1. The Immediate "Danger Zone" (Next 2 Weeks)

The market faces a gauntlet of four specific events that will determine if the current downtrend stabilizes or deepens.

January 22, 2026 (Bitcoin Mining Stress):

The Bitcoin network is scheduled for a difficulty adjustment. Estimates suggest difficulty will increase to ~148 trillion. This will further squeeze miner profit margins, potentially forcing them to sell more Bitcoin reserves to cover costs, adding sell pressure just days after the crash.

January 27, 2026 (Regulatory Showdown):

The U.S. Senate Banking Committee will hold the rescheduled markup for the CLARITY Act. This is the most critical regulatory date of Q1. If lawmakers fail to reach a consensus—or if the "poison pill" provisions regarding DeFi and tokenized equities remain—the market could price in a "regulatory winter" for the U.S., driving more capital offshore.

January 28, 2026 (Federal Reserve Decision):

The FOMC meets to decide on interest rates. Given the sticky inflation data (2.7%) and the looming tariff shock, the Fed is universally expected to hold rates steady at 3.75%. A "hawkish hold" (pausing rates while warning of inflation) would be negative for risk assets like crypto.

February 1, 2026 (Tariff Activation):

President Trump's 10% tariff on goods from eight European nations takes effect. Markets will be watching for immediate retaliatory measures from the EU. If the EU activates its "anti-coercion instrument," a full trade war begins, likely suppressing Bitcoin prices further.

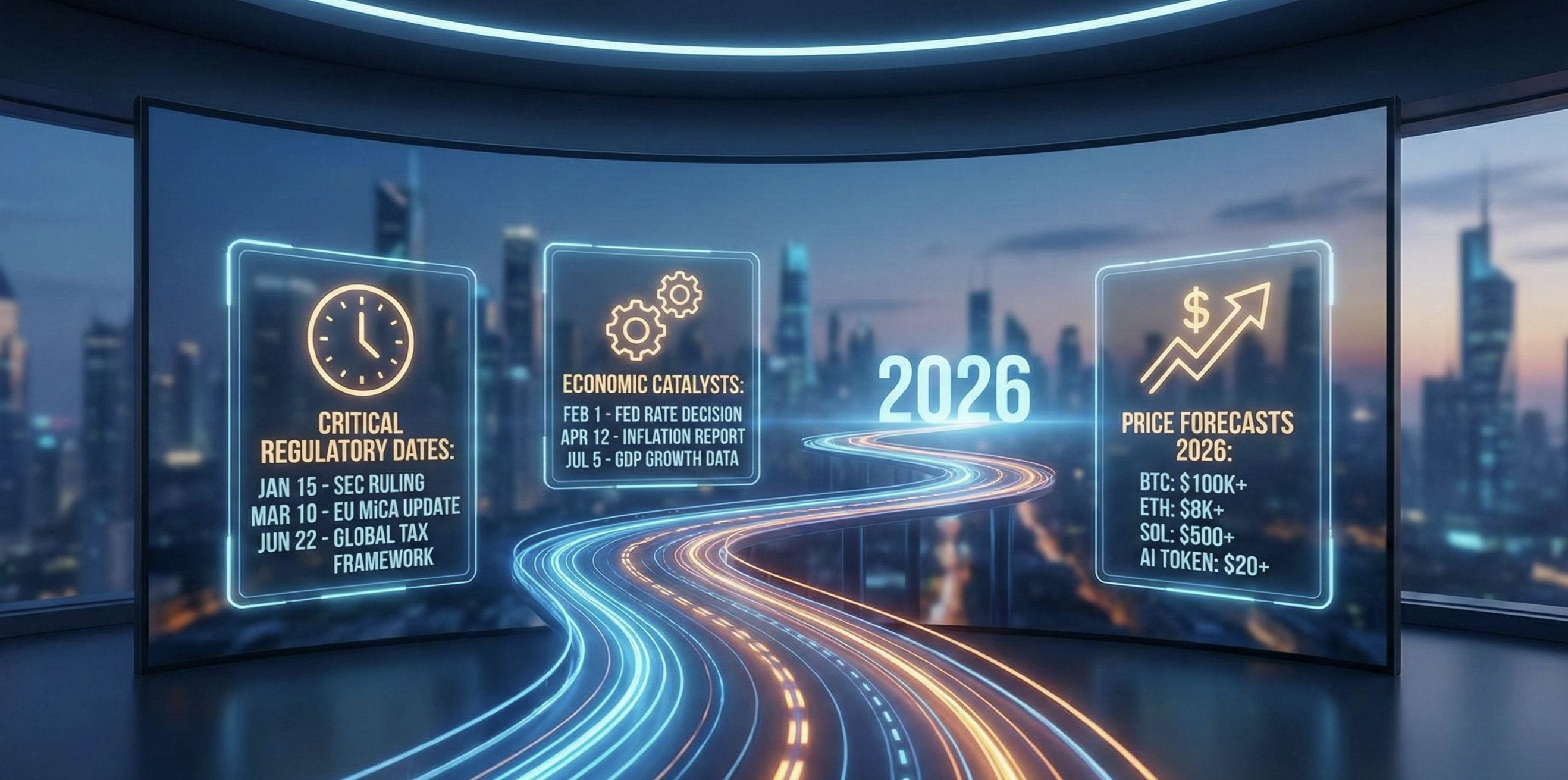

2. The Macro Outlook (Q1 – Q2 2026)

The first half of 2026 will be dominated by the tension between inflation and interest rates.

The Rate Cut Debate:

There is a sharp divergence in forecasts. Goldman Sachs predicts the Fed may resume cutting rates as early as March 2026. However, J.P. Morgan analysts predict the Fed will remain "on hold" for the entirety of 2026 to combat inflation If J.P. Morgan is correct, the "liquidity pump" crypto investors are hoping for will not arrive this year.

The June 1 Ultimatum:

The Greenland Tariff threat has a built-in escalation. If a deal for the purchase of Greenland is not reached by June 1, 2026, U.S. tariffs on European allies will jump from 10% to 25%. This creates a looming "Sword of Damocles" that may cap upside potential for assets until the summer.

3. Structural Shifts & Price Targets (Full Year 2026)

Beyond the immediate volatility, 2026 will see fundamental changes to the industry's plumbing.

The Miner-AI Pivot:

By the end of 2026, the economics of Bitcoin mining will look radically different. Research suggests that for many large mining firms, revenue from Bitcoin mining will drop to less than 20% of their total, with the vast majority coming from hosting AI and High-Performance Computing (HPC) centers.

Stablecoin "Flippening" in Europe:

Due to the enforcement of the EU's MiCA regulations, USDC is expected to gain significant market share over USDT (Tether) in Europe, as exchanges delist non-compliant stablecoins. This will make the European crypto market more regulated but potentially less liquid.

Price Forecasts:

Despite the bearish start, some models remain optimistic. Trading Economics forecasts Bitcoin could recover to $97,528 by the end of Q1 and potentially reach $106,697 by the end of the year, assuming the geopolitical shocks subside. Conversely, bearish analysts argue that if the "Greenland Crisis" persists, Bitcoin could fall 60% from its 2025 highs.