Data Serves as Modern Collateral: Walrus and the Emergence of Data-Driven Finance

Finance is advancing past tokens. The upcoming frontier is data.

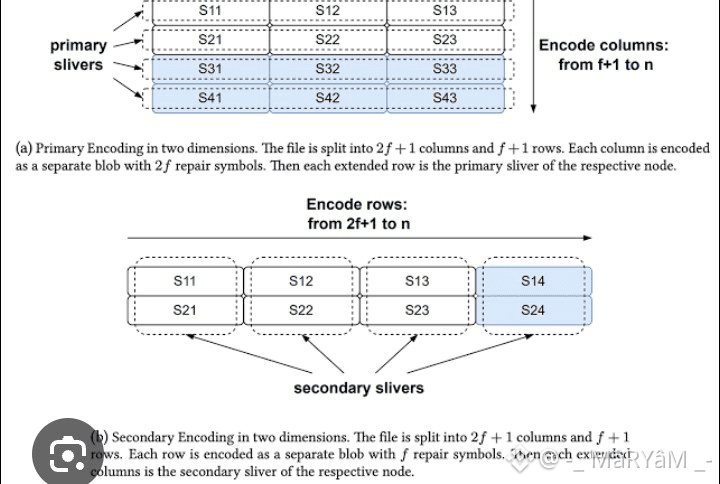

With AI models, analytics platforms, and decentralized applications producing enormous datasets, a new inquiry arises: how can we attribute value to the data itself? Walrus establishes a basis for this transition by allowing permanent, verifiable, and clearly owned data storage—crucial characteristics for data to serve as collateral.

In contrast to conventional assets, data needs to be verifiable to hold value. It should be unchangeable, verifiable, and enduring. Walrus allows datasets to operate independently from centralized sources, instilling trust in financial systems regarding their validity and durability.

This unlocks opportunities for completely novel financial concepts. Funding can be secured for AI training datasets. Historical market data can support structured products. Research archives, simulations, and governance documents can transform into economic resources instead of being seen as sunk costs.

Walrus converts data from a secondary product into a balance sheet entry. Eliminating uncertainty regarding storage permanence and access rights enables DeFi protocols and institutions to explore data-driven lending, insurance, and valuation strategies.

As financial markets move into the digital space, confidence transfers from intermediaries to foundational systems. Walrus doesn’t guess about this future—it creates it. In a realm where knowledge generates worth, the system that protects information safeguards finance as well.

Data is no longer inactive. With Walrus, it turns into something productive, collateralizable, and economically vibrant.

#WalrusStorage #DataDrivenFinance #DeFiFramework #AIFinance #Web3Ecosystem #DecentralizedResources