In the world of cryptocurrencies, stablecoins have become a central part of daily financial activity. Unlike Bitcoin or Ethereum, which experience large price swings, stablecoins are designed to maintain a stable value, usually pegged to a currency like the US dollar. This stability has made them popular for trading, lending, and even remittances. But there is a big difference between using stablecoins for occasional trading and using them as a reliable method to move money every day.

Creating a stablecoin is relatively easy. A team can mint tokens, back them with reserves, and list them on exchanges. But the real challenge begins after that. People do not just want stablecoins to exist they want them to work in practice. They want to send and receive money quickly, without paying unpredictable fees, and with confidence that transactions will settle smoothly even when the network is busy.

This is where the focus shifts from hype and innovation to reliability. Most blockchains try to do many things at once. They want to be platforms for decentralized finance, smart contracts, NFTs, gaming, and more. While this versatility is exciting, it often comes at a cost. Networks that try to “do it all” struggle to maintain speed and low fees during heavy usage. For a business or a treasury team, unpredictable delays or high fees make these networks hard to trust.

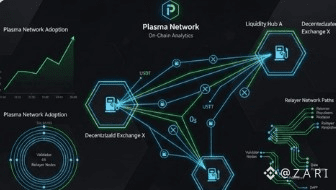

Plasma, a blockchain project gaining attention in the crypto community, takes a different approach. Instead of attempting to be a universal solution for every kind of blockchain application, Plasma focuses on one core function: stablecoin settlement. This might sound simple, but in practice, it is a powerful idea. By focusing on settlement infrastructure, Plasma aims to make the movement of stablecoins fast, cheap, and predictable at scale.

In real-world finance, money moves constantly. Companies pay suppliers, employees receive salaries, and banks and financial institutions transfer funds around the clock. Unlike trading activity, which can be concentrated at certain times, treasury flows are continuous. Payments do not pause because a network is congested or because fees have spiked. For a stablecoin network to succeed beyond speculative trading, it must be able to handle these flows under pressure, consistently.

Plasma’s design reflects this reality. By optimizing specifically for stablecoin transfers, the network can maintain predictable transaction times and stable fees. This reliability is not glamorous, but it is what makes a system usable in practice. Businesses are far more likely to adopt technology they can trust than technology that is flashy but inconsistent.

The broader significance of this approach is often overlooked. In crypto, many projects chase popularity, hype, or experimental applications. However, history shows that the technologies that quietly solve a practical problem often win in the long run. Email became standard because it simply worked. The internet became the backbone of global communication because it was reliable. In the same way, a blockchain network that enables everyday stablecoin settlement reliably can become indispensable without fanfare.

For investors and users, the value of such reliability is clear. Networks that work predictably attract more usage. More usage builds liquidity. Higher liquidity ensures that stablecoins can be moved quickly, without slippage, even during periods of high demand. This cycle reliability leading to usage, leading to liquidity, leading to long-term value is the foundation of sustainable growth. It is the kind of organic adoption that no marketing campaign can buy.

Another key advantage of Plasma’s focus is that it simplifies the user experience. One of the barriers to mainstream stablecoin adoption is the complexity of sending money on traditional blockchains. Users often need to worry about gas fees, network congestion, or whether they have the native token required to complete a transfer. These small frictions may be tolerable for traders who deal with them regularly, but for businesses and everyday users, they create friction that limits adoption. By keeping fees stable and transactions predictable, Plasma removes these barriers.

The implications extend beyond individual transactions. Reliable settlement infrastructure can also improve financial planning for businesses. If companies know exactly what fees they will pay and when transactions will settle, they can plan cash flow more effectively. This predictability is critical for treasury management, international payments, and even payroll systems. In traditional finance, this level of certainty is taken for granted. In crypto, it is rare, and that makes it a competitive advantage.

Of course, adoption does not happen overnight. Networks like Plasma need time to demonstrate reliability under real-world conditions. They also need partnerships with exchanges, wallets, and payment providers to create a seamless ecosystem for users. But the principles are clear. A blockchain network that focuses on the practical problem of stablecoin settlement—and does it well—can create real, lasting value.

Ultimately, the story of stablecoins moving beyond trading is a story about trust. Users and businesses will not adopt a system that is unpredictable. Investors will not back a network that cannot deliver consistent performance. By concentrating on infrastructure rather than hype, Plasma is attempting to solve the most important problem in crypto payments: making stablecoins work like money in the real world.

In conclusion, stablecoins are more than just trading tools. To achieve widespread adoption, they must be usable every day, under real-world conditions, and without surprises. Plasma’s approach focusing on fast, cheap, and predictable settlement is a reminder that sometimes the most important innovations are the ones that quietly make life easier. While flashy features attract headlines, reliability attracts adoption. And in the long run, adoption is what builds lasting value.

As we watch the crypto ecosystem evolve, it is worth asking: which projects will be remembered not for their hype, but for the quiet, practical ways they made money move reliably?