In leveraged crypto markets, significant single-day moves warrant attention—not for speculation, but for understanding market dynamics and risk exposure.

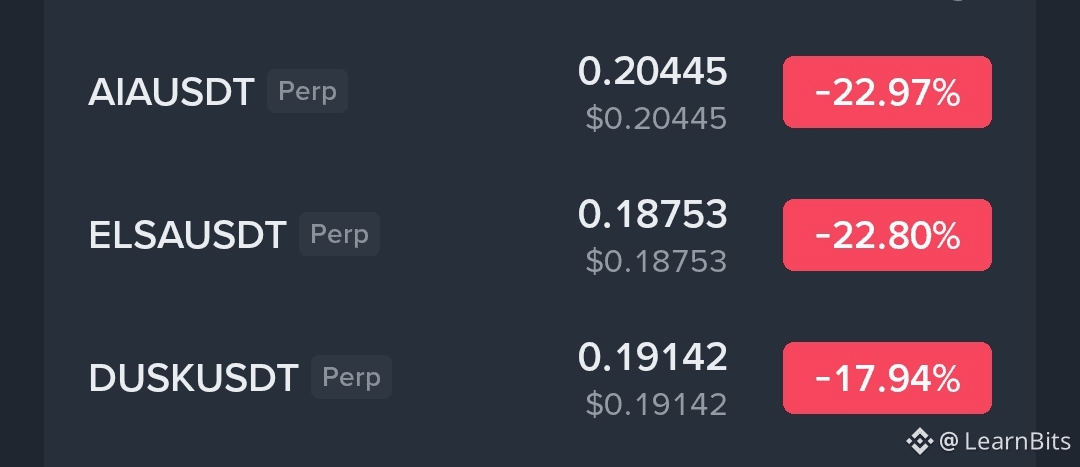

Today's Notable Decliners (24h):

🔻$AIA : -22.97% | Last: $0.2045

🔻$ELSA : -22.80% | Last: $0.1875

🔻$DUSK : -17.94% | Last: $0.1914

These are perpetual futures prices, which can deviate from spot prices due to funding rates and leverage effects. Moves of this magnitude in a 24-hour period highlight:

1. High Volatility: Especially prevalent in mid- and low-cap altcoins.

2. Leverage Impact: Liquidations can exacerbate downward momentum.

3. Sector Rotation: Often, such declines are not isolated and may reflect broader sentiment shifts or sector-specific news.

For traders and portfolio managers, environments like these reinforce the necessity of:

· Strict position sizing

· Clear stop-loss levels

· Differentiating between spot and derivative market movements

Understanding these dynamics is key to navigating crypto market cycles with discipline.