Vanar Chain’s framework extends beyond theoretical design into practical applications, particularly in decentralized finance (DeFi) and real-world asset (RWA) tokenization, where its AI integrations provide nuanced advantages.

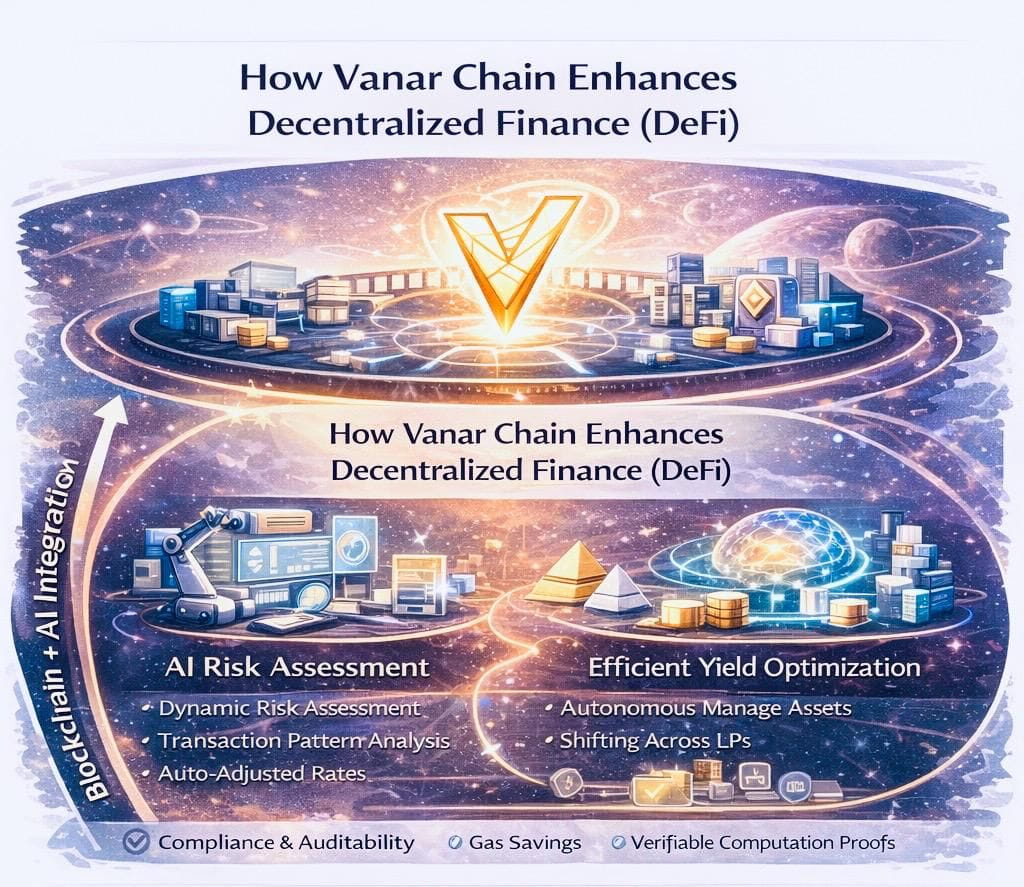

In DeFi, the chain facilitates advanced protocols by embedding AI for risk assessment and automation. For example, lending platforms on Vanar can utilize on-chain reasoning to evaluate borrower credibility dynamically, incorporating factors like transaction history and external market signals processed through semantic memory. This goes deeper than static credit scores; AI models analyze patterns to predict default risks, adjusting interest rates in real-time. Such a system could reduce bad debt by identifying subtle anomalies, like unusual wallet behaviors that traditional metrics overlook.

Further analysis reveals how Vanar’s modular data compression aids in handling large datasets common in DeFi, such as order books or liquidity pools. By storing compressed representations, the chain minimizes fees for high-frequency operations, enabling micro-transactions that are uneconomical on other networks. Consider yield farming: AI agents could autonomously optimize strategies by reasoning over historical yields stored semantically, shifting assets between pools without user intervention.

This introduces efficiency but also risks, such as over-reliance on AI predictions that might falter in black-swan events. Vanar’s verifiable proofs mitigate this by allowing users to audit AI decisions, fostering trust in automated systems.

