🚨🛢️ 80% of Venezuela’s oil revenue was settled in USDT, confirmed by the WSJ.$BTC

Most people think this was an “escape route.”

It wasn’t. ❌

💵 USDT = the US dollar, just faster, digital, and easier to move.

But it still has:

A company 🏢

A CEO 👔

Compliance rules 📋

And most importantly… a FREEZE button 🧊

Now connect the dots 🧠

🔒 Tether has already frozen wallets linked to Venezuela’s oil trade

💥 It recently froze $182M USDT on Tron — one of its largest actions ever

That single fact says everything.

✅ Stablecoins are useful, yes.

❌ But if they can be frozen, they are not sovereign money for a nation that wants control.

Now let’s play game theory — plain and simple ♟️

USDT → Censorable ❌

Yuan → Political leverage attached ❌

Gold → Try settling $500M globally in 10 minutes 🐌

CBDCs → Same kill switch, just government-branded ❌

So what’s left? 🤔

There is only ONE asset that:

Settles globally 🌍

Finalizes instantly ⚡

Requires no permission 🚫

Can’t be frozen 🧊❌

🟠 21 million supply

🟠 No CEO

🟠 No headquarters

🟠 No phone number to call

This is the Bitcoin ad that never needed a marketing budget 🔥

The highest-stakes, most desperate capital on Earth just learned:

👉 There is only one exit door.

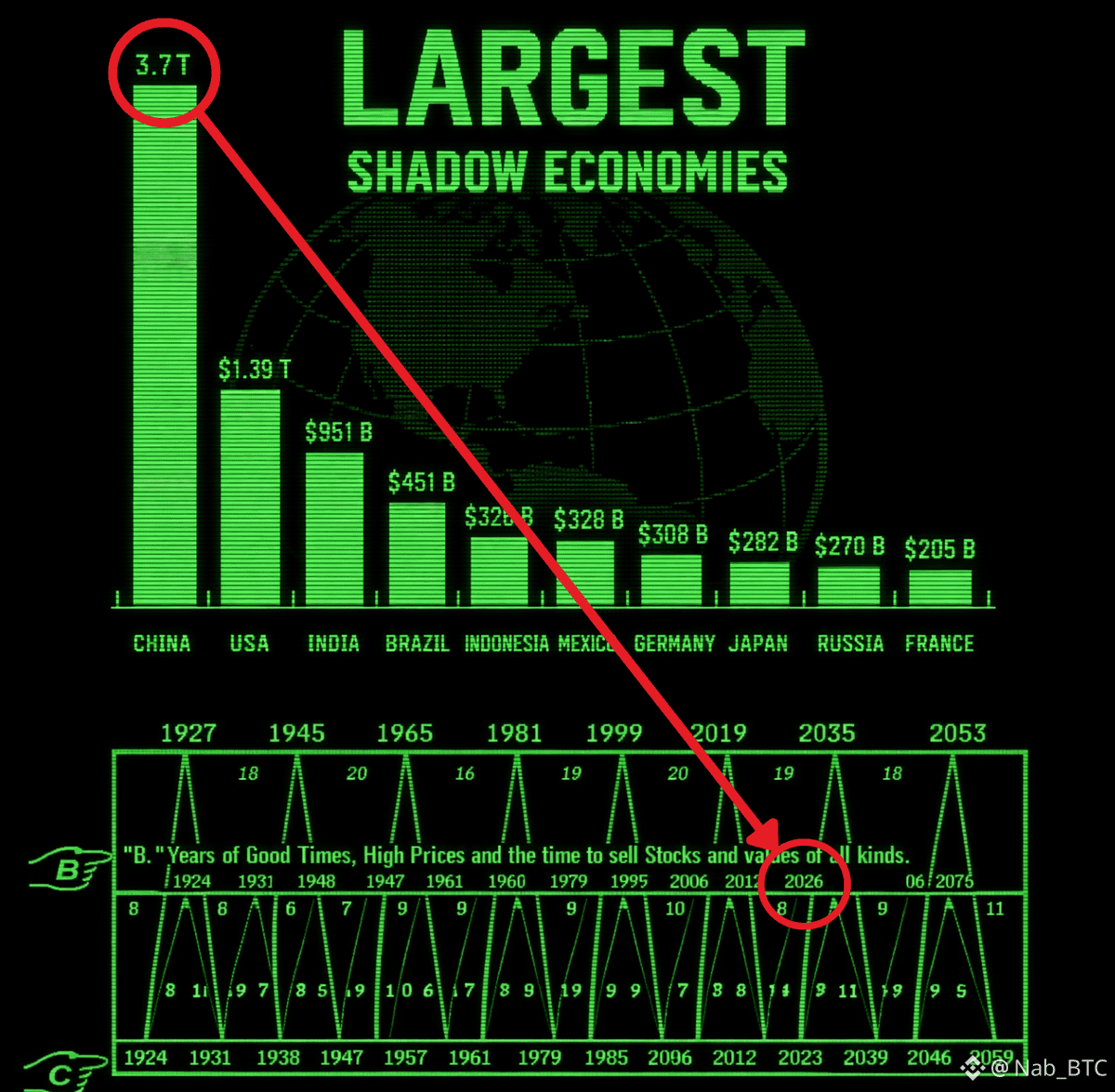

🌎 Countries hedging against dollar weaponization —

China, India, Brazil, Russia, and others — will use Bitcoin.

💰 And when they do…

TRILLIONS will flow in.

📉 The price doesn’t show it yet.

📈 But it will.

🧠 I’ve studied macro for 10 years.

📊 I called multiple major market tops — including the October BTC ATH.