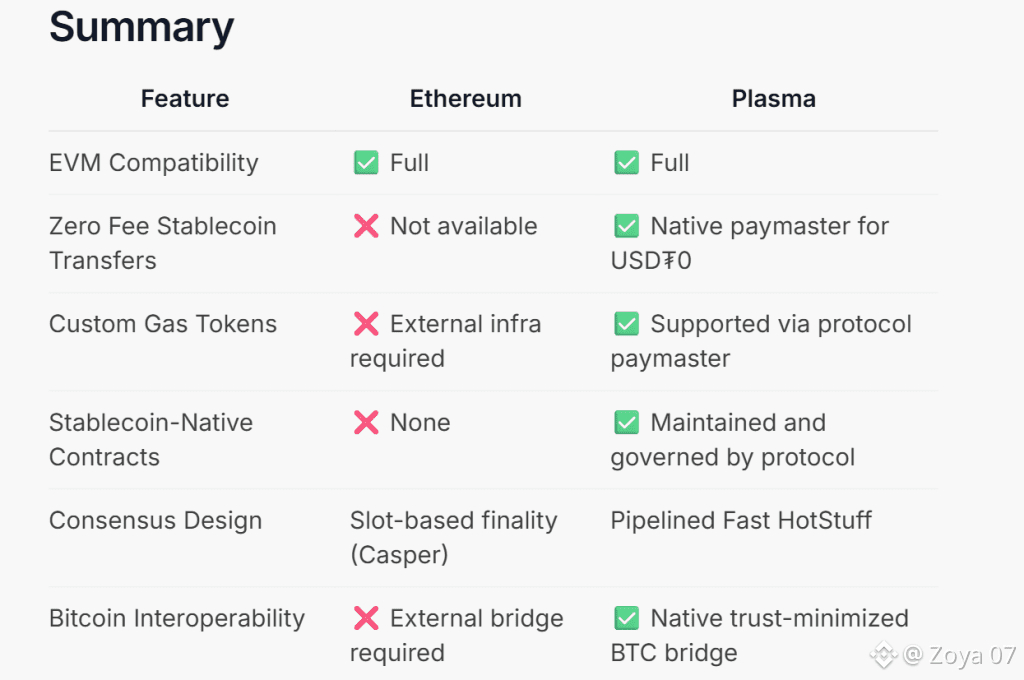

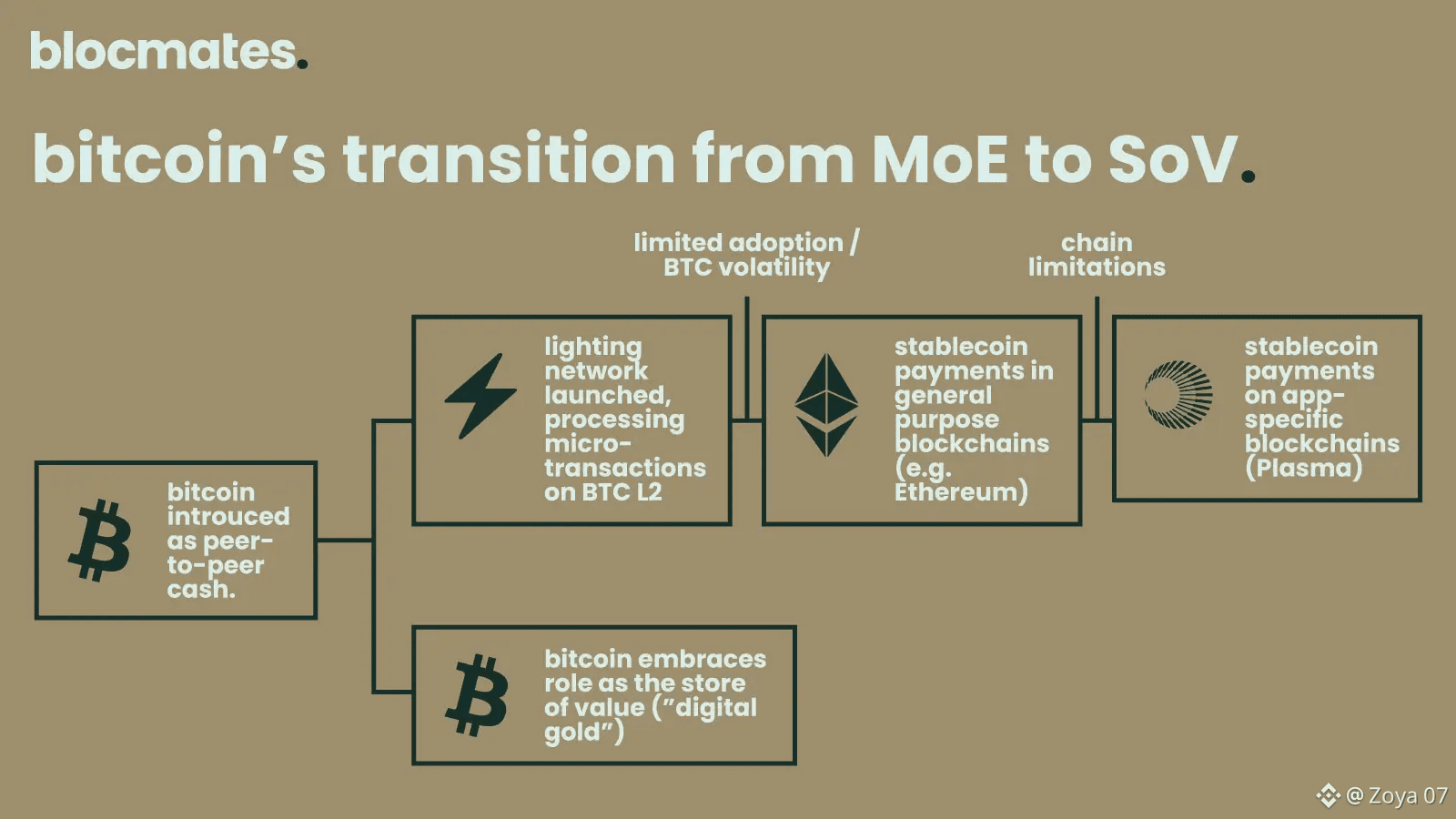

Plasma began with a deceptively simple promise: treat stablecoins not as an afterthought, but as the raison d’être of a blockchain. From that starting point the project stitched together three engineering choices that shape everything else full Ethereum compatibility so developers and wallets slide in without friction, a consensus and execution stack tuned for tiny-latency settlement, and an anchoring model that leans on Bitcoin for an extra layer of neutrality and censorship resistance. The result feels less like another general purpose chain and more like a payments rail rebuilt from the ground up for money that must keep a dollar peg in practice, not just on paper.

plasma.to +1

At the execution layer Plasma runs a high performance EVM-compatible client, meaning smart contracts written for Ethereum can be deployed with little or no modification. That choice drastically shortens the adoption path: existing tooling Hardhat, Foundry, MetaMask and the ecosystem of developer libraries work the same way, but they run in an environment engineered for throughput and deterministic cost-models instead of trying to shoehorn payments into a general-purpose chain built for tokenized scarcity. The compatibility comes courtesy of a stack often summarized as “Reth plus custom runtime enhancements,” which preserves EVM semantics while exposing optimizations for gas handling and low-latency settlement.

Binance +1

