Most blockchains still pretend that privacy and regulation are enemies. That belief is outdated and honestly lazy. Institutions don’t avoid crypto because it’s slow or expensive. They avoid it because privacy usually breaks compliance, and compliance usually destroys privacy. Dusk exists because that trade-off is fake.

Dusk Network functions as what it correctly calls a licensed stack. Not a marketing phrase, an architectural decision. Instead of treating regulation as an external constraint, Dusk embeds it directly into how the network operates. That single choice is why it matters.

At the cryptographic level, Dusk does not rely on one trick. It stacks zero-knowledge proofs, fully homomorphic encryption, and ZK-ID into a system that is purpose-built for finance, not ideology. ZK proofs handle confidential transactions without leaking trade data. FHE allows obfuscated orderbooks and private DeFi logic while still remaining auditable when required. ZK-ID solves the KYC problem the correct way: compliance without public exposure. No wallet doxxing. No on-chain identity theater.

This is where most privacy chains fail. They protect users from everyone, including regulators. That sounds good until you try to onboard real capital. Dusk does the opposite. It protects users from the public while remaining legible to oversight. That distinction is everything.

The regulatory side is not theoretical either. Dusk is designed to power NPEX-licensed markets, including MTF, ECSP, and Broker frameworks. That means assets issued and traded on Dusk are not pretending to be compliant, they are operating inside existing legal structures. This is why Dusk can handle real RWAs instead of synthetic copies and wrapped promises.

Institutional accessibility is another area where Dusk quietly outclasses most chains. Through DuskEVM, institutions can deploy using standard Ethereum tooling. No retraining teams. No six-month integration cycles. Months become days. That alone removes a massive friction point that most crypto people underestimate.

Settlement is where it gets serious. Dusk offers instant settlement with deterministic finality via Kadcast consensus. This isn’t about speed for traders. It’s about legal certainty. When a transaction settles instantly, ownership is final. No clearing delay. No counterparty limbo. That is how liquidation risk actually gets reduced, not by slogans.

Cross-chain movement is handled the same disciplined way. By integrating Chainlink CCIP, Dusk allows regulated assets to move across more than 65 chains without losing their compliance properties. This is critical. Most bridges break legal guarantees the moment assets leave their home chain. Dusk preserves them.

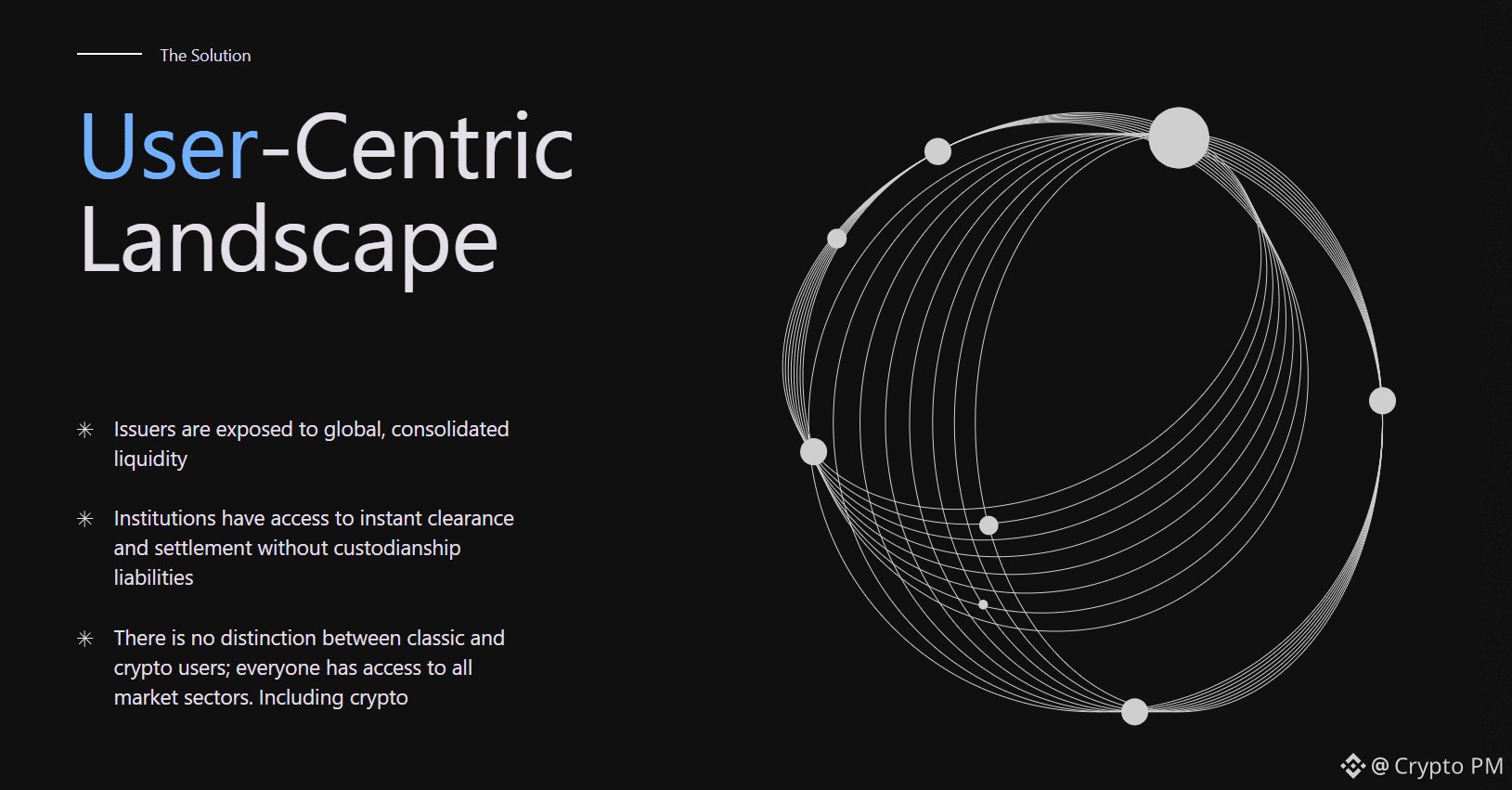

The result is simple but rare: users can self-custody institutional-grade assets privately, institutions can operate within regulation, and neither side has to compromise. That is why comparisons to a “Swiss bank vault with Ethereum speed” actually make sense here.

The $16 trillion tokenized asset market will not move to chains that ignore law or expose positions. It will move to infrastructure that understands both enforcement and discretion. Dusk is one of the very few projects built with that reality in mind.

Most people still judge blockchains by TPS and vibes. Institutions judge them by liability, privacy, and settlement certainty. Dusk was built for the second group, not the first.

That is why it looks boring to some and inevitable to others.