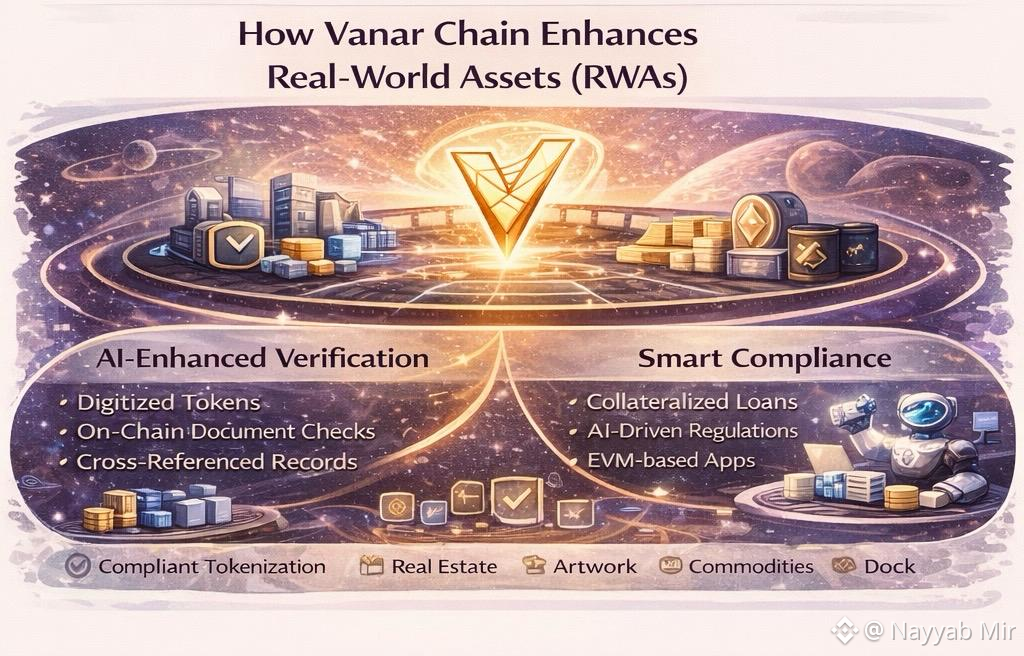

Shifting to RWAs, Vanar Chain tokenizes physical assets like real estate or commodities with AI-enhanced verification. The process begins with digitizing asset data, where AI primitives ensure authenticity through on-chain checks. For instance, semantic memory can cross-reference documents against public records, flagging discrepancies automatically.

This deepens tokenization by enabling fractional ownership with embedded intelligence; tokens could include AI logic for automated dividend distribution based on asset performance metrics. Analytically, this addresses liquidity issues in traditional markets, as AI-driven oracles provide real-time valuations, reducing the need for centralized appraisers.

In a creative lens, envision RWAs on Vanar as living entities: a tokenized property isn’t static but evolves with market data, its smart contract “thinking” through AI to adjust terms like lease renewals. This could revolutionize supply chain finance, where tokenized inventory uses AI to predict demand and trigger sales autonomously.

However, challenges arise in regulatory compliance; AI verifications must align with legal standards, and any model biases could lead to unfair asset representations. Vanar’s EVM compatibility allows integration with compliance tools, but thorough testing is essential to avoid disputes.

Deeper into use cases, Vanar supports hybrid models where DeFi intersects with RWAs, such as collateralized loans backed by tokenized art. Here, AI assesses asset volatility, drawing from semantic databases of similar items, to set loan-to-value ratios.

This analytical approach minimizes over-collateralization, freeing capital, but requires robust data inputs to prevent manipulation. Potential drawbacks include scalability under high RWA volumes, as AI computations could queue during peaks, though the chain’s throughput design aims to handle this.

Engagingly, these applications transform passive investments into interactive ecosystems, where users engage with assets as if conversing with an intelligent advisor. In DeFi, this means protocols that learn from user behaviors to suggest personalized strategies, while in RWAs, it enables community-driven asset management through AI-governed DAOs.

Ultimately, Vanar Chain’s use cases demonstrate a balanced enhancement of existing Web3 tools, emphasizing precision and automation without overcomplicating user experiences. As adoption grows, the true test will be in integrating diverse asset classes while maintaining decentralization.