Where Plasma departs from typical EVM chains is in its consensus design and the way blocks are produced and finalized. The chain’s consensus marketed as PlasmaBFT is a Fast HotStuff-derived protocol tailored for sub-second finality and thousands of transactions per second. That isn’t just a marketing line: the architecture intentionally reduces cross-node chatter for finality and packs transaction inclusion and settlement into compact, frequent checkpoints so merchants and remittance systems can treat on-chain transfers as effectively instant. For stablecoin rails, speed and predictable finality are not luxuries; they directly affect when a merchant can accept payment and when liquidity needs to be moved between rails.

plasma.to

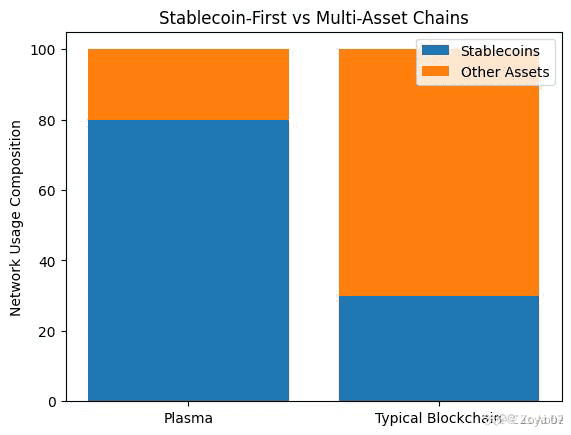

Plasma also rethinks gas economics from a stablecoin’s perspective. Two practical product choices stand out: paymaster-enabled, “gasless” transfers for the native stablecoin flows and a “stablecoin-first” gas model that lets fees be denominated and paid in stable assets rather than native tokens. Paymasters act as intermediaries that sponsor transaction gas for specific flows (for example, USDT peer-to-peer transfers), enabling end users to send value without needing to hold a separate native token as gas. On top of that, the chain supports mechanisms to automatically swap or denominate fees in USD₮ or other supported stable instruments so a merchant who wants fees settled in dollars can operate without having to touch volatile native tokens. These design choices materially lower the UX barrier for everyday users and payment rails where end customers expect dollar denominated, predictable costs.

