Most traders don’t consider compliance until it hits them: a token gets delisted, a product shuts down, or a region quietly becomes unsupported. The truth is simpler: regulators dislike uncertainty, and markets dislike surprises. On-chain compliance is becoming a practical concern for investors focused on long-term participation, not just short-term gains.Traditional finance operates on rules, not vibes. If a blockchain hosts assets resembling financial instruments, regulators will ask familiar questions: Who can trade or hold this? How are sanctions enforced? How is disclosure handled, and how is user data protected? These requirements are not going away. In Europe, frameworks like MiCA are already pushing crypto projects toward clear standards, and securities-style markets touch MiFID II and related regimes.Dusk positions itself directly in this reality. It is a privacy blockchain designed for regulated finance, supporting compliance on-chain while maintaining user confidentiality through zero-knowledge technology. The core idea: privacy that works with compliance, not against it. Public chains offer total transparency, helping auditors but exposing balances, trading behaviors, and counterparties. Dusk lets users prove what needs to be proven without showing everything.

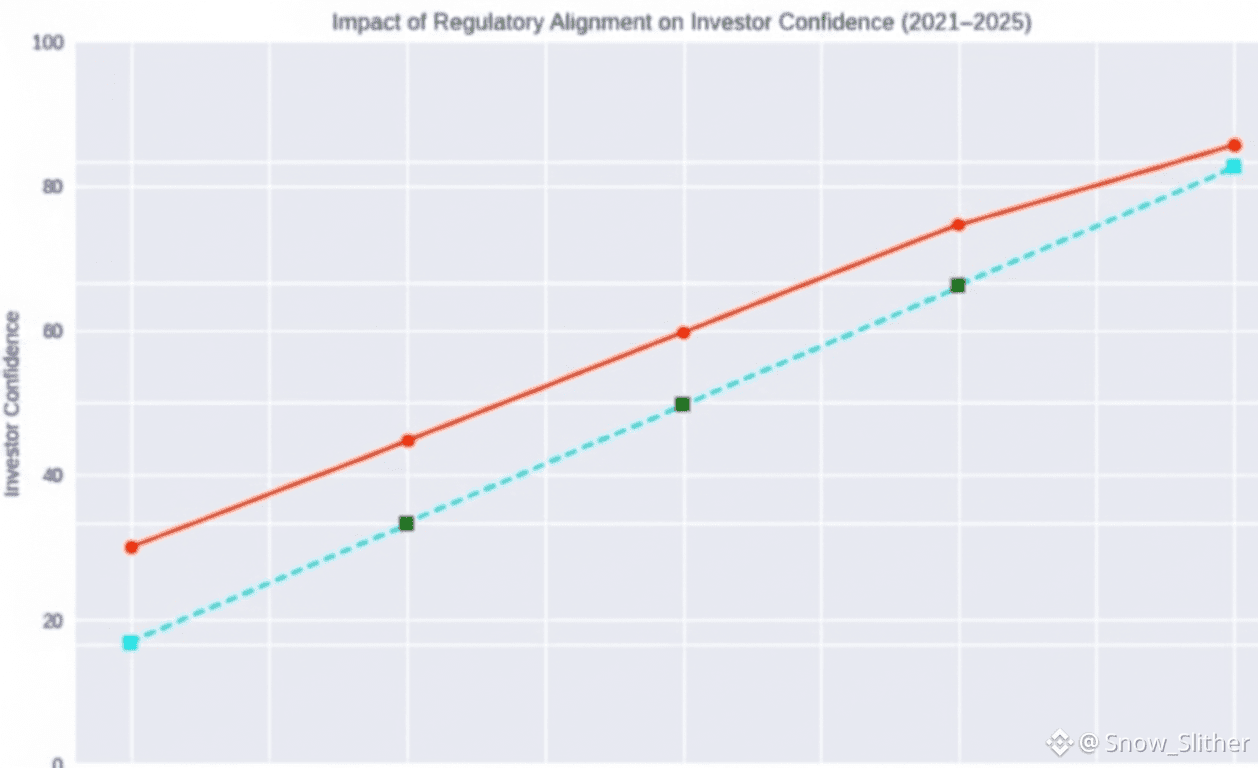

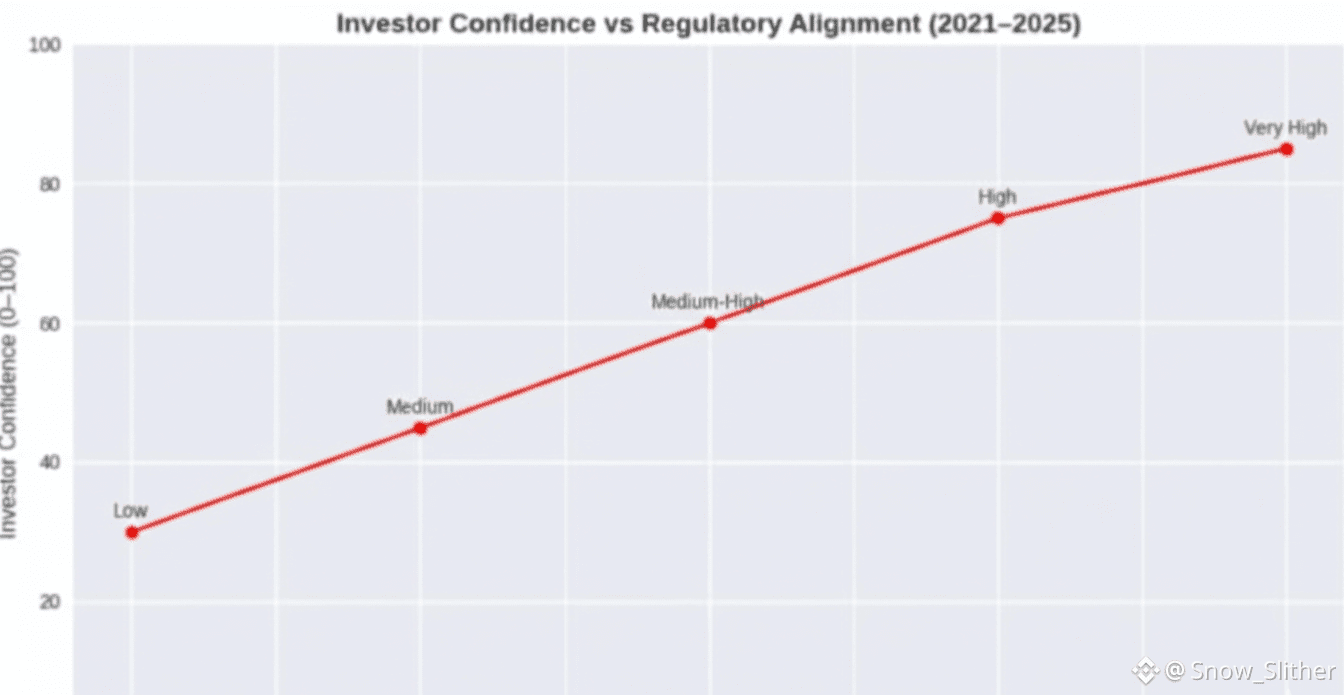

Example – Identity Verification: Dusk introduced Citadel, a zero-knowledge KYC system. Users can prove they meet regulatory requirements without broadcasting personal information, allowing institutions to comply without creating a public identity database.From