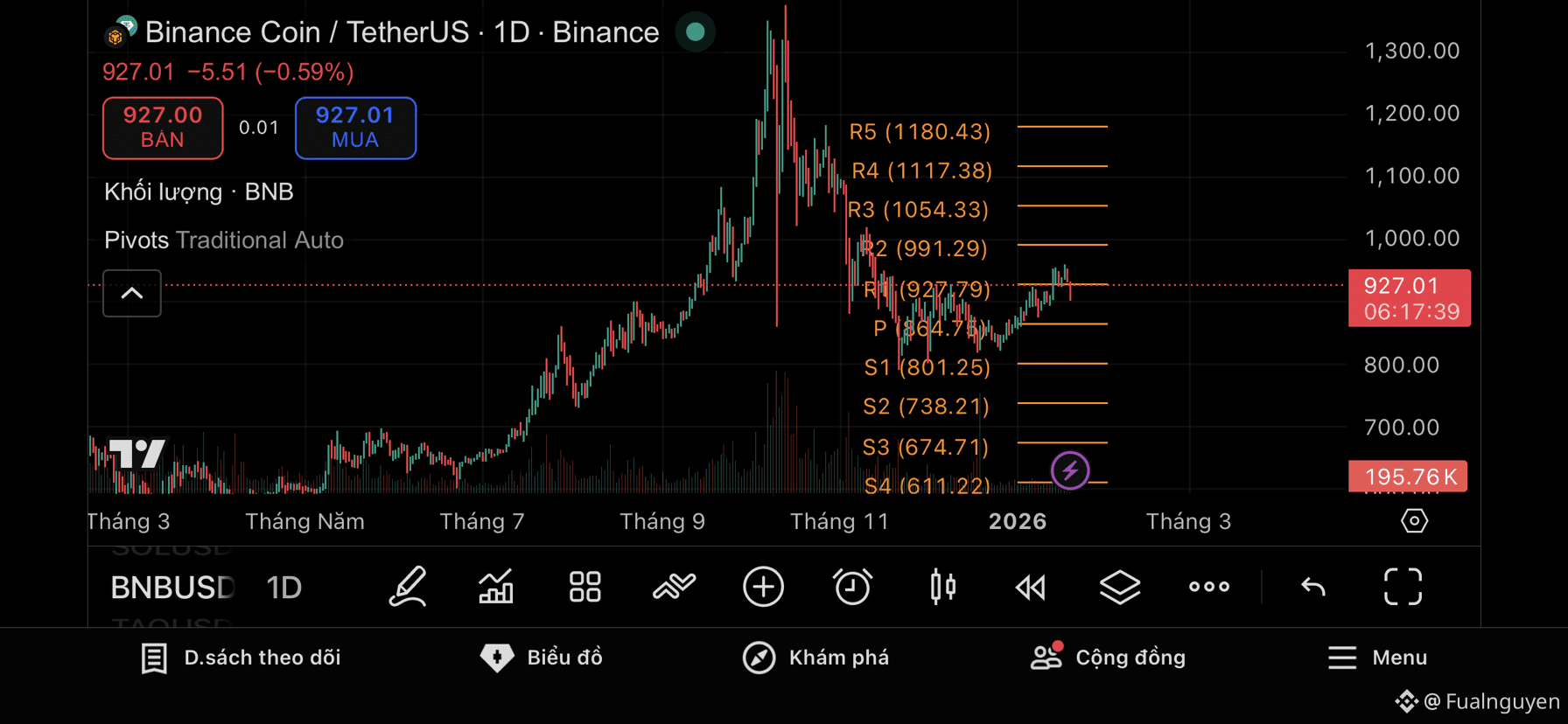

The equilibrium level sits at $864—a price zone BNB has repeatedly broken above and retested, proving its strength—while coming close to R2 at $991. This means BNB has already run two legs for every one leg that other altcoins managed during their sprint phases. Over the past four months, price has only dipped slightly below the pivot (P) before rotating back up to test it again, oscillating around this area. This confirms the absence of meaningful selling pressure. BNB holders tend to have strong hands and control a significant volume.