CoinGecko +1

Security and neutrality are communicated through Plasma’s decision to anchor to Bitcoin. Rather than trying to be a Bitcoin replacement, Plasma positions itself as a programmable sidechain with periodic commitments anchored to Bitcoin’s ledger to inherit parts of its censorship-resistance and long-term security assumptions. That anchoring model is pitched as a credibility booster for financial counterparties that care about settlement finality tied to Bitcoin’s widely observed chain, and it’s part of the broader narrative that a payments-focused chain should minimize any single-point-of-control over settlement. That choice also helps in conversations with regulated institutions that often view Bitcoin’s provenance as a neutral source of trust.

Axios

The story behind Plasma’s early momentum is as practical as its technical choices. The project raised institutional capital to accelerate mainnet development and liquidity provisioning, with press coverage noting a Series A round that signaled interest from funds focused on crypto infrastructure. Strategic relationships with exchange and payments players and early operational ties to teams aligned with major stablecoin issuers helped Plasma bootstrap liquidity and integrations so that the zero-fee or near-zero-fee stablecoin flows could actually scale from day one rather than wait for organic network effects. Industry reporting also flagged participation and backing from players close to the stablecoin ecosystem, which both accelerates product-market fit and raises legitimate questions about neutrality that the team addresses through Bitcoin anchoring and an open validator model.

Axios +1

In product terms Plasma has moved quickly beyond abstract primitives to concrete offerings that speak to both retail and institutional users. For consumers in high adoption markets regions where stablecoins are already a familiar remittance or settlement medium Plasma’s promise is simple: send USD₮ with near-instant confirmation, negligible fees and a UX that hides gas entirely. For merchants and institutions the pitch emphasizes predictable settlement, programmatic paymasters for automated fee handling, and integrations for rails that want settlement in dollar-equivalent tokens rather than volatile gas tokens. The team has also discussed financial primitives like staking and a native token that plays governance and security roles, but these are framed operationally: staking secures the network and governance steers incentives and token economics rather than being the product itself.

plasma.to +1

Operationally the chain’s early milestones reflect the two-sided nature of the problem: protocol design and market adoption. On the technical side the stack continues to iterate on latency, block production cadence, and paymaster primitives so that gasless flows are safe from abuse yet remain frictionless. On the business side the project focused on liquidity partnerships, exchange listings and integrations so that stablecoins particularly USDT arrive on the chain with ample float and market-making support. That combination is important: stablecoin rails are only useful when you can move value in and out quickly and cheaply, and when counterparties trust both the settlement speed and the ability to redeem or move off-chain as needed.

Yahoo Finance +1

No project is without trade-offs. Building a chain explicitly optimized for stablecoins narrows its sweet spot: it is less suited to experiments that demand scarce native-token economics, and its governance and incentive mechanisms must work harder to convince institutions that the chain is neutral even if certain partners seed liquidity. The Bitcoin anchoring reduces some centralization concerns but adds operational complexity. Paymaster models reduce UX friction for end users but create new attack surfaces and economic vectors that require careful mitigations. For enterprises and regulators, the questions are not just technical but legal and operational: custody, on/off ramps, and compliance for dollar-denominated value remain core issues that any payments-grade chain must address.

plasma.to +1

Viewed as a whole, Plasma’s thesis is straightforward and discipline-driven: make stablecoins first-class citizens by baking payment primitives, low-latency finality, and dollar-native gas semantics into the fabric of the chain, then lean on established ecosystems and Bitcoin anchoring to accelerate trust. Whether that calculus displaces incumbent rails depends on execution, the regulatory landscape for stablecoins and payments, and the project’s ability to remain technically neutral while working with powerful industry partners. For anyone building payment products, remittance services or dollar-denominated apps, Plasma represents a deliberate attempt to convert stablecoin theory into a production-grade rail and it deserves attention precisely because it treats payments as the primary workload, not a secondary application.