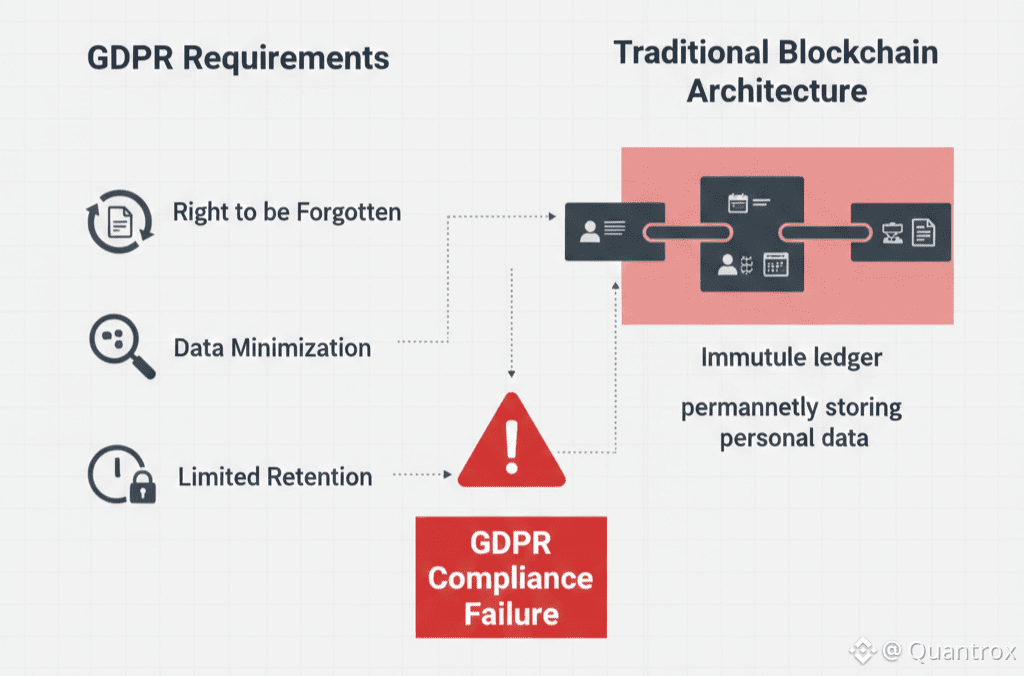

The “right to be forgotten” broke blockchain, or at least it broke most blockchain architectures. European privacy regulations require that individuals can request deletion of their personal data under specific circumstances. Blockchain’s core feature is immutability. Data written to the chain stays there permanently. These requirements seemed fundamentally incompatible, and most blockchain projects just ignored the problem, hoping it wouldn’t matter. Dusk didn’t ignore it.

It mattered. Companies operating in Europe started getting legal opinions about whether using public blockchains for any application involving personal data violated GDPR. The answers were mostly “yes, probably.” Putting names, addresses, transaction details, or any personally identifiable information directly on immutable public ledgers creates compliance problems that can’t be easily fixed later. This is where Dusk took a different architectural path.

Privacy coins thought they solved this by encrypting everything. If personal data is encrypted and nobody can read it, maybe GDPR doesn’t apply. Regulators disagreed. Encrypted personal data is still personal data under GDPR. The fact that it’s unreadable today doesn’t eliminate compliance obligations, especially if encryption could theoretically be broken in the future. Dusk never relied on encryption alone as a GDPR solution.

Public blockchains went in the opposite direction, putting everything in the open and assuming GDPR compliance was someone else’s problem. That works until European customers or regulators start asking how data deletion requests are handled. “Sorry, blockchain is immutable” isn’t a valid legal answer. Dusk avoided this dead end by design.

