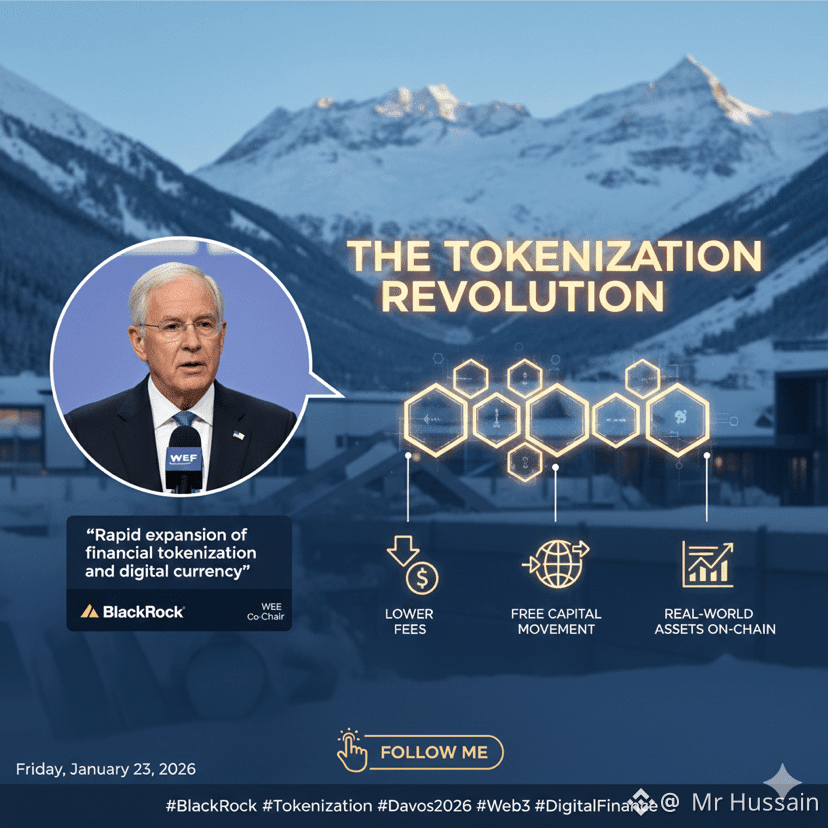

When the CEO of the world’s largest asset manager speaks, the market listens. At Davos, Larry Fink (BlackRock) didn't just mention digital assets—he called for an all-out "rapid expansion" of financial tokenization.

⛓️ Why Davos is Buzzing About Tokenization

Fink’s vision is simple but revolutionary: Moving finance onto the blockchain isn't about the hype; it’s about efficiency. He highlighted two massive pain points this shift will solve:

• Slash Transaction Fees: Removing the "middleman tax" that eats into investor returns.

• Frictionless Capital: Real-time movement of assets across borders without the 3-5 day banking lag.

💡 The Takeaway

We are witnessing the "Great On-Chaining." It’s no longer a question of if traditional finance adopts digital currency, but how fast they can build the infrastructure to support it. For those of us already in the space, this is the ultimate institutional "I told you so."

The Big Question: As BlackRock pushes for a tokenized future, which sector do you think benefits first? Real estate, stocks, or private equity?

#BlackRock #Tokenization ##WEFDavos2026 #Web3 #DigitalFinance #RWAs #Write2Earn