Dusk Network didn’t appear overnight. It’s a project that has been quietly building since 2018 with one clear goal: to make blockchain actually work for real, regulated finance without throwing privacy out the window. While most chains choose either full anonymity or full transparency, Dusk chose the hard road doing both, properly.

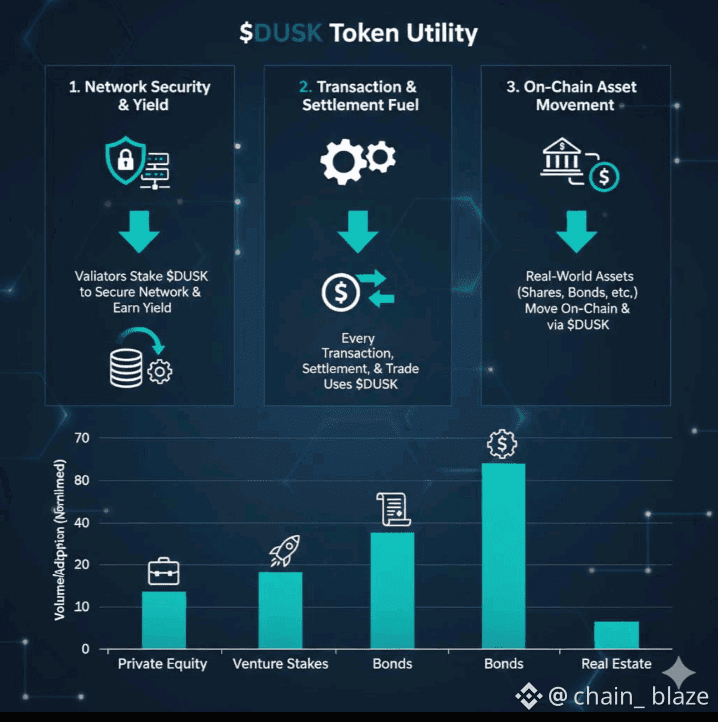

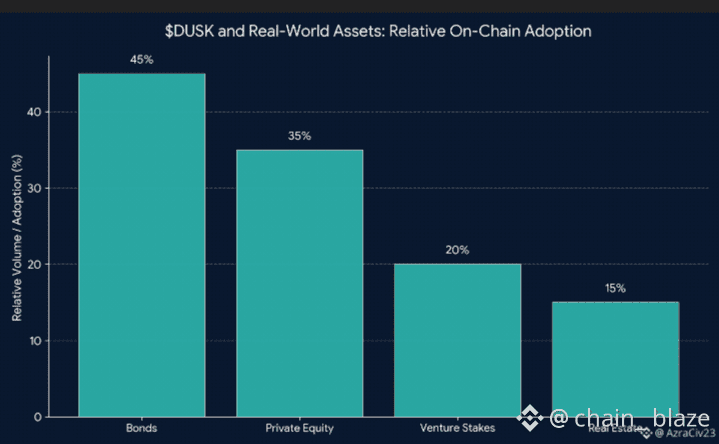

At its core, Dusk is a Layer-1 blockchain designed as real financial market infrastructure. Not hype finance, not experimental DeFi for insiders, but the kind of infrastructure that banks, exchanges, and institutions can legally use. Think tokenized stocks, bonds, funds, and real-world assets that need rules, audits, and compliance — but still deserve privacy.

The big idea behind Dusk is simple: privacy should be the default, not a luxury, and compliance should be built into the system, not bolted on later. On Dusk, transactions can remain confidential, yet regulators or auditors can be granted access when legally required. That balance is what sets it apart from almost every other blockchain in the space.

Technically, Dusk is built in a modular way so each part does one job well. The base layer handles settlement, security, and consensus. On top of that sits an EVM-compatible environment, meaning developers can build smart contracts using familiar Ethereum tools while benefiting from Dusk’s privacy features. Identity and access rules are not outsourced to centralized services either they’re part of the protocol itself, allowing institutions to enforce who can participate, under what conditions, and why.

Instead of energy-heavy mining, Dusk runs on a Proof-of-Stake system called Succinct Attestation. It’s designed for fast finality, efficiency, and security, which matters when you’re settling real financial assets, not just swapping tokens. Privacy is powered by zero-knowledge proofs, enabling transactions that hide sensitive data while still proving everything is valid.