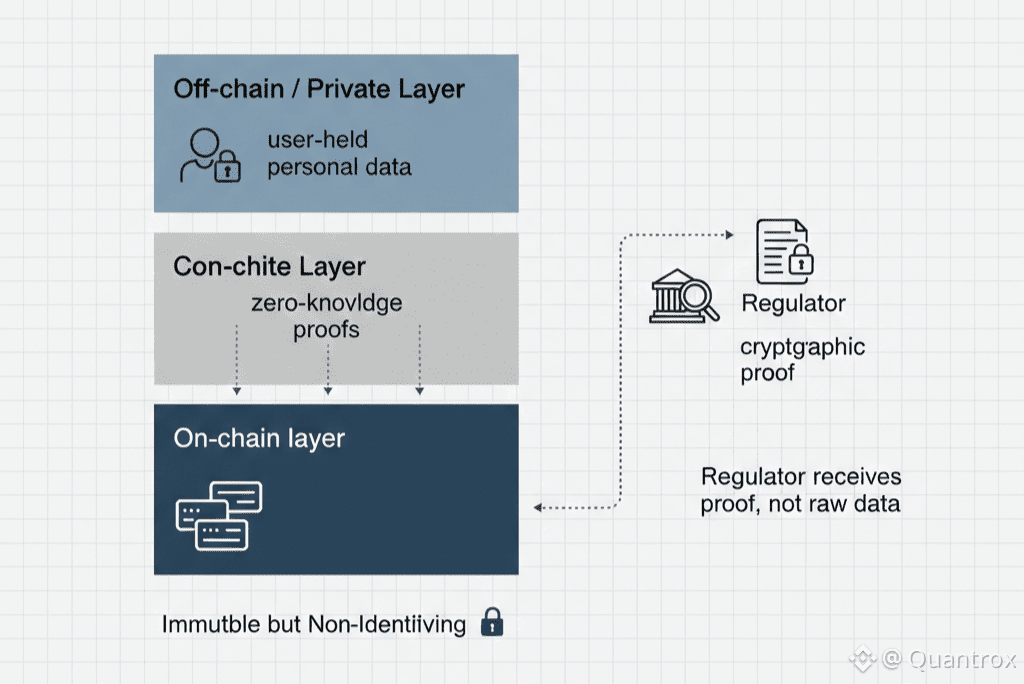

Dusk architected around the problem from the beginning by keeping personal data off the public blockchain entirely. Shielded transfers on Dusk encrypt transaction details so sender and amount aren’t visible to the public. More importantly for GDPR, the personal data never enters the public ledger in plaintext or in any form that creates a permanent public record.

The receiver still knows who paid them on Dusk. That information exists locally for the transaction participants. It can be proven cryptographically if needed for compliance purposes. But it isn’t broadcast to thousands of nodes worldwide where it becomes permanent and uncontrollable. This distinction matters for GDPR, and it’s something Dusk was designed to respect.

Personal data that stays between transaction participants and is only disclosed to regulators under proper legal authority doesn’t create the same compliance problems as personal data permanently written to public blockchains. Dusk treats the blockchain as a coordination layer, not a storage layer for personal information.

Citadel, the self-sovereign identity protocol built specifically for Dusk, extends this logic to identity verification. Traditional KYC processes require users to submit sensitive documents that service providers then store. Users lose control over their data, and service providers take on GDPR liability. Many blockchain projects underestimated how serious that liability is.

Citadel flips this model. On Dusk, users prove they meet requirements — age thresholds, jurisdiction restrictions, accreditation status — without revealing the underlying personal data. Zero-knowledge credentials let someone prove they’re over 18 without sharing a birthdate. Prove European residency without exposing an address. Prove accredited investor status without handing over financial records.

The personal data never leaves the user’s control. Service providers verify proofs without receiving raw information. This satisfies compliance requirements while avoiding the data storage obligations that trigger GDPR risk. You can’t violate the right to be forgotten for data you never held. Dusk benefits directly from this design.

NPEX building DuskTrade on this infrastructure makes sense for European securities markets. Financial regulations require KYC and investor verification. GDPR requires protecting personal data and honoring deletion requests. These requirements look contradictory until you separate verification from data custody something Dusk enables.

An institution can verify that an investor meets regulatory requirements using Citadel on Dusk. They can prove that verification happened. But they don’t need to store passports, tax returns, or bank statements that create long-term GDPR exposure. The verification happens without permanent data collection.

Dusk trades some abstract anonymity for practical compliance. Pure anonymity sounds appealing, but it doesn’t work for institutional finance under European regulation. GDPR-compatible privacy that still supports verification works better in real markets, and that’s the approach Dusk took.

The €300 million in securities expected to move through DuskTrade will test whether this architecture satisfies regulators in practice. Theory and implementation don’t always align. Regulators may raise questions once real transaction flows are examined. But Dusk starts from a stronger position than architectures that permanently expose or permanently obscure personal data.

Public blockchains that store personal data permanently violate GDPR principles. Anonymous systems that prevent required identity checks violate financial regulations. Dusk sits between these extremes by keeping personal data off chain while allowing verification when legally required.

Quantoz operating under an EMI license from the Dutch Central Bank suggest comfort with Dusk GDPR approach. TradeOn21X’s involvement suggests confidence from those navigating DLT-TSS frameworks. Cordial Systems providing custody shows institutional trust. These partnerships would be unlikely if Dusk data privacy architecture were fundamentally flawed.

Markets are still catching up to what GDPR-compliant blockchain infrastructure means in Europe. MiCA and the DLT Pilot Regime created regulatory clarity, but GDPR remains a quiet filter most projects fail. Dusk addressed it early before enforcement pressure made it unavoidable.

European regulators have not aggressively enforced GDPR against blockchain projects yet largely because institutional adoption has been limited. As adoption grows scrutiny will increase. Projects that treated GDPR as an afterthought will struggle. Dusk was built with GDPR in mind from the start.

Whether Dusk satisfies every GDPR interpretation will ultimately be decided through real regulatory engagement. Compliance is nuanced and evolves. What’s clear is that Dusk took the problem seriously instead of ignoring it.

The “right to be forgotten” didn’t break blockchain in general. It broke architectures that embedded personal data into immutable public ledgers. Dusk built a different model that keeps personal data off-chain while maintaining verifiable trust on-chain.

GDPR once seemed abstract. Now it’s a practical gatekeeper for European blockchain adoption. Dusk built for that reality early.

The impossibility problem wasn’t impossible.

It just required designing blockchain systems around privacy law instead of pretending it didn’t exist.