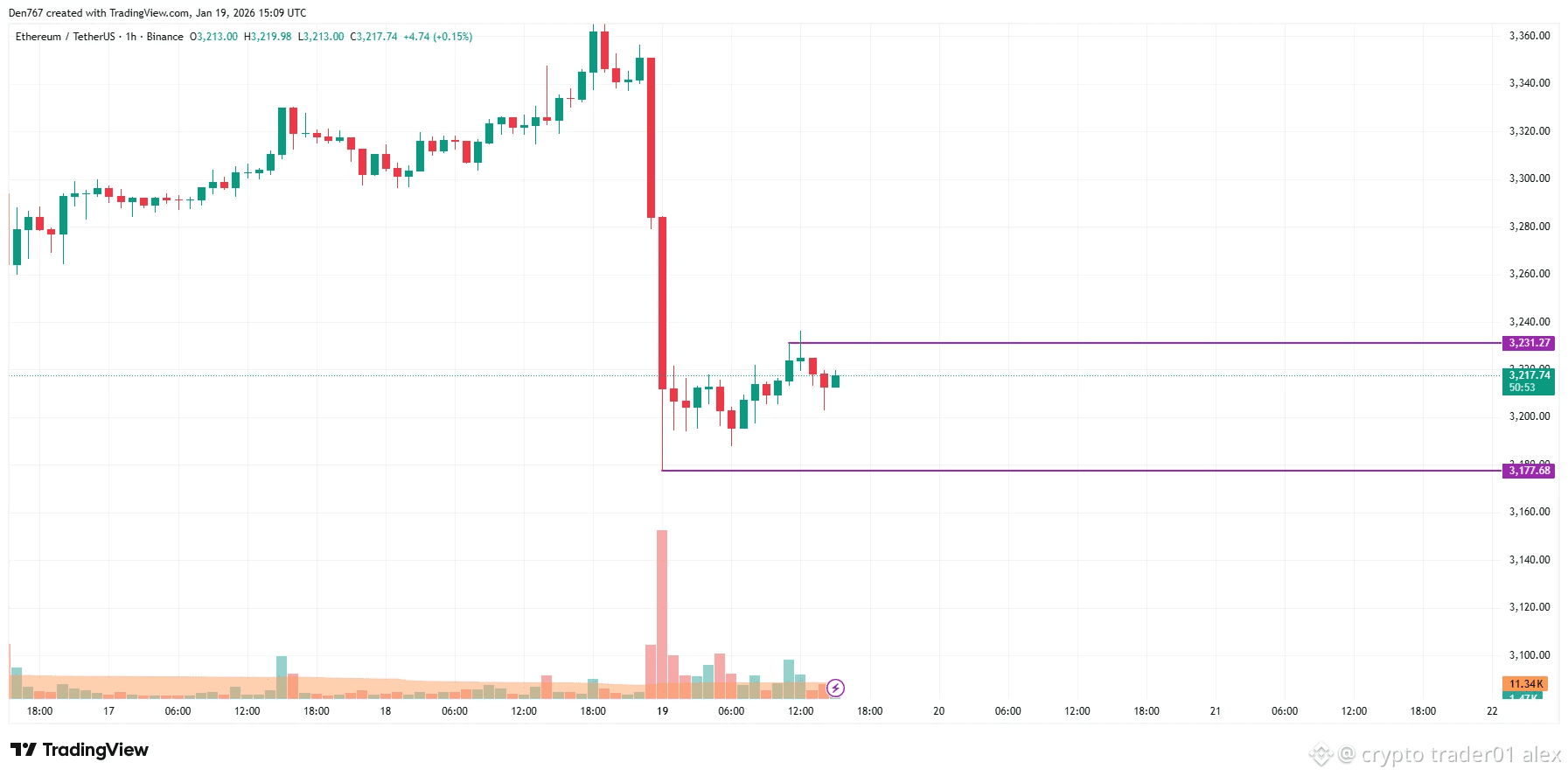

$ETH $3,090–$3,300 range depending on exchange data (ETH price fluctuating around $3.1K)

Market Behavior:

• Recent sessions show mixed momentum — slight bearish pressure under long-term resistance but short-term volatility remains.

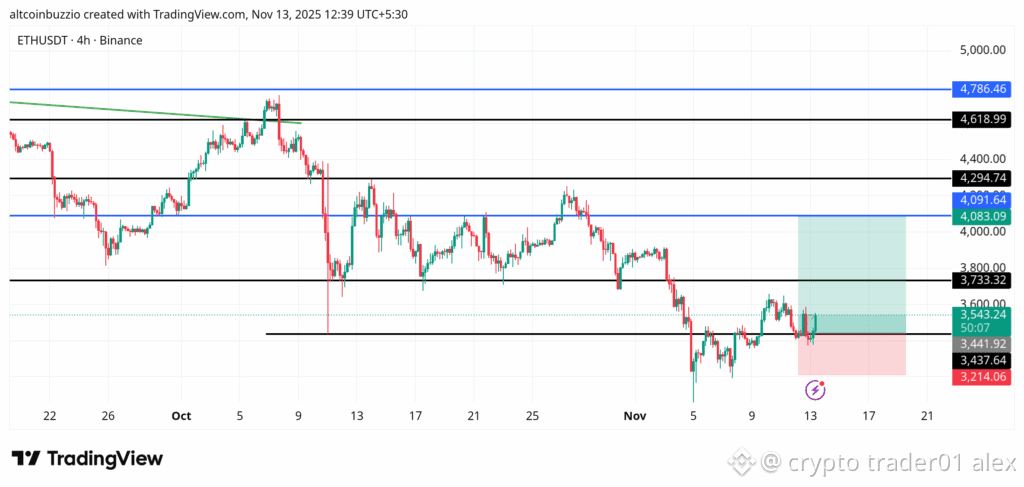

📉 Short-Term Technical Summary

Trend Context:

• ETH is trading below key long-term resistance (200-day SMA near ~$3,660) — bearish pressure.

