@Dusk came out of the gates with a very clear mission: to be the blockchain that lets real financial markets banks, securities, tokenized bonds, regulated markets live on‑chain without compromising either privacy or compliance. It wasn’t built as another generic Layer‑1 where everything is public; from day one it married zero‑knowledge cryptography with regulatory primitives so institutions can issue, settle and trade tokenized assets under real world rules, while still keeping sensitive information shielded but auditable.

The project itself dates back to 2018 when its founders laid out the vision and kicked off token sales. That initial private sale and ICO ran through late 2018 at around $0.04 per DUSK, raising roughly $8–10 million from supporters including Binance Labs (now YZi Labs) and others, giving early backers a meaningful entry point before public trading began.

For several years DUSK lived mostly as an ERC‑20/BEP‑20 tradable token across exchanges, but the big architectural leap came with its mainnet launch on September 20, 2025, when the native Dusk blockchain finally went live and started producing blocks under its own consensus.

That launch shifted Dusk from concept to operating infrastructure: validators staking native tokens, settlement happening on‑chain, and privacy‑preserving primitives like shielded transactions turning from idea into reality. Soon after, the team delivered practical tooling like a two‑way bridge with Ethereum‑compatible assets and in late 2025 opened up DuskEVM in public testnet so developers can start building compliant, Solidity‑based applications.

On the exchange front, DUSK has broadened its availability dramatically in the last year. Early listings included BitMart’s DUSK/USDT pair in March 2025, and in October 2025 the token made its US debut on Binance US, opening up liquidity in perhaps the world’s most important regulated market for traders and institutions alike.

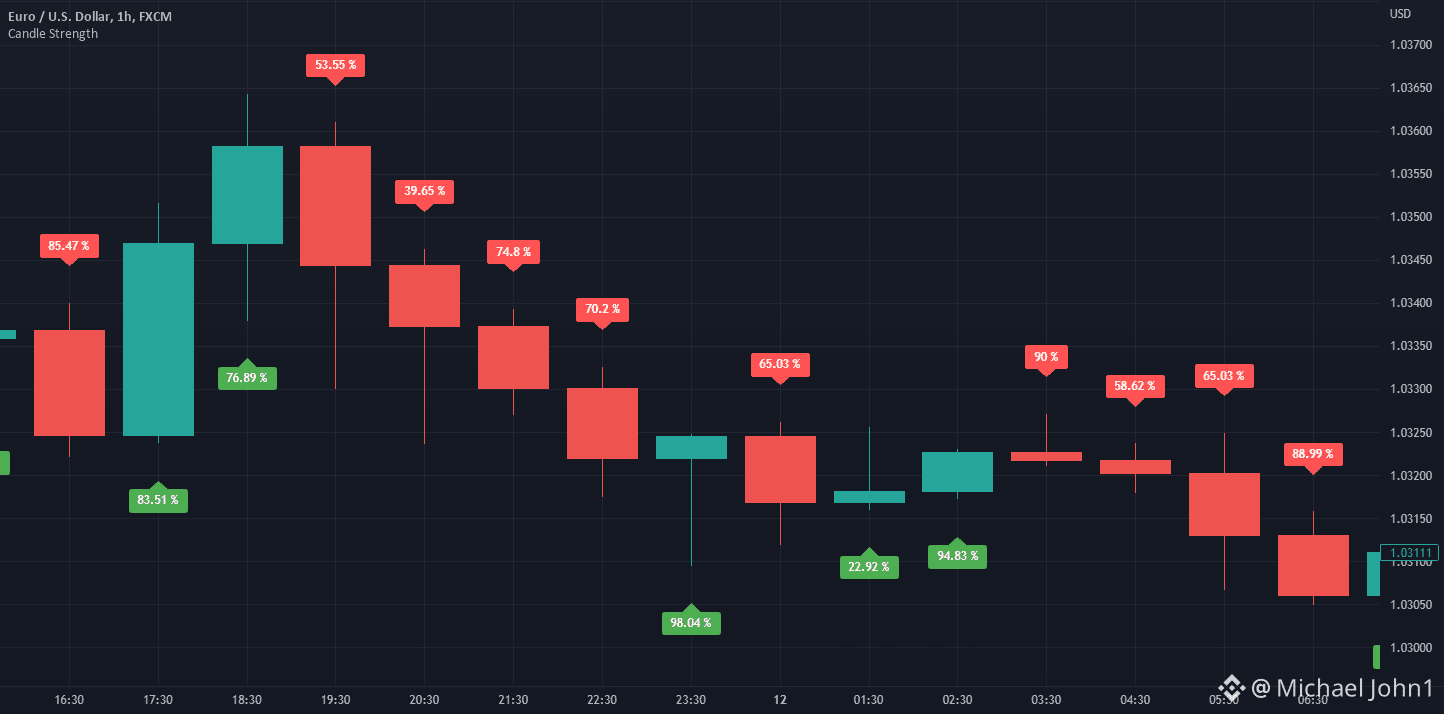

Price action over time reflects that evolution: for most of its life DUSK traded quietly below a dollar, but broader adoption and ecosystem milestones drove momentum into 2025 and 2026. Today it sits in the roughly $0.20–$0.25 range with daily volume in the tens to hundreds of millions of dollars on big exchanges, showing that market participation has grown with utility.

When people talk about TVL total value locked in crypto they mean how much value is actively committed to on‑chain protocols, a rough proxy for activity and trust. Unlike pure DeFi networks built around decentralized lending or AMMs, Dusk’s current TVL story is more nascent and tied to its emerging ecosystem of compliant applications and bridges rather than massive liquidity pools you’d see on big DeFi chains. The focus here isn’t yield farming but building real regulated venues for tokenized securities and institutional rails.

That ecosystem angle is key: beyond price and volume, there’s work underway to bring regulated securities on‑chain, to stitch traditional assets into programmable formats, and to let institutions build real financial market infrastructure using privacy‑preserving smart contracts. In a world where data privacy and regulatory compliance are often at odds with blockchain transparency, Dusk’s modular architecture separating settlement, privacy layers, and EVM‑compatible execution aims to give you both sides of that equation.

Backers like Binance/YZi Labs, BlockVenture and others who saw early value in this compliance‑first angle helped seed the project, and token sale participants from 2018 still look back at significant ROI compared to their entry price. It’s not about speculation alone though; the heavy lifting has been in building out tech that might genuinely replace parts of legacy finance with on‑chain equivalents that respect rules and confidentiality.