All of this isn’t theoretical anymore. In January 2025, Dusk produced its first immutable mainnet blocks, officially stepping into live operation. That was a major milestone from that moment, Dusk stopped being “in development” and started being infrastructure. A few months later, a two-way bridge went live, allowing DUSK tokens to move across chains while preserving privacy guarantees. By the end of 2025, the public DuskEVM testnet launched, opening the doors for developers to deploy and test smart contracts on a compliant, privacy-first network.

The roadmap ahead is focused and realistic. Full EVM support on mainnet is coming, along with deeper integrations into decentralized exchanges, stronger developer tools, and broader cross-chain connectivity. Interoperability isn’t just about moving tokens it’s about moving regulated assets safely across ecosystems, and that’s where Dusk’s partnerships matter.

One of the most important collaborations is with Chainlink, bringing secure data feeds and cross-chain interoperability tools to support real-world assets. This allows tokenized securities on Dusk to reference real market prices and interact with other blockchains without breaking compliance. On the institutional side, Dusk has worked with regulated entities in Europe, including Dutch exchange initiatives focused on legally issuing and managing on-chain securities.

There’s also growing discussion around euro-denominated digital money connected to the Dusk ecosystem, designed to meet strict European regulations. While some of this information comes from community and partner reports, it points to a broader trend: Dusk isn’t chasing memes or quick liquidity it’s positioning itself where regulated capital actually flows.

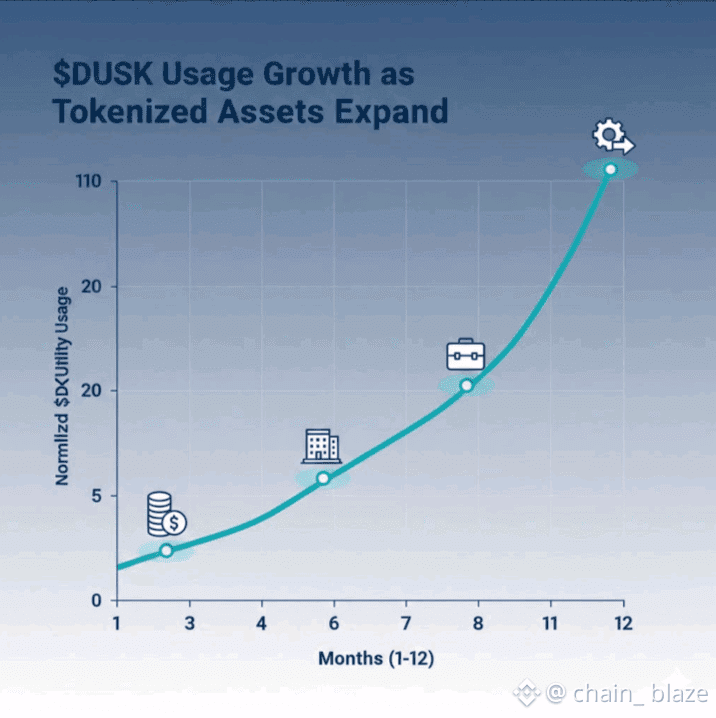

The DUSK token plays a central role in all of this. It’s used to pay network fees, secure the chain through staking, participate in governance, and power cross-chain movement. In early 2026, renewed attention around real-world assets and interoperability sparked a strong market reaction, with DUSK seeing sharp price movement alongside rising institutional interest. As always, prices change fast, but the underlying signal was clear: markets noticed that Dusk is shipping.

Regulation is not an afterthought here. Dusk is designed to align with European frameworks like MiCA, MiFID II, and the EU DLT Pilot Regime, while respecting data privacy laws similar to GDPR. This makes it one of the few blockchains that regulators can actually understand and institutions can confidently deploy on.

Behind the scenes, developer activity has been steadily increasing. Tooling is improving, grants are available for builders, validators are expanding, and real applications are beginning to take shape. It’s not noisy growth it’s the kind that tends to last.

In short, Dusk Network is carving out a very specific and very important space. It’s not trying to replace every blockchain. It’s trying to become the place where serious finance meets blockchain privacy without breaking the law. With mainnet live, smart contracts on the way, and real institutional ties forming, Dusk is no longer a promise. It’s becoming part of the financial rails of the future.