I've been watching Walrus holders behave strangely as WAL sits at $0.1352 for the past few hours after yesterday's drop. Down another 3.91% today. Volume dropped to just 5.73 million tokens in 24 hours. RSI hovering at 30.68, still technically oversold. But here's what's strange—nobody's actually selling in meaningful size.

That sounds good until you think about what it means.

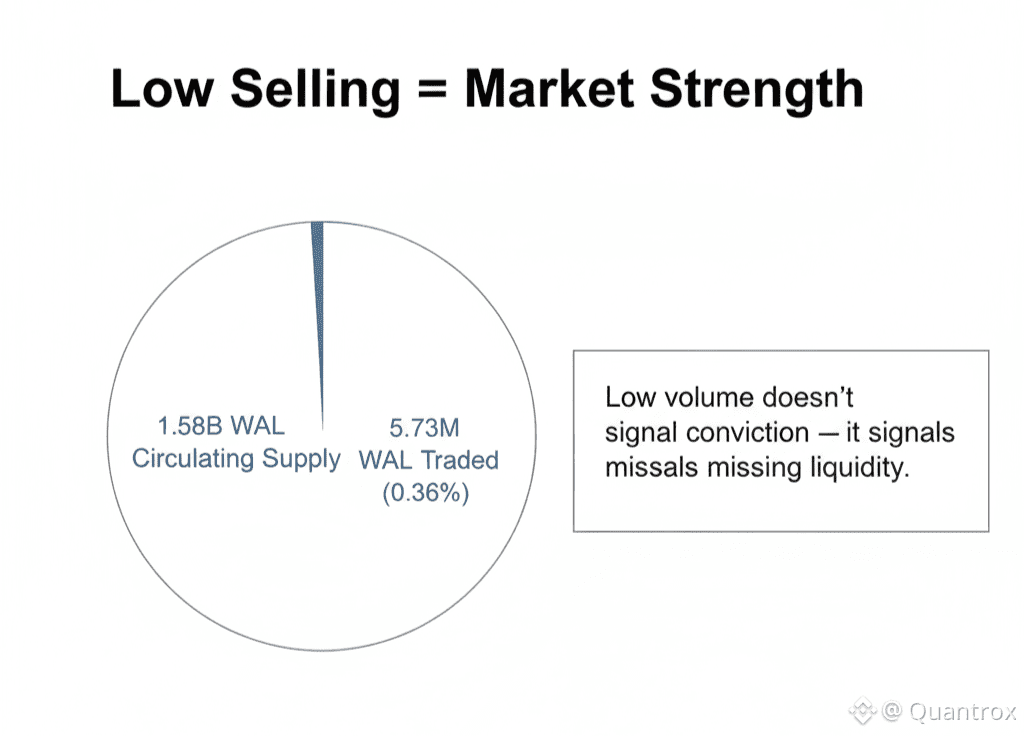

When Walrus dropped from $0.1423 to $0.1350, barely half a percent of circulating supply changed hands. 5.73 million WAL out of 1.58 billion. That's not holders showing conviction. That's liquidity drying up. And dried liquidity creates problems that most Walrus supporters haven't thought through yet.

Right now the 24-hour volume in USDT terms is $798,849. Less than $800k moving an entire protocol's token price around. I've seen individual whale trades bigger than Walrus's entire daily volume. That's not depth. That's fragility pretending to be stability.

