@Dusk began as a focused answer to a specific gap: how to bring institutional-grade financial instruments on-chain while preserving both privacy and regulatory auditability. Founded in 2018 with a mission to enable regulated markets to issue, trade, and settle real-world assets natively on a blockchain, Dusk positions itself as a purpose-built Layer-1 that balances confidentiality for market participants with the transparency regulators require.

Dusk Network

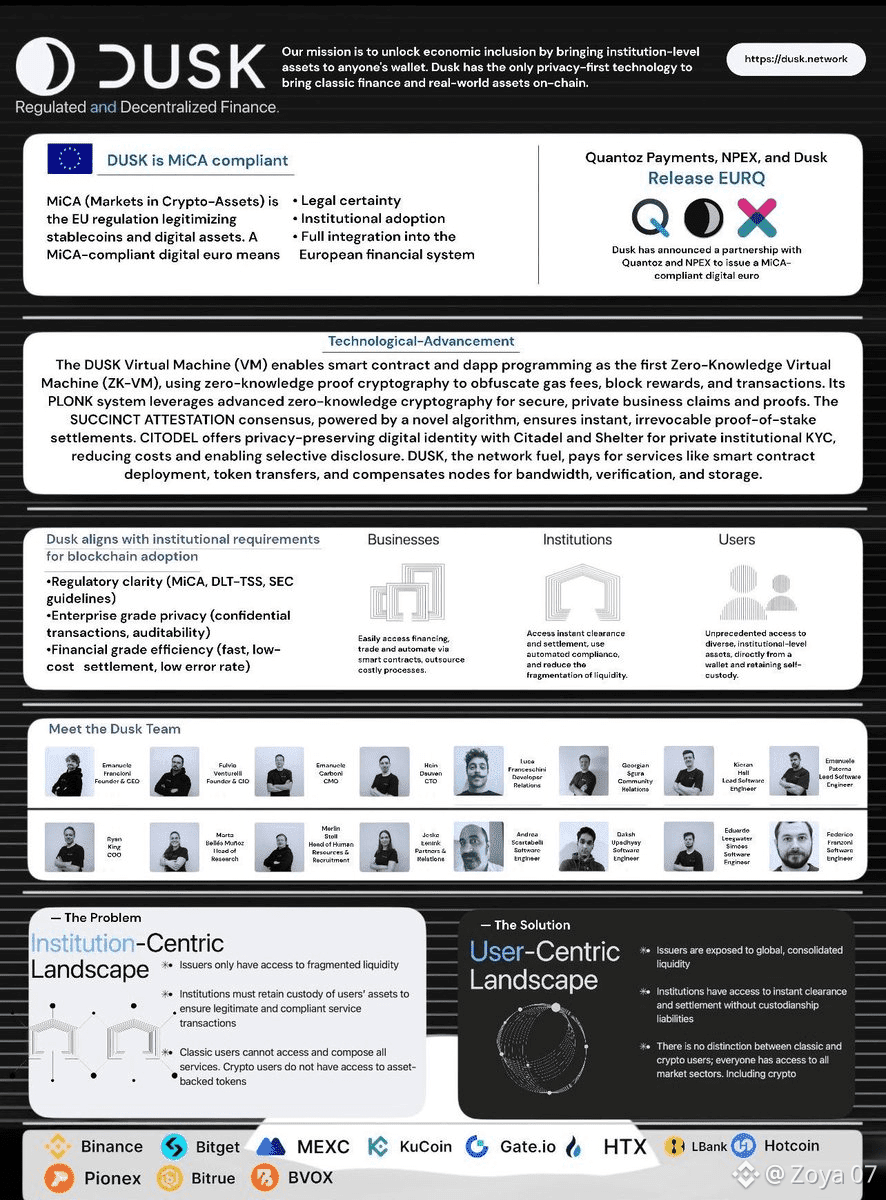

The project’s technical roadmap always revolved around a modular architecture: rather than forcing every application to run in the same execution environment, Dusk separates settlement from execution so specialized environments can be optimized for different needs. That design lets the chain offer high-throughput settlement guarantees while also supporting specialized execution layers examples include EVM-compatible environments for Solidity developers and experimental confidential-compute runtimes that aim to preserve transaction privacy without sacrificing composability. This separation is central to Dusk’s promise of letting financial firms and marketplaces build onchain workflows that look and behave like regulated infrastructure.

DOCUMENTATION

Privacy on Dusk is not an afterthought but a core design principle. The protocol integrates zero-knowledge techniques and other cryptographic primitives to enable confidential transactions and selective disclosure: parties can prove compliance or settlement without revealing the underlying sensitive details to the world. At the same time, the network advertises mechanisms for auditable proofs so that custodians, exchanges, and regulators can verify that settlement and custody invariants hold when required. That dual aim privacy for end users and auditability for institutions drives many of the protocol choices and partnerships the team pursues.

DOCUMENTATION

On the adoption and regulatory front, Dusk has pursued concrete collaborations that reflect its strategy: by partnering with regulated trading venues and payments vendors, the protocol aims to embed compliance primitives into the rails themselves so tokenized securities can be issued and traded under existing regimes. Public materials and market summaries highlight collaborations with parties such as NPEX and payments/issuance partners intended to help projects comply with EU frameworks like MiCA and the DLT Pilot Regime. Those partnerships are a practical recognition that tokenization at scale requires legal and operational bridges as much as cryptography.

CoinMarketCap +1

The timeline to mainnet and the network’s live milestones matter for anyone considering integrations. Dusk publicly announced a mainnet target and rollout plan, and community posts indicate the network produced its first immutable blocks as the team moved from testnets into production grade operation. Those milestones mark the transition from research and test deployments to an environment where real-world asset tokenization, regulated settlement, and EVM-style development can be trialed with counterparties and custodians. If you plan to integrate, treating these dates as checkpoints and validating feature parity on the network before moving live is prudent.

Dusk Network +1

From a token and economic perspective, the DUSK token plays roles across network security, fees, and incentives; public market pages list circulating supply figures and live market data that prospective users and integrators should review because liquidity and market depth affect the practical cost of paying onchain fees or hedging exposure. Exchanges and market trackers publish real-time price, volume, and supply metrics that change daily, so anyone budgeting for issuance or custody should pull the current stats from market feeds before finalizing numbers.

Binance +1

Operationally, running validator or node infrastructure on Dusk will look familiar to teams that manage permissionless chains, but with extra attention to compliance tooling, secure key management, and optional privacy-preserving modules. The open-source repos, docs, and reference clients are intended to let auditors and integrators inspect the exact proofs, settlement flows, and privacy APIs that enterprises will need to satisfy legal or internal risk teams. This openness is a double benefit: auditors can verify the implementation, and developers can prototype specialized marketplaces and custody arrangements faster than with closed or proprietary stacks.

DOCUMENTATION

No platform is without tradeoffs. Dusk’s focus on regulated finance and privacy-compliant primitives introduces complexity compared with general-purpose chains: projects will need to evaluate regulatory requirements, integration paths to offchain identity and KYC providers, and the operational cost of running privacy-preserving workflows. Yet for firms whose main barrier to blockchain adoption has been regulatory or privacy risk custodians, exchanges, and asset managers the architecture Dusk offers is one of the more pragmatic paths toward safe tokenization. For teams building on Dusk, the sensible next steps are to read the whitepapers and documentation, run small pilots with a narrow set of assets, and engage with partner exchanges and custody providers to validate the full issuance-to-settlement lifecycle before scaling up.