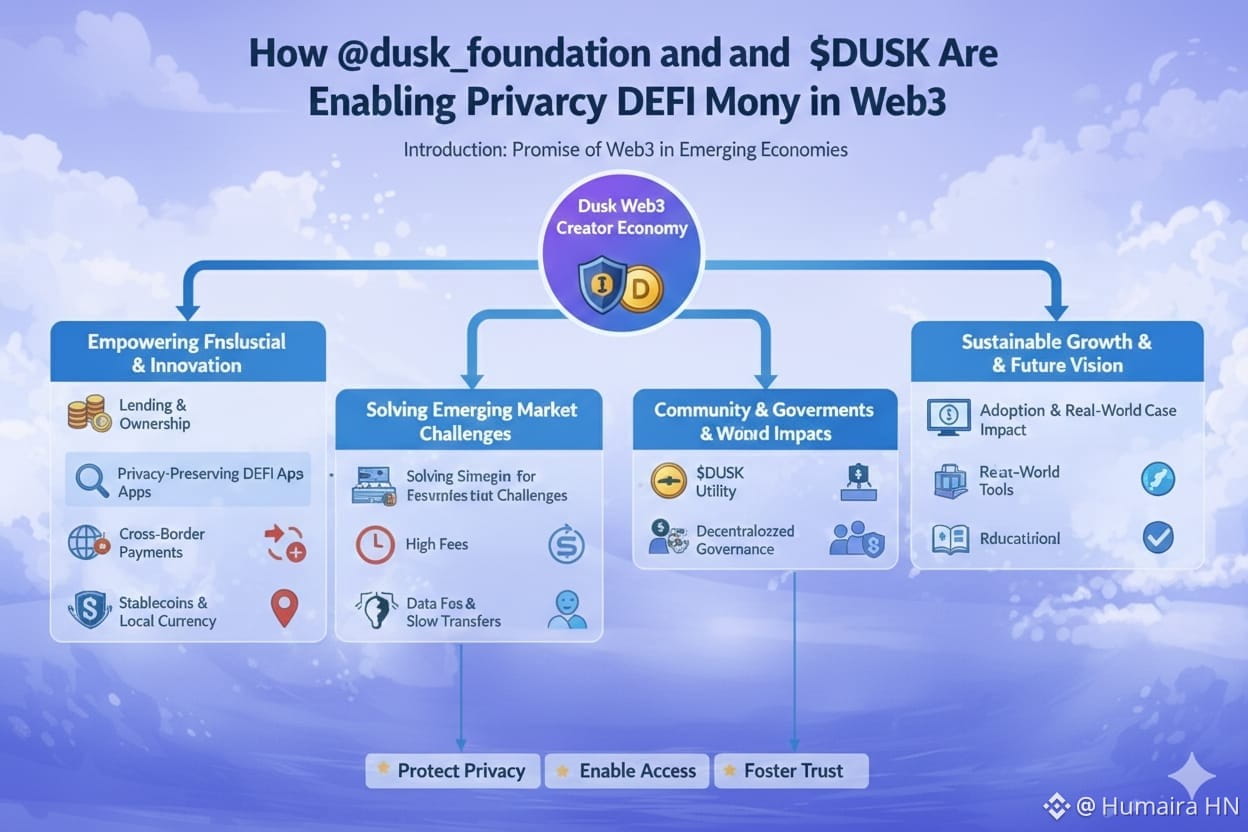

Introduction: The Promise of Web3 in Emerging Economies

When I first started exploring blockchain, I was fascinated by its potential to provide financial services to people without access to traditional banking. In emerging markets, millions of individuals lack secure, affordable, and accessible financial tools. Web3 promises to fill this gap, but existing solutions often expose sensitive financial data or rely on platforms that don’t consider local regulations.

This is where @Dusk and its token $DUSK caught my attention. Dusk’s architecture is uniquely designed to protect user privacy while enabling decentralized finance applications, making it ideal for regions where financial data is sensitive, and trust in institutions may be limited. In my view, this combination of privacy and DeFi can unlock financial inclusion in ways that traditional platforms have struggled to achieve.