The equilibrium level sits at $864—a price zone BNB has repeatedly broken above and retested, proving its strength—while coming close to R2 at $991. This means BNB has already run two legs for every one leg that other altcoins managed during their sprint phases. Over the past four months, price has only dipped slightly below the pivot (P) before rotating back up to test it again, oscillating around this area. This confirms the absence of meaningful selling pressure. BNB holders tend to have strong hands and control a significant volume.

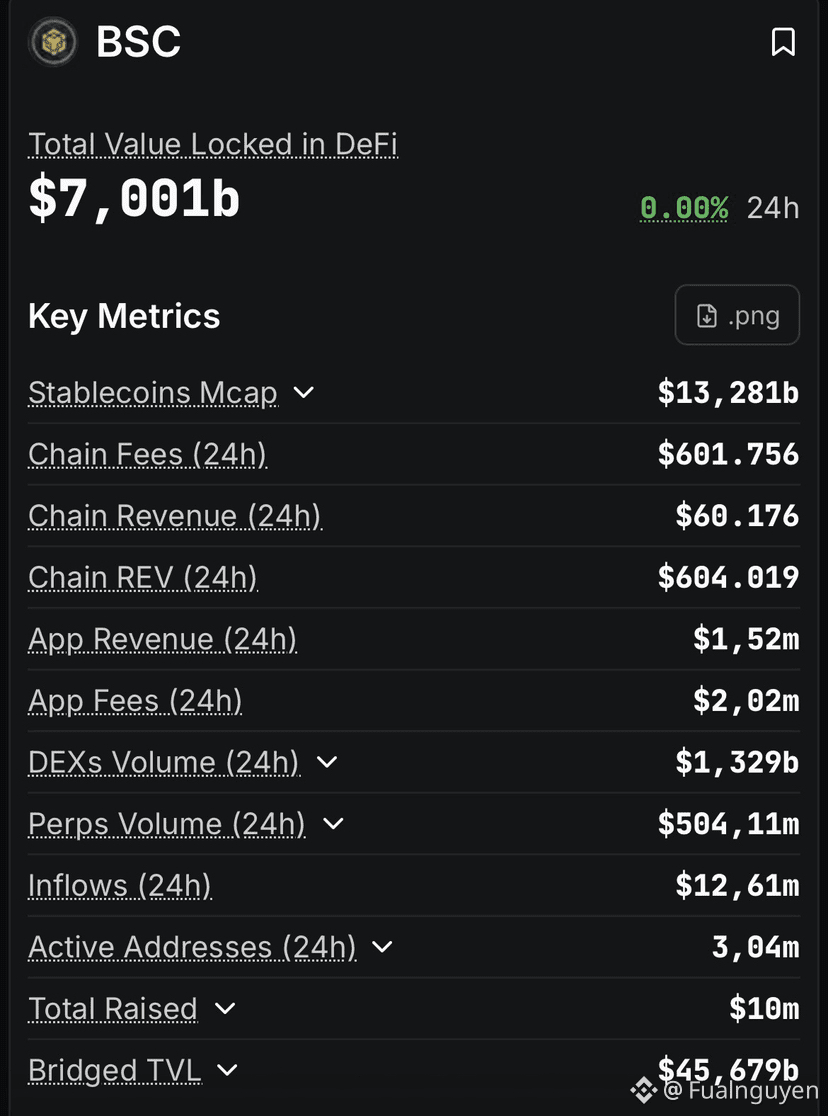

So what defines a typical BNB holder? Most BNB holders actively use the Binance ecosystem—from trading to Launchpad participation—creating genuine demand to hold the token. On-chain data shows that BNB Chain consistently maintains more than 1.5–2 million active wallets per day, reflecting high real usage and a deeply engaged, long-term holder base. However, supply remains relatively concentrated, with top wallets controlling over 50% of total supply. This structure encourages a long-term investment mindset among BNB holders, with stability as a priority.

Fire tests gold, adversity tests strength, four months of deep market declines have put BNB to the test—and it passed. Its strength comes from deep internal fundamentals: a blockchain project that balances market dynamics, technical capability, and the ability to build a top-tier ecosystem. #BNBholic #Fualnguyen