@Dusk emerged in 2018 at a time when public blockchains were largely polarized between two extremes: open, permissionless networks with little regard for regulatory realities, and closed, permissioned ledgers that sacrificed decentralization for compliance. From the beginning, Dusk positioned itself in the middle of that spectrum, aiming to create a layer-1 blockchain that could support real financial markets, regulated institutions, and tokenized assets while preserving privacy as a fundamental property rather than an optional add-on. This vision shaped every architectural decision, from consensus design to cryptography, governance, and developer tooling.

At its core, Dusk is built specifically for financial infrastructure. Instead of optimizing for generalized smart contract experimentation, the network focuses on use cases such as compliant decentralized finance, issuance and lifecycle management of tokenized securities, and privacy-preserving settlement of real-world assets. The design assumes that participants may include banks, brokers, asset issuers, and regulated intermediaries who must meet legal obligations like KYC, AML, reporting, and auditability, without exposing sensitive transactional data on a fully transparent ledger. Dusk addresses this tension by embedding privacy directly into the protocol while allowing selective disclosure when required by regulators or counterparties.

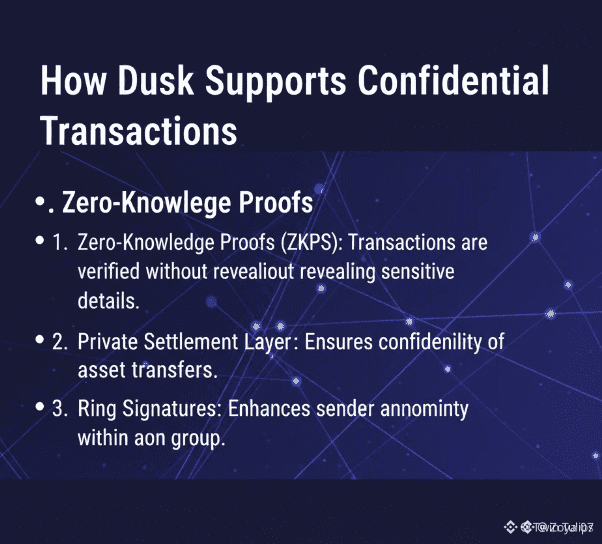

The blockchain uses a modular architecture that separates concerns such as execution, settlement, privacy, and compliance logic. This modularity allows financial applications to be built with fine-grained control over what data is private, what is public, and under which conditions information can be revealed. Rather than relying on off-chain workarounds or application-level hacks, Dusk integrates cryptographic primitives like zero-knowledge proofs into the base layer, enabling transactions and smart contracts that can be validated by the network without revealing underlying sensitive data. This approach is especially relevant for financial instruments where balances, counterparties, and trade terms are confidential by nature.

Consensus on Dusk is designed to support fast finality and predictable settlement, which are essential for institutional finance. The network employs a Byzantine Fault Tolerant consensus mechanism tailored for security and energy efficiency, avoiding proof-of-work while maintaining strong guarantees against double spending and malicious validators. Finality is achieved quickly, allowing transactions involving securities or financial contracts to be considered settled with a high degree of certainty, a critical requirement for post-trade processes, collateral management, and regulatory reporting.

Smart contracts on Dusk are built with privacy and compliance in mind. Developers can write logic that enforces rules around who is allowed to interact with a contract, under what regulatory conditions, and how data is shared. This enables the creation of compliant DeFi protocols where, for example, liquidity pools, lending platforms, or derivatives products can restrict participation to verified entities while still operating on a decentralized network. At the same time, auditability is preserved through cryptographic proofs and permissioned disclosure, allowing auditors or regulators to verify correctness without gaining unrestricted access to all transaction data.

A major focus of the Dusk ecosystem is the tokenization of real-world assets. Traditional financial instruments such as shares, bonds, funds, and structured products can be represented on-chain in a way that mirrors their legal and economic characteristics. Dusk’s infrastructure supports the full lifecycle of these assets, including issuance, distribution, corporate actions, and secondary market trading. Privacy plays a crucial role here, as institutions require confidentiality around ownership and transaction history, while regulators need assurance that rules are being followed. By embedding these requirements into the protocol, Dusk aims to reduce operational friction and costs compared to legacy financial infrastructure.

Governance and network incentives are structured to align with long-term stability rather than short-term speculation. The DUSK token is used for staking, securing the network, and participating in governance decisions that influence protocol upgrades and economic parameters. This governance model is intended to give stakeholders a direct role in shaping the evolution of the network, particularly as regulatory environments and institutional requirements change over time. Rather than frequent disruptive changes, Dusk emphasizes gradual, carefully reviewed upgrades suitable for infrastructure that financial institutions can rely on.

From an ecosystem perspective, Dusk has consistently focused on partnerships and use cases that reflect its regulated-finance orientation. Instead of chasing retail hype cycles, the project has worked on frameworks and pilots involving compliant DeFi, security token issuance, and privacy-preserving settlement systems. This slower, more deliberate approach reflects the reality of institutional adoption, where technical robustness, legal clarity, and long-term support matter more than rapid experimentation.

In a broader blockchain landscape, Dusk represents a distinct philosophy: that decentralization, privacy, and regulation are not mutually exclusive. By designing a layer-1 blockchain specifically for financial infrastructure, it challenges the assumption that public blockchains must either be fully transparent and unregulated or fully permissioned and centralized. Whether this model becomes a standard for institutional finance will depend on regulatory developments and real-world adoption, but Dusk’s architecture clearly demonstrates that privacy-first, compliant blockchain systems are not only possible, but increasingly necessary as traditional finance and decentralized technologies converge.