Dusk is not trying to be loud, flashy, or trendy. It’s trying to be useful especially for the parts of finance that actually matter in the real world. At its core, Dusk is a Layer-1 blockchain built specifically for regulated financial systems. That means banks, exchanges, asset managers, and institutions can use it without breaking laws, while still benefiting from blockchain efficiency and privacy.

What makes Dusk different is how it treats privacy and compliance as equals, not enemies. On most blockchains, you either get full transparency with no privacy, or full anonymity that regulators hate. Dusk sits in the middle. Transactions can stay confidential, but authorized parties like regulators, auditors, or compliance officers can still verify what they need to see. Privacy is built in by design, not added as a feature later.

The network officially entered a new phase when its mainnet went live in January 2025. That moment mattered because it meant Dusk stopped being “experimental” and became production-ready. From that point on, the blockchain started producing immutable blocks, supporting real assets, real validators, and real financial logic. Privacy-preserving smart contracts and asset issuance became usable on a live network, not just in theory.

Since then, development hasn’t slowed down. One of the biggest steps forward was the launch of a two-way bridge connecting Dusk with Ethereum-style networks. This allows assets to move between Dusk and EVM ecosystems while keeping privacy intact through zero-knowledge proofs. In simple terms, it means Dusk can interact with the wider crypto world without giving up what makes it special.

Toward the end of 2025, Dusk opened its EVM testnet. This was a big signal to developers. It means anyone familiar with Ethereum tooling can start building on Dusk, using the same smart contract logic but with privacy and compliance baked in. For builders, this lowers the barrier. For institutions, it increases confidence that the ecosystem can scale.

Looking ahead, Dusk’s roadmap is clearly aimed at traditional finance moving on-chain. Features like advanced staking, privacy-centric asset issuance, scalable execution layers, and regulated payment infrastructure are all part of the plan. There’s also a strong focus on bringing full asset lifecycles on-chain not just trading tokens, but issuing, managing, auditing, and settling real securities in a legally compliant way.

Partnerships play a major role in this vision. Dusk’s collaboration with Chainlink and NPEX shows where the project is heading. NPEX is not a crypto startup it’s a licensed Dutch stock exchange. Together, they’re working on tokenizing real European securities under existing regulations. Chainlink adds secure data feeds and cross-chain infrastructure, which is critical when dealing with real money and regulated assets.

Dusk is also active beyond pure technology. By co-founding the Leading Privacy Alliance, the team is engaging with policymakers, builders, and institutions to explain why privacy doesn’t have to mean secrecy, and why compliance doesn’t have to kill innovation. That kind of positioning matters if blockchain is ever going to be taken seriously by governments and financial authorities.

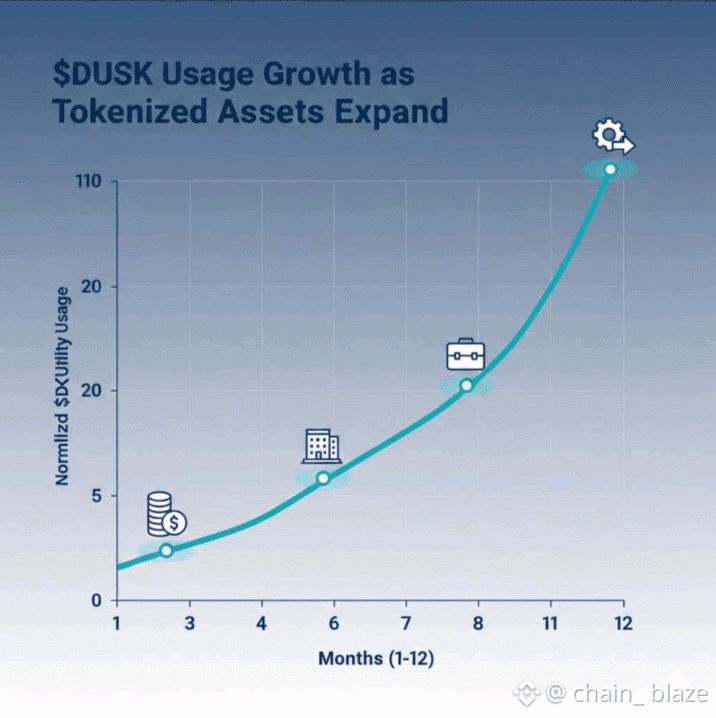

The DUSK token sits at the center of all this. It’s used for fees, staking, governance, and securing the network. As mainnet activity has grown with validators, smart contracts, and bridges coming online on-chain usage has steadily increased. It’s not hype-driven growth, but infrastructure-driven momentum.

In practical terms, Dusk is being shaped to support tokenized stocks, bonds, funds, compliant DeFi products, regulated stablecoins, and institutional payment systems. Whether it’s confidential lending, compliant AMMs, or digital euro-style assets, the goal is the same: bring real finance onto blockchain rails without breaking the rules.

Right now, Dusk is in an interesting place. The mainnet is live. The technology works. Bridges are open. Developers can build. Institutions are testing. It’s no longer a promise it’s an operating system for regulated finance that’s slowly being switched on.

Dusk may not dominate headlines, but it’s quietly positioning itself where blockchain adoption actually happens: in the space where privacy, law, and money meet.