an investor perspective, the focus isn’t whether compliance is “good” or “bad,” but market access and durability. Ignoring regulatory direction may work temporarily but can limit serious capital participation. Dusk emphasizes MiCA-aligned principles and other relevant regimes, ensuring a realistic compliance workload for regulated entities.Real-World Scenario: A small EU-based fund seeks tokenized asset exposure but must demonstrate compliance to auditors. On fully transparent chains, strategy may leak via wallet tracking. On fully private chains without compliance layers, oversight fails. Dusk sits in the middle: private activity with selective proofs, maintaining market accessibility even under tighter regulation.

Market Metrics (Jan 2026): DUSK trades around $0.055, market cap ~$26.86M, 24-hour volume ~$19.91M, circulating supply ~487M tokens. Metrics don’t confirm the thesis but show it remains a relatively small asset sensitive to narrative, execution, and regulatory developments.Regulatory evolution: alignment doesn’t guarantee approval.Privacy tech scrutiny: regulators may worry about misuse.Adoption: institutions may adopt slowly, with long sales cycles.Market sentiment: tokens tied to infrastructure can stay undervalued, spike, then cool off unpredictably On-chain compliance is no longer a marketing angle—it’s a survival requirement for projects aiming at serious financial rails. Dusk’s approach balances privacy and regulation as complementary constraints. Execution over time will determine its relevance; ignoring compliance increasingly resembles ignoring liquidity.@Dusk $DUSK #Dusk #dusk