Overview

$USDC Coin (USDC) is a digital stablecoin that is pegged to the United States Dollar. Launched in 2018 through a collaboration between Circle and Coinbase (the Centre Consortium), it has evolved into the second-largest stablecoin by market capitalization and is widely regarded as the "gold standard" for transparency and regulatory compliance in the crypto ecosystem.

* Short-term U.S. Treasuries: Managed primarily through the Circle Reserve Fund, which is an SEC-registered money market fund.

Circle publishes monthly attestations from top-tier accounting firms, providing users with a high level of confidence that every digital token can be redeemed for a physical dollar.

Market Dynamics and Resilience

As of early 2026, $USDC has cemented its position with a market capitalization of approximately $75–$78 billion. It is a cornerstone of the Decentralized Finance (DeFi) ecosystem, serving as a primary pair for lending, borrowing, and yield farming across over 30 blockchain networks, including Ethereum, Solana, and Base.

The March 2023 De-peg Incident:

The most significant test for USDC occurred during the collapse of Silicon Valley Bank (SVB) in March 2023. Circle disclosed that $3.3 billion of its reserves were held at the failing bank, causing USDC to temporarily drop to roughly **$0.88**. However, after the FDIC guaranteed all deposits at SVB, USDC quickly regained its $1.00 peg, demonstrating a resilience that many other stablecoins lacked.

Future Outlook: 2024–2026

* Regulatory Compliance: USDC has been a frontrunner in adhering to new global frameworks, such as the EU’s MiCA (Markets in Crypto-Assets) regulation, making it the preferred choice for institutional investors.

* Global Payments: With the expansion of the Cross-Chain Transfer Protocol (CCTP), USDC is increasingly used for near-instant, low-cost cross-border payments, competing directly with traditional systems like SWIFT.

* Institutional Adoption: Growing interest from traditional finance (TradFi) and the integration with platforms like Visa and Stripe suggests that USDC will continue to bridge the gap between legacy banking and the digital economy.

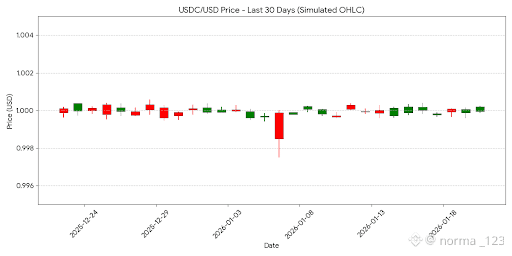

Price Analysis: Last 30 Days

The following chart illustrates the price stability of USDC over the last 30 days. Note that while it is pegged to $1.00, minor fluctuations (wicks) are common due to exchange liquidity and high-volume trades.

[View the USDC Simulated 30-Day Candlestick Chart]

The data shows that despite the high volatility of the broader crypto market, USDC remains extremely stable, with the majority of its trading range staying within the tight bracket of $0.999 to $1.001.