When the Financial Action Task Force updated the travel rule in 2019, most of the crypto industry ignored it. It sounded like another bureaucratic requirement that decentralized systems would somehow bypass. Five years later, that assumption explains why privacy coins keep getting delisted and why institutions refuse to touch anonymous blockchain technology. Dusk is the exception because it was built for this reality from the start.

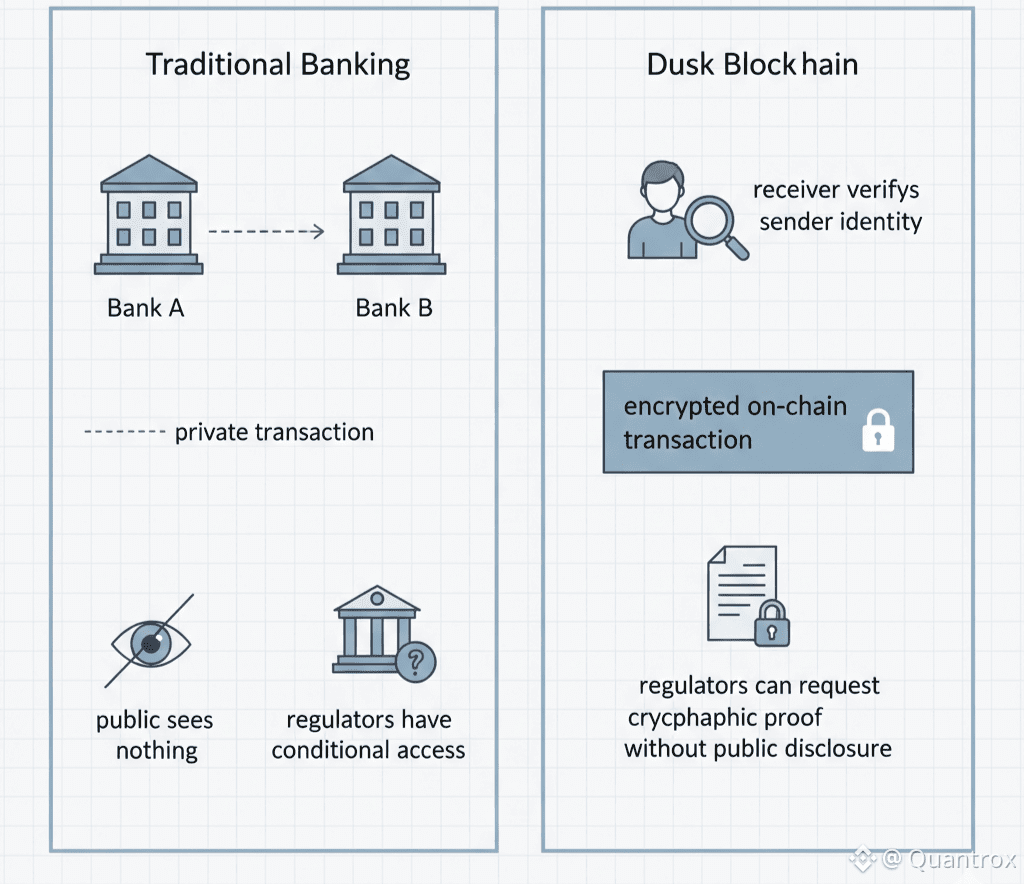

The travel rule itself is straightforward. Financial institutions must share sender and recipient information for transactions above certain thresholds. Banks already do this. When you wire money internationally, your identity is shared with the receiving bank. That information stays confidential between institutions, but it’s available for compliance and audits. Dusk mirrors this exact model on-chain.