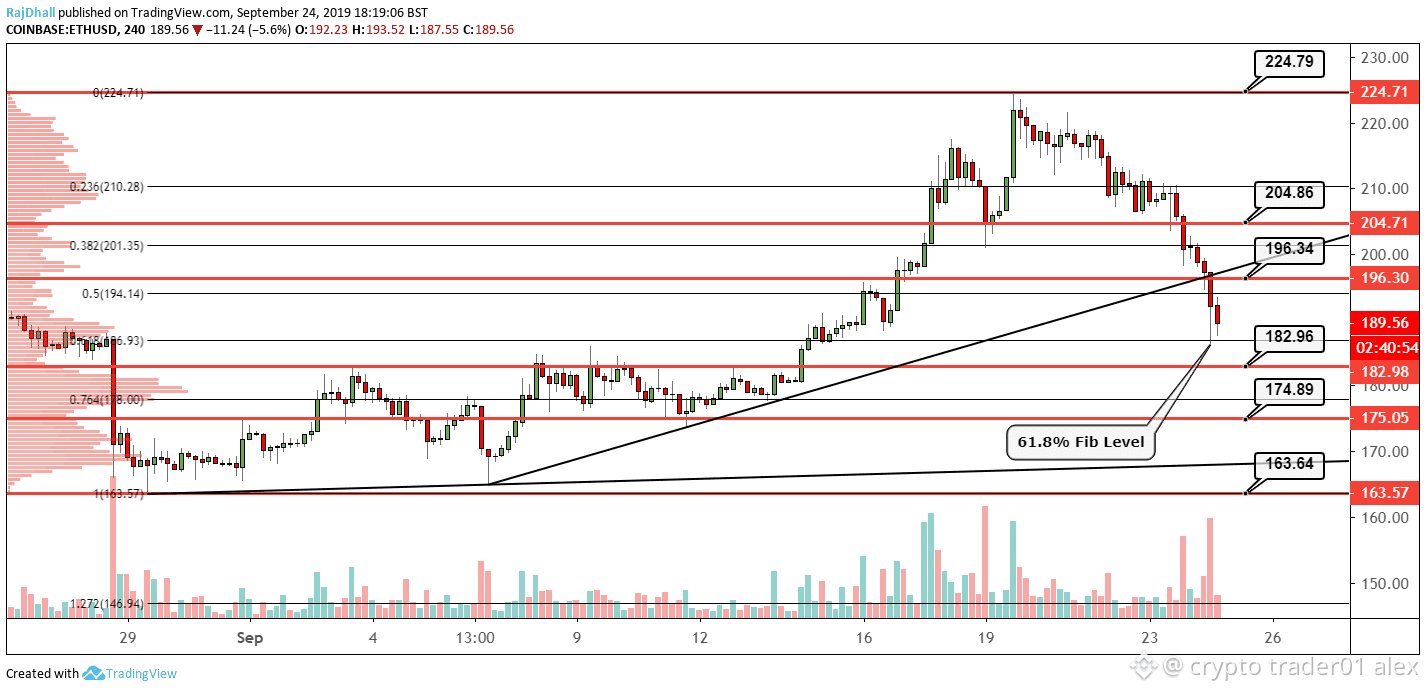

• Price hover near critical support such as Fibonacci ~50% retracement ~$3,140.

• RSI ~ neutral, MACD near flat — indicates balance between bulls & bears.

🎯 Key Levels to Trade

🟢 Bullish Scenarios (Long Trades)

Entry Zones:

Primary Buy: $3,140–$3,160 (support cluster)

Aggressive Buy: $3,000–$3,050 (momentum support sweep)

Targets:

Target 1: $3,280–$3,300 (short-term resistance)

Target 2: $3,400–$3,450 (breakout zone) – only if price closes daily above $3,300

Stop-Loss (for Longs):

Below $3,000

If price closes above $3,300–$3,320 with volume, higher targets toward $3,500 become more plausible.

🔴 Bearish Scenarios (Short Trades)

Entry Zones:

Short Entry 1: ~$3,320–$3,350 (failed break resistance)

Short Entry 2: ~$3,400 (rejection of higher breakout)

Targets:

Target 1: $3,140–$3,100

Target 2: $3,000–$2,920 (key support zone)

Stop-Loss (for Shorts):

Above $3,450

A daily close below $3,140 risks deeper correction with sellers dominating.

🧠 Technical Indicators at a Glance

IndicatorSignalNotesRSI~NeutralNot oversold nor overbought (balanced momentum) MACDMildly bearishBearish tendency as price under SMAs VolumeMixedNo strong breakout confirmation yet

🗓️ Trade Plan Checklist

For a Long Setup:

Wait for price to stabilize above $3,140–$3,160.

Look for a bullish candlestick confirmation (e.g. bullish engulfing) near support.

Set stop-loss just under $3,000.

Take partial profits near $3,280–$3,300.

For a Short Setup:

Look for rejection candle near $3,320–$3,350.

Confirm increased sell volume.

Place stop-loss above $3,450.

Targets at $3,140, then $3,000–$2,920.

🚥 Risk Factors to Watch

Bearish Triggers:

Daily close under $3,140.

Heavy sell volume & ETF outflows.

Bullish Catalysts:

High inflows to ETH ETFs.

Daily close above $3,300.

🧾 Summary

Short-term view: Neutral-to-slightly bearish below long-term resistance.

Preferred strategy: Trade range until breakout confirmation.

Bullish bias only above: $3,300 daily close.

Bearish risk increases below: $3,140.