I opened DuskTrade.

€300M in tokenized securities, queued to settle.

And nothing moved.

Not broken. Not invalid.

Just… waiting.

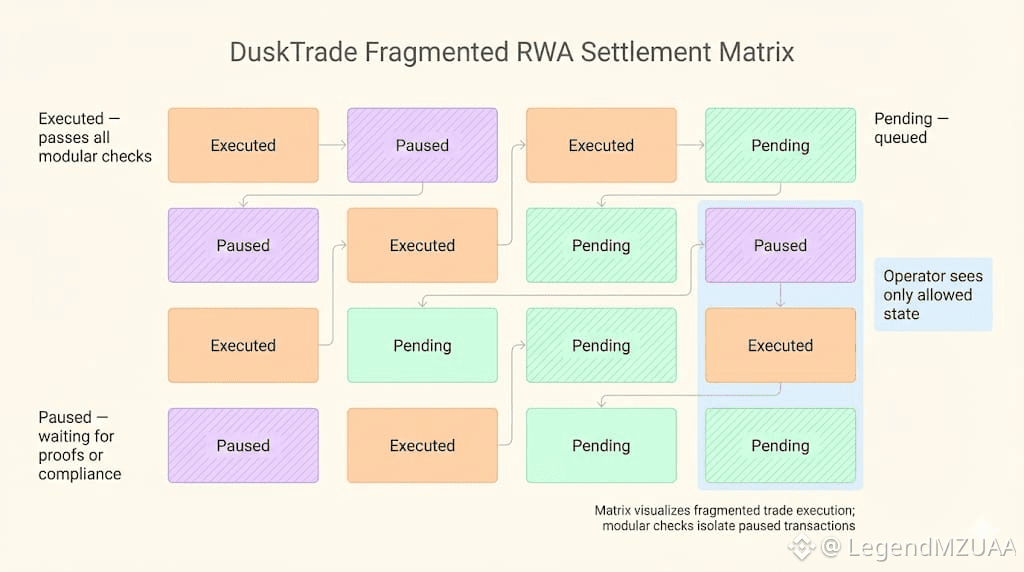

Some trades cleared immediately. Others didn’t. The list stretched. Screens blinked green. Reports updated. Everything seemed fine, but the queue behind them kept growing.

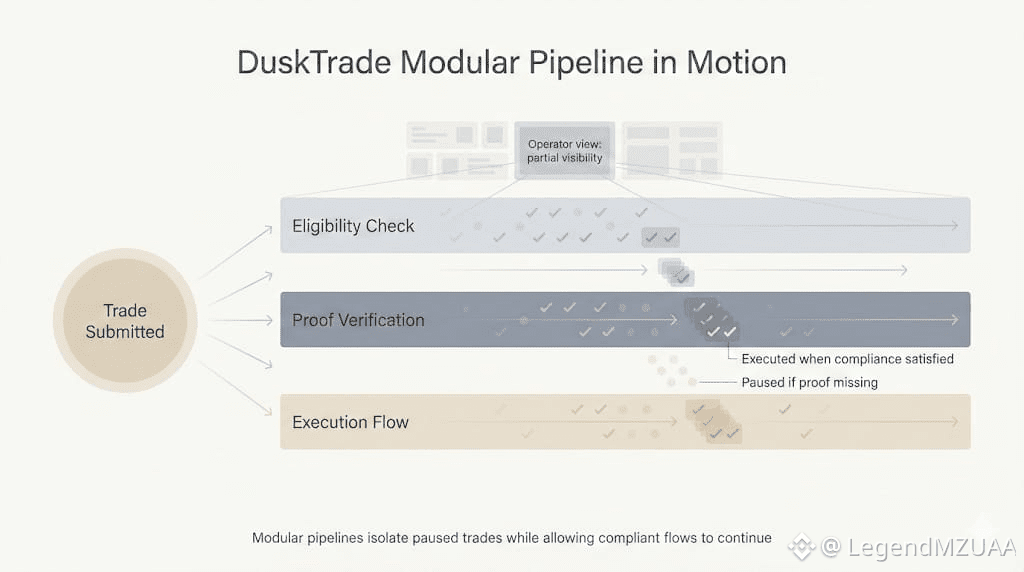

Hedger modules checked eligibility. DuskEVM processed flows that could. One certificate missing. Another proof delayed. The rest stayed put. The system didn’t force movement. Everything else appeared normal, or at least, it seemed so.

A batch of bonds paused.

Another ticked forward.

The dashboard shows only what each operator is allowed to see. You don’t get the full picture. You don’t need it.

I leaned back. Traders tapped fingers. Analysts squinted at the green ticks. The first queued trade finally moved. Quietly. Slowly. The next followed. The flow never moved all at once. Never smoothly. But always correctly.

Tokenized RWAs carried proofs embedded in the modular pipeline. NPEX-linked assets entered DuskTrade and passed through Hedger privacy layers. Audit trails recorded each step. Nothing leaked. Positions remained hidden. And still, you could follow the movement if you watched closely.

Some transactions cleared quickly. Others lingered. One batch waited while another proceeded. Then the next. Pauses revealed themselves in the rhythm of the dashboard, in the small gaps between executed trades. The system’s rules were invisible, but their effect unmistakable.

You begin to notice the edges. Where alignment has arrived, where it hasn’t. How modular pipelines isolate one stalled trade without blocking the others. How DuskEVM handles executable flows while Hedger modules hold what cannot yet move.

The dust moved. Slowly. Fragmented.

Never all together.

Never wrong.

And when it landed, every tokenized security, every RWA, every batch was exactly where Dusk intended.