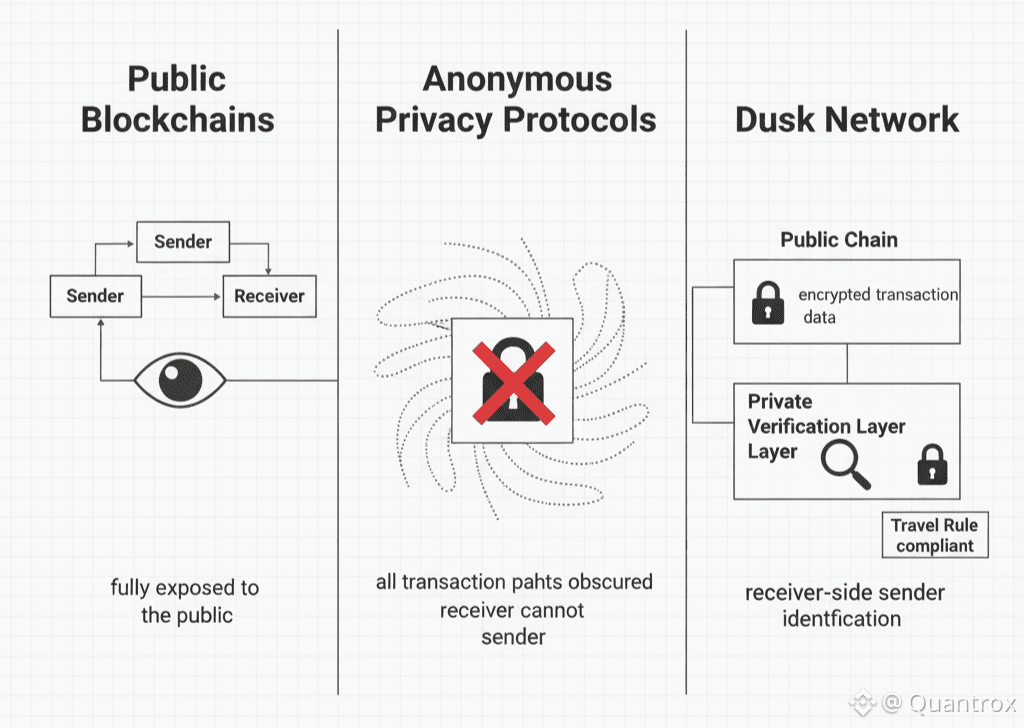

Blockchain disrupted that balance. Bitcoin and Ethereum expose everything publicly. Anyone can see who transacts with whom and how often. On the other end of the spectrum, privacy coins like Monero and Zcash hide everything from everyone. Neither extreme satisfies what the travel rule actually requires. Institutions must know counterparties while keeping that information private from the public.

Most privacy protocols optimized for anonymity and hoped regulation would adapt later. Monero’s architecture makes sender identification impossible even for receivers. Zcash’s shielded transactions do the same. These designs protect personal privacy but collide directly with compliance requirements institutions cannot ignore. Dusk rejected that tradeoff entirely.

Instead of choosing anonymity, Dusk built privacy that works within regulatory frameworks. Dusk shielded transfers encrypt transaction details on-chain, keeping them invisible to the public and to competitors. At the same time, Dusk allows the receiver to identify the sender and generate cryptographic proof of that identification when required. Privacy for the public, accountability for authorized parties.

That design choice once looked like a compromise. In hindsight, it’s the only approach that actually survives regulatory enforcement. The travel rule isn’t theoretical anymore. Regulators now understand blockchain mechanics, and enforcement is tightening. Dusk didn’t adapt to the travel rule later — it anticipated it.

This is why NPEX building a regulated securities exchange on Dusk makes sense. As a licensed MTF and ECSP under Dutch supervision, NPEX must comply with travel rule requirements. They cannot risk their licenses by using infrastructure that prevents sender identification. DuskTrade, built on Dusk, allows them to meet compliance obligations without exposing sensitive trading data publicly.

On DuskTrade, institutions can trade tokenized securities without broadcasting positions, flows, or counterparties to competitors watching the blockchain. Yet NPEX can still verify sender identities on Dusk when receiving transactions, satisfying travel rule obligations without leaking that data publicly. This balance is precisely what regulators expect.

The difference between privacy from the public and privacy from regulators determines which blockchain protocols work for institutional finance. Traditional banking already operates this way. Your balance isn’t public, but your bank can disclose it under legal authority. Dusk replicates this operational privacy model on-chain instead of reinventing finance around anonymity.

Other privacy protocols attempted to hide information from everyone, including authorized parties. That model conflicts with how regulated finance actually works. Dusk accepted from the beginning that accountability was non-negotiable and engineered privacy around that constraint.

Quantoz issuing the EURQ stablecoin on Dusk reinforces this point. Quantoz operates under an EMI license from the Dutch Central Bank and is subject to strict anti-money-laundering frameworks. If Dusk’s privacy architecture conflicted with travel rule compliance, EURQ could not exist on Dusk as a regulated euro stablecoin.

The broader pattern is becoming clear. Privacy technology in regulated markets faces a choice: build privacy that works within compliance frameworks, or be excluded as regulation tightens. Anonymous privacy may survive in niche use cases, but it will not power institutional finance. Dusk chose the former early.

For years, privacy coins thrived on narratives around censorship resistance and financial sovereignty. Those narratives resonate with individuals but fail to address institutional realities. Institutions need operational privacy, not anonymity. Dusk focused on those needs while others debated whether regulation should exist at all.

That strategic decision now looks prescient. MiCA is enforced. The DLT Pilot Regime is live. European institutions finally have clear frameworks for blockchain adoption. Dusk enters this phase with infrastructure already aligned to these rules rather than scrambling to retrofit compliance.

The timing almost looks intentional. Dusk positioned itself for regulated markets before regulations fully crystallized. DuskEVM launched as MiCA enforcement began. DuskTrade prepares to go live as institutions seriously evaluate tokenized securities. Each milestone aligns with regulatory demand for exactly what Dusk offers.

Other protocols are attempting to bolt compliance onto architectures designed for anonymity. That’s extraordinarily difficult. Cryptographic designs that eliminate traceability cannot easily restore it. Dusk made different foundational choices, ensuring receivers can always identify senders while preserving privacy from public observation.

TradeOn21X’s partnership with Dusk validates this approach. As a pioneer of the DLT-TSS framework, TradeOn21X operates under direct regulatory supervision. Partnering with infrastructure unlikely to pass compliance reviews would be irrational. Their involvement signals confidence that Dusk’s privacy model holds up under real scrutiny.

The €300 million securities pipeline moving toward DuskTrade will test this architecture in practice. Real issuers, real assets, real regulators. If Dusk performs as designed, it proves compliant privacy is achievable. If it fails, years of positioning collapse quickly.

Execution risk remains. Even sound architectures can stumble in live environments. Regulators may raise new questions once transactions scale. But conceptually, Dusk aligns blockchain privacy with how regulated finance already functions.

The travel rule once seemed like an obscure compliance detail. It became the filter separating privacy technology institutions can use from technology they can’t. Dusk passed that test by building accountability into privacy from day one.

That’s why every privacy protocol failed the travel rule — except Dusk.