The promise of blockchain technology has always been rooted in radical transparency. For over a decade, the industry has operated under the mantra that an open ledger is a fair ledger. However, as the dust settles on the initial hype of Decentralized Finance (DeFi) and the world pivots toward the tokenization of Real-World Assets (RWA), a glaring flaw has emerged. This flaw isn't a bug in the code, but a fundamental characteristic of public blockchains: the front-running problem.

In the current landscape, transparency has become a double-edged sword. While it allows for trustless verification, it also exposes institutional strategies to predatory exploitation. If crypto truly intends to absorb the trillions of dollars circulating in traditional capital markets, it must evolve. The future of finance isn't just decentralized; it must be privacy-aware. This is precisely where Dusk enters the frame, redefining how confidentiality and compliance coexist.

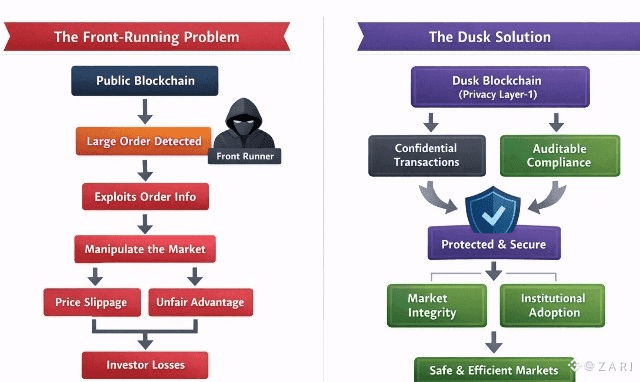

THE PREDATORS IN THE MEMPOOL To understand why privacy is a necessity, one must first look at the "mempool" the digital waiting room where transactions sit before being added to a block. On fully transparent networks like Ethereum, this waiting room is visible to everyone. This visibility has given rise to a sophisticated class of predatory bots designed to harvest Maximal Extractable Value (MEV).

When an institution attempts to move a significant position or rebalance a treasury, these bots detect the intent instantly. By paying a slightly higher transaction fee, a bot can "front-run" the trade, buying the asset milliseconds before the institution and selling it back milliseconds after. This "sandwich attack" results in slippage and worse execution prices for the honest participant.

For a retail trader swapping a few hundred dollars, this might be a minor annoyance. For a pension fund moving hundreds of millions, it is a catastrophic breach of fiduciary duty. You cannot run a serious global market when every move you make is telegraphed to your competitors and automated exploiters. Dusk addresses this by ensuring that the contents of these transactions are shielded from prying eyes, effectively neutralizing the front-runner's advantage.

THE INSTITUTIONAL PRIVACY PARADOX.

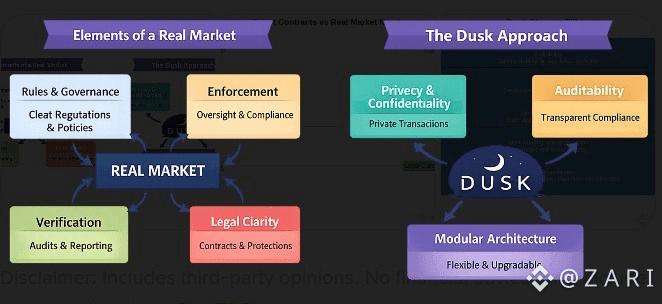

Institutional players operate under a complex set of requirements that public blockchains currently struggle to meet. On one hand, they have a legal obligation to maintain confidentiality. On the other, they must comply with strict Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations.

This is the "Privacy Paradox. If a bank uses a completely private, anonymous chain, they fail their regulatory audits. If they use a completely transparent chain, they leak their proprietary trading strategies and endanger their clients capital.

Protocols like Dusk are positioning themselves as the solution to this paradox. By utilizing Zero-Knowledge Proofs (ZKP), these systems allow for a "middle way." They provide a framework where the details of a transaction the amount, the sender, and the receiver remain encrypted and invisible to the public, yet the network can still mathematically prove that the transaction is valid and compliant with specific rules.

WHY REAL-WORLD ASSETS DEMAND CONFIDENTIALITY

The conversation around privacy becomes even more urgent when we discuss the tokenization of Real-World Assets. We are moving toward a world where real estate, private equity, and government bonds live on-chain.

In these markets, information is the most valuable currency. If a developer is quietly acquiring land titles via a blockchain, public transparency would cause prices to skyrocket before the acquisition is complete. In the world of private equity, the timing of an entry or exit is a guarded secret.

Without privacy-aware infrastructure like Dusk, tokenized markets will remain a playground for small-scale experiments. To attract institutional liquidity, the plumbing of the financial system must offer the same protections found in traditional "dark pools" or private ledgers, but with the efficiency and settlement speed of a blockchain.

BEYOND MANIPULATION: THE MODULAR DEFENSE

The market for financial manipulation is not static. As defenses improve, so do the methods of exploitation. This is why the architecture of these new financial layers matters. A modular approach allows the network to upgrade its privacy features and compliance logic without overhauling the entire system.

By separating the execution layer from the privacy and settlement layers, Dusk ensures that its infrastructure remains resilient against new forms of MEV and regulatory shifts. This flexibility is what transforms a blockchain from a rigid ledger into a professional-grade financial tool that can grow alongside the evolving needs of global markets.

THE CULTURAL SHIFT: PRIVACY AS PROTECTION

For years, the word privacy in crypto was synonymous with anonymity and by extension, illicit activity. However, the narrative is shifting. We are beginning to realize that privacy is not about hiding crimes; it is about protecting legitimate economic activity.

Market integrity is impossible without a degree of confidentiality. If a market allows for the systematic "taxing" of large participants through front-running, that market is fundamentally broken. Privacy-aware infrastructure is the repair kit for this broken system. It levels the playing field by ensuring that a trader's intent remains their own until the moment of execution.

THE ROAD AHEAD

As we look toward 2026 and beyond, the divide between "hobbyist" chains and "institutional" chains will likely widen. The winners in the institutional space will be those who can provide a compliance-first privacy model.

Dusk and its Layer-1 design represent a significant leap forward. They acknowledge that the "Front Running Problem is a systemic risk to the global adoption of blockchain. By integrating confidentiality into the very fabric of the protocol, they are building a sanctuary for institutional liquidity.

In the end the transition to privacy-aware infrastructure isn't just a technical upgrade it is a prerequisite for the next era of global finance. If we want a world where the largest banks and treasuries operate on-chain we must give them the tools to do so safely. Privacy is the shield that makes the open economy possible.