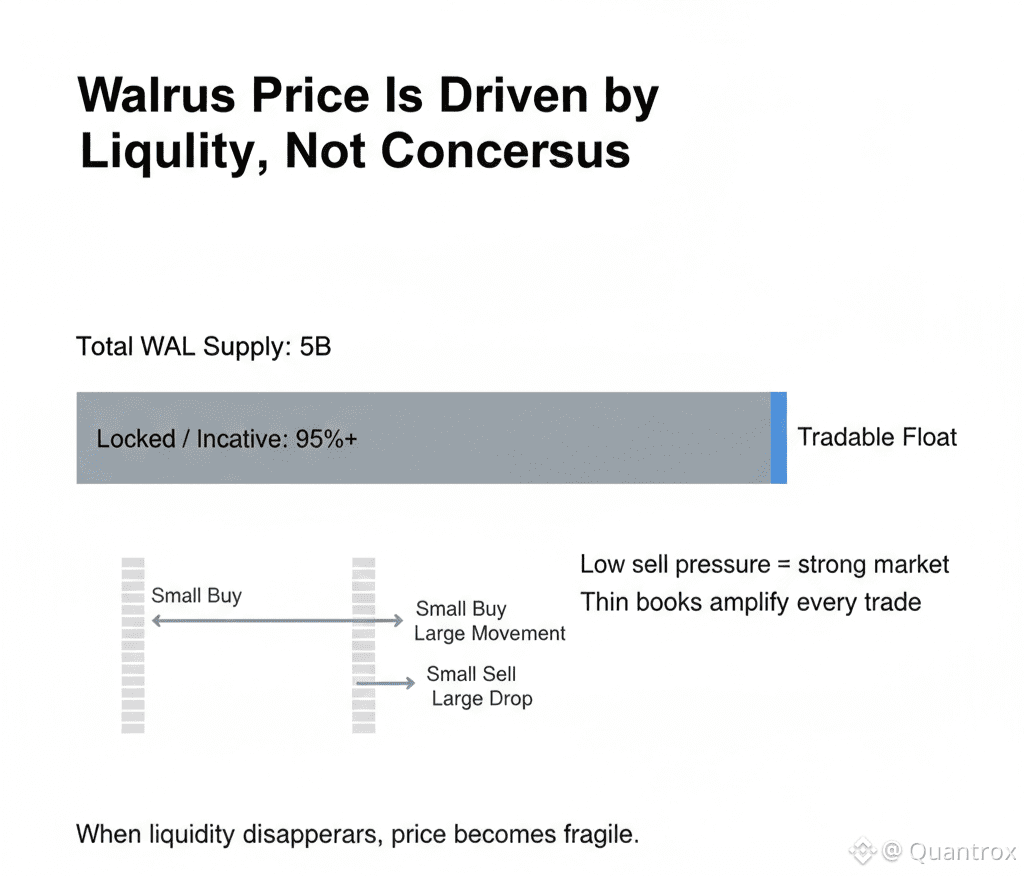

The usual explanation is that WAL tokens are locked in stakes. Node operators committed to infrastructure can't just dump. Delegators earning rewards aren't liquid. Fine. That removes sell pressure. But it also removes the other side of the equation—there's no buying pressure either because there's nowhere to buy size without moving the market violently.

Think about what happens when someone actually needs to acquire meaningful WAL position. Maybe a new storage node operator wants to stake. Maybe an application needs tokens to prepay for capacity. They can't buy $100k worth without spiking the price significantly. The order books are too thin. Slippage would eat them alive.

Walrus pricing mechanisms assume some baseline liquidity exists. Storage costs get voted on every epoch based on fiat targets, but those votes mean nothing if the token itself has no reliable price discovery. When volume sits at $798k daily and 95%+ of supply is locked or inactive, what's the "real" price of WAL?

The answer is whatever the last marginal seller accepted. And right now that's $0.1352. But it's not like thousands of people independently decided that's fair value. It's just where the few available tokens happened to trade when someone hit market sell.

I keep thinking about what happens during the next unlock event. Walrus has 3.42 billion WAL still locked out of 5 billion max supply. Eventually portions of that unlock. When they do, even small amounts hitting the market could move price significantly if current liquidity conditions persist.

Most projects would kill for low sell pressure. Walrus has it. But paired with equally low buy pressure and thin books, it's not the flex people assume. It's just illiquid.

Here's where it gets uncomfortable. Storage nodes need to acquire WAL to expand operations. They earn revenue in WAL but might need to buy more for additional stake. When liquidity is this thin, even routine operational purchases become price events. That's backwards from how infrastructure tokens should work.

The 105 Walrus operators running nodes across 17 countries aren't worried about daily price moves. They're building for years. But they still need functioning token markets to manage their operations. If buying $50k worth of WAL moves the market 5%, that's a problem for anyone trying to scale infrastructure.

Walrus burns WAL through slashing and certain fee mechanisms. Deflationary pressure is real. But deflation only matters if there's actual price discovery happening. Burning tokens in an illiquid market just makes the remaining supply even harder to trade without impact.

The RSI at 30.68 screams oversold. Technical analysts would say bounce incoming. But oversold with volume this thin doesn't mean the same thing. There's no flood of buyers waiting to step in because there weren't many buyers to begin with. It's not accumulation. It's absence.

I pulled up the order book earlier. Bid-ask spreads wider than they should be for a protocol with Walrus's backing. Not enough depth on either side. A few thousand dollars of market orders could gap the price in either direction. That's not how serious infrastructure projects trade.

Maybe this is temporary. Maybe as Walrus usage grows, more participants need to hold WAL for operational reasons and liquidity improves naturally. Or maybe the token design accidentally created a situation where most supply stays locked forever and the tiny tradeable float just bounces around based on whoever needs to buy or sell for non-speculative reasons.

What's clear is that low selling pressure isn't saving Walrus from anything. It's paired with equally low buying interest and the combination creates fragile price discovery. The token might be down only 3.91% today, but that number is almost meaningless when it's based on less than $800k of actual trading.

Walrus infrastructure keeps running. Storage keeps getting allocated. Nodes keep operating. All true. But the token trading dynamics are developing in ways that might become a problem if they persist. You can't build serious infrastructure on top of a token that trades like a micro-cap altcoin with no liquidity.

I don't know if this gets better or worse from here. What I do know is that everyone celebrating "holders not selling" is missing the part where nobody's buying either. And in markets, absence of selling without presence of buying isn't bullish. It's just empty.

Time will tell if Walrus figures out how to bootstrap real liquidity. For now, the price is whatever the last trade happened to be, based on almost no volume and even less depth. That's not price discovery. That's price accident.