🔥 POST 1 — $GUN | WHEN COLLATERAL CRACKS, LIQUIDITY BLEEDS

🚨 A BIG STORM IS FORMING — AND $GUN IS AT THE EDGE OF IT

This isn’t crypto drama.

This is bond market pressure leaking into risk assets.

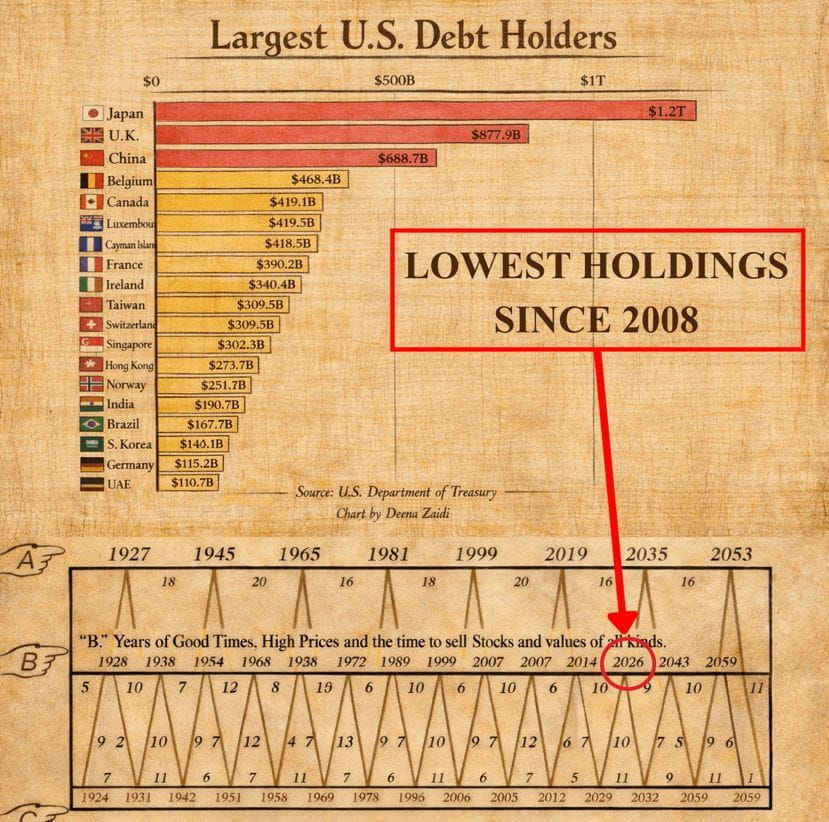

Countries are dumping US Treasuries.

Yields are rising.

Money is getting expensive.

When liquidity tightens, only the strongest narratives survive.

🌍 Market Overview

Treasury yields climbing = leverage gets punished

Risk-off rotation already visible

Volatility expanding → fake moves increase

$GUN isn’t immune — but it’s tradable if you stay disciplined.

📊 Key Levels

Support: 0.285 / 0.262

Resistance: 0.318 / 0.346

These levels matter because liquidity hunts start here.

⏱️ Outlook

Short-Term:

Chop + stop hunts

Expect wicks, not clean trends

Mid-Term:

Relief bounce possible if yields cool

Needs volume confirmation

Long-Term:

Macro-dependent

Survives only if liquidity returns to risk assets

🎯 Trade Targets

1️⃣ 0.318

2️⃣ 0.346

3️⃣ 0.382

(Scale out. Don’t marry the trade.)

🧠 Pro Trader Tips

No emotional longs near resistance

Reduce leverage — this is not a hero market

Watch US10Y yield before every entry

⚠️ Bonds move first.

Crypto reacts fastest.

Respect the storm ⛈️

⚡ POST 2 — $SXT | SMART MONEY MOVES QUIETLY BEFORE THE CRASH

🚨 THIS ISN’T FEAR — THIS IS FLOW DATA

Europe & China dumping Treasuries at 2008-level aggression.

That’s not random.

That’s capital repositioning.

$SXT sits right where liquidity decides direction.

🌍 Market Overview

Bond sell-offs = collateral stress

Stress = funding costs rise

Rising costs = weak hands exit

Crypto doesn’t crash first.

It bleeds first.

📊 Key Levels

Support: 0.138 / 0.129

Resistance: 0.154 / 0.168

Market will react violently around these zones.

⏱️ Outlook

Short-Term:

High volatility scalps

Fake breakdowns likely

Mid-Term:

Bounce possible on yield stabilization

Needs BTC stability above key range

Long-Term:

Strong only if macro eases

Otherwise: long accumulation phase

🎯 Trade Targets

1️⃣ 0.154

2️⃣ 0.168

3️⃣ 0.184

🧠 Pro Trader Tips

Enter near support, not after green candles

Keep dry powder — cash is a position

Track DXY + yields together

This isn’t boring bond stuff.

This is liquidity warfare.

🌪️ POST 3 — $HANA | WHEN MONEY GETS EXPENSIVE, HYPE DIES

🚨 WARNING FOR OVER-LEVERAGED TRADERS

India dumping Treasuries at the biggest scale since 2013.

That tells you one thing:

💥 Capital is getting defensive.

In these conditions, only precision trades survive.

🌍 Market Overview

Rising yields choke risk appetite

Liquidity dries → volatility spikes

Small caps feel pain first and hardest

$HANA is in a decision zone.

📊 Key Levels

Support: 0.041 / 0.038

Resistance: 0.046 / 0.052

These are execution levels — not guesses.

⏱️ Outlook

Short-Term:

Quick spikes, fast reversals

Ideal for light leverage or spot

Mid-Term:

Needs macro relief

Otherwise sideways grind

Long-Term:

Depends on broader risk cycle

Patience beats prediction

🎯 Trade Targets

1️⃣ 0.046

2️⃣ 0.052

3️⃣ 0.059

🧠 Pro Trader Tips

Don’t average down blindly

Stop-loss is survival, not weakness

Yield spikes = reduce exposure instantly

📉 Bonds whisper first.

📉 Stocks listen next.

📉 Crypto screams last.#BTC100kNext? #BTC100kNext? #TrumpCancelsEUTariffThreat