A promise of radical transparency, unbreakable settlement, and a new era of efficiency. Yet, for the institutions that move the world’s capital, that promise has remained just out of reach. Public blockchains were too exposed, private chains were glorified databases, and the sacred tenets of compliance and privacy were left at the door. The industry built a revolutionary engine, but forgot to build the chassis for the most powerful vehicles. That era of compromise is over. The gates are open. Dusk Network is here, and it is engineered for the institutions ready to lead the next financial dawn.

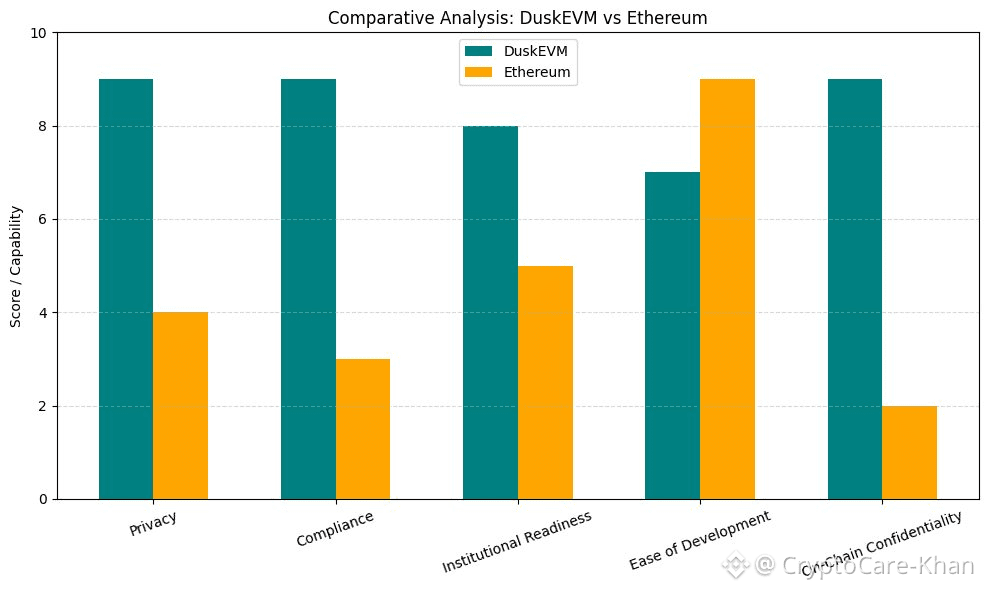

This isn’t just another layer-1. This is a paradigm sculpted in regulatory granite and cryptographic steel. Dusk was born from a singular, unwavering vision: to provide a public, permissionless blockchain that doesn’t just accommodate institutional needs, but is fundamentally architected for them. We’re talking about a substrate where trillion-dollar markets—securities, bonds, funds, carbon credits—can transition on-chain without sacrificing a single byte of their operational necessity. Privacy. Compliance. Performance. Dusk delivers them not as add-ons, but as the core pillars of its existence. This is the missing piece, the bridge between the wild frontier of crypto and the governed world of global finance. And it’s not a future roadmap item. It’s live. It’s adopted. It’s racing ahead.

Let’s break the hype with cold, hard innovation. At Dusk’s heart lies the Zero-Knowledge Proof, not as a niche feature, but as the network’s lifeblood. Their proprietary Suter Shield and PLONK-based ZK-Citadel technology allow for something previously thought impossible: confidential, anonymous transactions on a public, auditable ledger. An institution can execute a multi-million dollar transfer or a complex derivative settlement. The network validates it perfectly. The compliance officers can verify its legitimacy. Yet, to the outside world, the sensitive details remain encrypted, protected. This is the holy grail. It means competition can thrive without exposing strategy. It means investor privacy isn’t sacrificed for transparency. It means the chain is ready for the real world, right now.

But what good is a private transaction if it can’t be enforced by law? Dusk pioneers the concept of Compliant Privacy. Through their revolutionary technology, XCL, they embed regulatory logic directly into digital assets. Think of it as programmable compliance. A security token can be coded so it can only be held by accredited investors in specific jurisdictions. A transfer can be automatically screened against sanctions lists. All of this happens confidentially, without exposing the parties involved, but with the irrevocable proof that the rules were followed. This isn’t about stifling innovation; it’s about providing the guardrails that allow institutional capital to flow at highway speeds, safely and securely. It turns regulatory necessity into a seamless, automated feature. This is how you build for adoption.

And the institutions are not just watching—they’re building. The proof is in the partnerships. Dusk is the blockchain of choice for landmark real-world asset tokenization projects. They are the infrastructure for the first-ever digitized treasury bond issuance in collaboration with a European stock exchange. They are the foundation for tokenized carbon credit markets and compliant security token platforms that are already operational. This isn’t testnet speculation; this is mainnet reality. These are blue-chip names, traditional finance giants, choosing Dusk as their on-ramp to the future. They are voting with their code, their capital, and their reputation. They see the engine, and they are building their flagship vehicles on top of it.

This brings us to the true catalyst: the community. The Dusk ecosystem isn’t a passive audience; it’s a coalition of the ambitious. It’s the developers who are tired of building toys and are ready to build titans. It’s the investors who understand that the trillion-dollar RWA narrative needs a technical champion, not just a buzzword. It’s the pioneers who see that the next cycle won’t be won by memes alone, but by infrastructure that unlocks real-world value.

We are at an inflection point. The market is screaming for assets with tangible backing, for systems that work within the world as it is, not as we wish it to be. Dusk Network stands alone as the only public blockchain that answers this scream with a fully-formed, battle-tested solution. It has the tech to protect, the compliance to legitimize, and the growing roster of institutional partners to prove it works. The trading floors, the fund managers, the clearinghouses—they no longer need to imagine a chain fit for purpose. It exists.

So, the question shifts. It’s no longer “is institutional blockchain possible?” The Dusk mainnet has answered with a resounding, operational yes. The question now is, “who will be left behind?” The old guards clinging to opaque systems? The chains that prioritize hype over substance? The time for speculation is fading. The time for scalable, compliant, institutional-grade utility is rising with the Dusk.

This is more than an investment in a token. This is a stake in the plumbing of the future financial system. It’s a bet on the inevitable merger of Wall Street and Crypto Street, not on a distant corner, but on the main thoroughfare being built today. The sun is setting on the era of compromise. A new, brighter financial day is beginning. Watch the institutions move. Listen to the builders build. Feel the momentum shift. This is Dusk. The network is designed. The adoption is here. The future is public, private, and powered by conviction. The dawn belongs to those who are ready.