If you've traded on Ethereum or Solana recently, you've likely paid a hidden tax without noticing. It's called MEV (Maximal Extractable Value), and in 2025 alone, it took over $600 million from regular traders.

Dusk Network is praised for its stock exchange partnerships and following the rules, but its DeFi system is seeing a quieter change. Besides building a chain for banks, Dusk is making the first Layer-1 that completely stops front-running and sandwich attacks, which are some of the worst things that can happen in crypto trading.

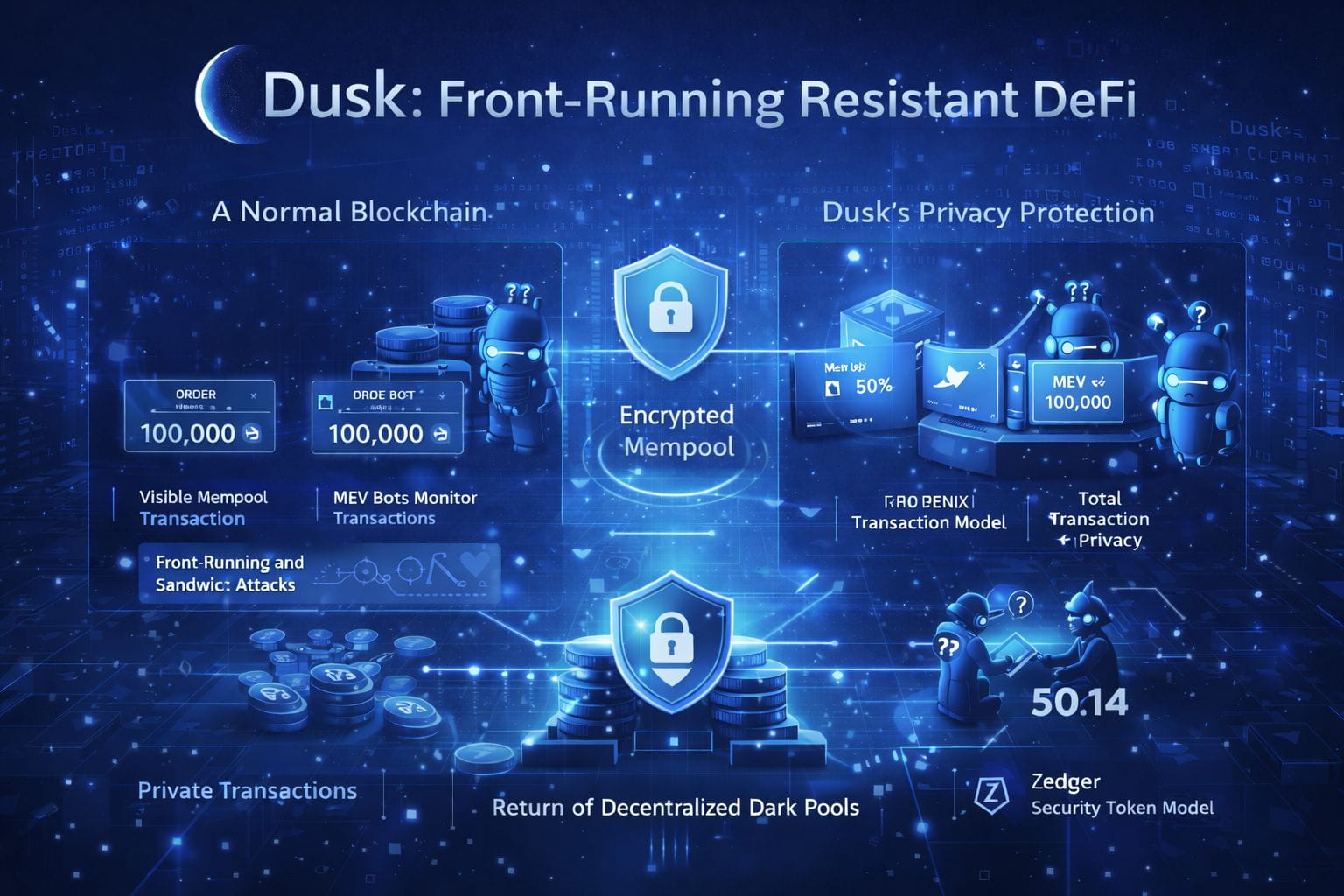

To understand why Dusk is special, you need to know how a normal blockchain works. When you trade tokens on Uniswap, a Mempool (a waiting area) is created. It stays there until a validator picks it up, and everyone can see it. Smart bots watch this waiting area. If they see you buying a token for $100,000, they know your buy order will push the price up. So, they quickly pay the validator to put their sell order right after yours and their buy order right before yours. When you pay more, they keep the difference. You've been sandwiched. On open chains like Ethereum, this is just how it is.

Dusk's answer: Protection through Privacy. Dusk solves this with better tech, not just better rules. Before your trade goes to the mempool, its transaction model, Phoenix, encrypts the details. In Dusk, the Mempool isn't see-through. Validators can see that a transaction exists and that a fee is paid, but they can't see which token is being traded, how big the trade is, or the user's slippage tolerance. Without this info, MEV bots can't see what's happening. They can't front-run a trade they can't measure. So, Dusk is the first Layer-1 that stops MEV by default. This means better prices for regular traders. It also means big players can move in and out of positions without warning the market.

The Return of Dark Pools. This setup makes it possible to bring back a financial tool that's common in traditional finance but hasn't worked in DeFi: dark pools. In regular stock markets, dark pools—private exchanges where big institutions trade shares without showing the order book—handle about 40% of all trading. They do this to avoid price slippage or panic. Right now, Dusk is the only chain that can handle decentralized dark pools. An institution can sell €10 million of tokenized Tesla stock to another institution on-chain, thanks to its Zedger model, a mix that handles security tokens. The order book is never shown to high-speed traders, so there's no price impact, even though the trade happens instantly and proves it follows the rules (using ZK proofs).

Why Liquidity Might Move. This is Dusk's idea for DeFi 2.0. Liquidity goes where it's treated well. Right now, providing liquidity on Ethereum is risky because of LVR (Loss Versus Rebalancing)—basically, arbitrageurs taking money from liquidity providers (LPs). On Dusk, the same privacy shield protects LPs. Without front-running, traders get zero-slippage execution. Institutions use dark pools to change their positions in size. Market makers are safe from harmful flows.

Looking Ahead to 2026. Even though the NPEX stock exchange integration is getting the most attention, the real trading volume in Q2 2026 might come from the DuskSwap system (or whatever the main DEX becomes). Watch the on-chain Average Trade Size number. It's small (retail) on Solana and mixed on Ethereum. As Smart Money realizes that Dusk is the only safe place to move millions on-chain without being eaten by bots, expect this number to increase a lot. Privacy is more about profit margins than secrets. And Dusk is the only one playing that game.