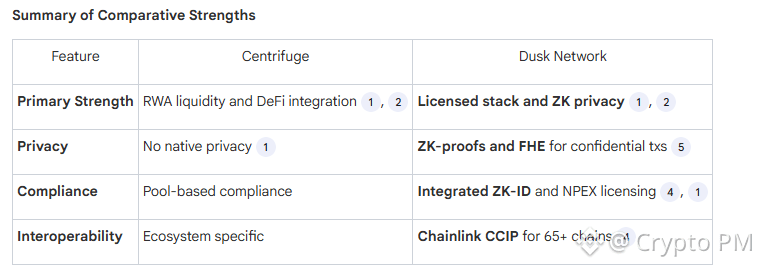

Every time real world assets come up people immediately throw Dusk and Centrifuge into the same sentence and act like they are fighting for the same pie. They are not. This comparison keeps happening because on the surface both touch RWAs and that is where most thinking stops. That is lazy thinking and it leads to wrong conclusions.

I want to slow this down a bit and look at what each one is actually trying to do because once you see it clearly the difference is obvious even if people keep ignoring it.

Centrifuge Is About Liquidity First Always

Centrifuge is built around one core idea. Bring real world assets into DeFi and make them liquid. It does this well. It connects RWAs into lending markets like Aave and Maker and lets assets be borrowed against. That is its strength and also its boundary.

The entire design is about access to liquidity. Not market structure. Not how assets are traded. Not how institutions operate. It is about capital efficiency inside existing DeFi rails.

There is nothing wrong with that. But it defines what Centrifuge can and cannot be. It assumes open transparency. It assumes DeFi style exposure. It assumes users are okay with everything being visible.

Institutions are usually not okay with that at all.

Dusk Starts From The Market Not From Yield

Dusk approaches RWAs from the opposite side. It does not start with how to plug assets into DeFi. It starts with how markets actually function in regulated finance.

That difference changes everything.

Dusk is not trying to maximize liquidity first. It is trying to build a legally viable market environment where assets can be issued traded settled and held without breaking laws or exposing participants.

That means privacy is not optional here. It is required.

Privacy Is The First Wall Institutions Hit

Centrifuge has no native privacy. Everything behaves like normal DeFi. Positions visible flows visible strategies visible. That works fine for crypto natives who are used to it.

Institutions cannot operate like that. They cannot show positions. They cannot leak strategies. They cannot expose order books. That is not preference it is obligation.

Dusk integrates zero knowledge privacy directly into execution. Trades can be confidential. Order books can be obfuscated. And still auditable when required. That balance is not decorative it is foundational.

This is where most comparisons break down completely.

Regulation Is Not A Side Quest For Dusk

Dusk is built as a licensed stack. That is not marketing language. Through NPEX it supports regulated trading environments with MTF and ECSP licenses. That means assets traded on Dusk exist inside legal frameworks from day one.

Centrifuge does not try to run regulated secondary markets. It onboards assets and lets them access liquidity. Different goal entirely.

If the endgame is experimental access Centrifuge works.

If the endgame is institutional scale under law Dusk is built for that.

Infrastructure Depth Tells You Intentions

Dusk runs a multi layer architecture with very specific roles. Settlement consensus EVM compatibility and privacy focused virtual machines are separated intentionally. Deterministic finality matters. Custody matters. Compliance matters.

This is heavy infrastructure work and it shows what Dusk is optimizing for. Long term regulated operation.

Centrifuge is lighter by design because it does not need that depth to do its job.

The Core Difference People Refuse To Admit

Centrifuge brings assets into DeFi.

Dusk builds the market those assets actually live in.

One optimizes liquidity.

The other optimizes structure.

One works well inside existing systems.

The other tries to replace parts of those systems with something legally compatible on chain.

Calling them competitors misses the point completely.

Why This Matters Going Forward

If RWAs stay small and experimental DeFi solutions are enough. If RWAs grow into real capital markets then transparency alone breaks the model.

Institutions do not care about yield screenshots. They care about custody privacy compliance and settlement finality.

That is the gap Dusk is trying to fill and why its progress looks slow and boring to people chasing narratives.

my take

I think this comparison exposes how shallow most RWA discussions are. People see the same label and assume the same goal. That is wrong.

Centrifuge is useful and does what it claims. Dusk is doing something harder and less popular which is building structure instead of chasing liquidity.

If RWAs never leave DeFi labs then Dusk will look unnecessary. If RWAs become real markets then Centrifuge alone will not be enough.

I do not think one replaces the other. I think they exist for different futures. And pretending otherwise is just avoiding the uncomfortable parts of this conversation.