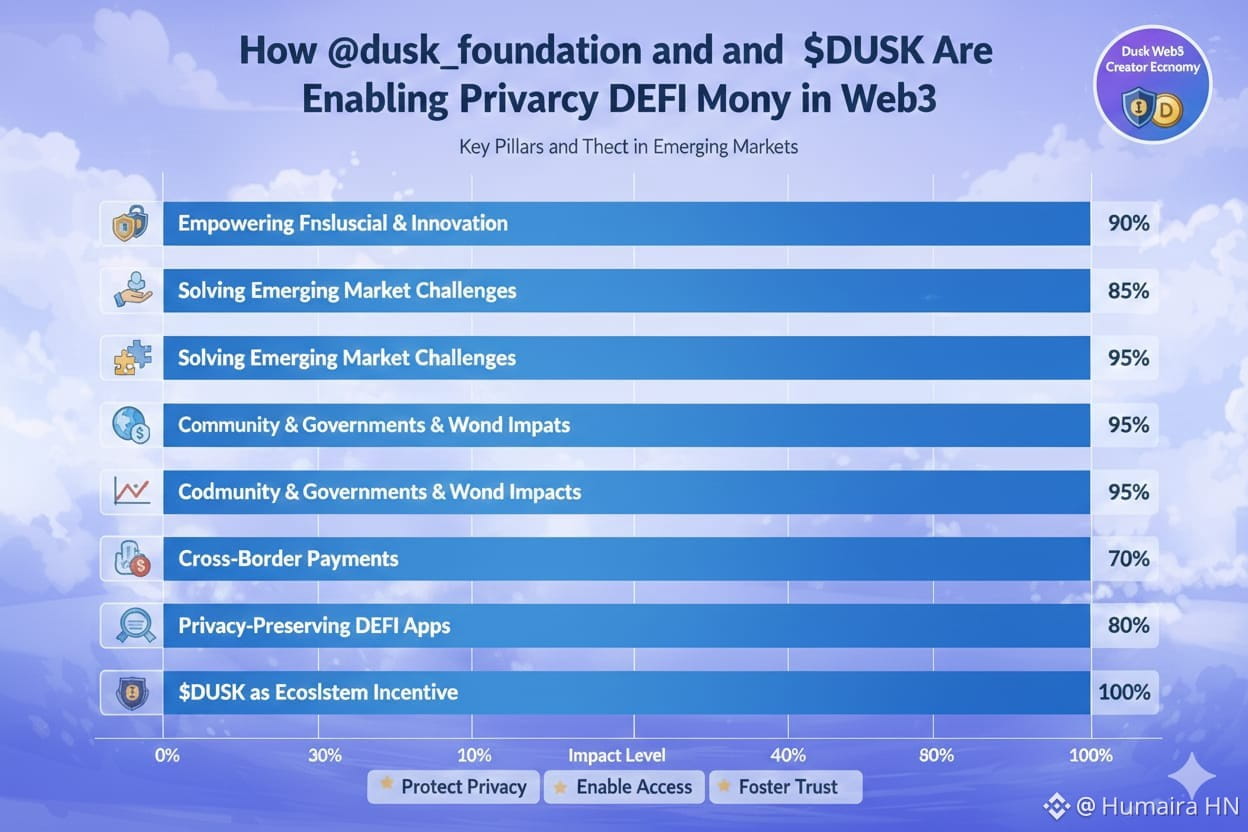

From my perspective, Dusk represents more than a technical solution, it’s a catalyst for financial empowerment. By allowing people in emerging markets to participate in lending, borrowing, and trading without compromising sensitive information, Dusk bridges the gap between accessibility and privacy, setting the stage for the next generation of inclusive DeFi applications.

The Challenge of Financial Inclusion

One of the biggest obstacles to financial inclusion is lack of access to safe and private financial tools. In many emerging markets, traditional banks are either absent or charge prohibitive fees. Digital finance exists, but platforms often require extensive personal information, which can be a barrier for people in underserved regions.

I’ve seen firsthand how this affects individuals and small businesses. Entrepreneurs may have innovative ideas but lack access to microloans. Families may struggle to safely store and transfer money across borders. Even digital wallets can compromise privacy, making users vulnerable to exploitation or fraud.

Dusk addresses these challenges by enabling privacy preserving DeFi applications. Its network allows developers to build solutions that provide financial services while keeping sensitive user data confidential. For me, this is crucial for adoption in regions where trust is fragile and regulatory compliance is complex.

Privacy as a Core Value

What excites me most about Dusk is how privacy is built into the network’s core design. Unlike many DeFi platforms that focus only on transparency, Dusk allows financial operations to occur without revealing user identities or transaction details publicly.

From my experience observing emerging market economies, privacy is not just a technical feature it’s a social necessity. People are often concerned about exposing income, savings, or business activities. Dusk allows them to participate in digital financial ecosystems without fear of unwanted scrutiny.

This approach also enables developers to create innovative financial products that balance transparency for auditability with confidentiality for end users. In my view, this is the type of infrastructure needed to build trust in DeFi applications across diverse socio economic environments.

DeFi Applications for Lending and Microfinance

One of the areas where Dusk shines is privacy preserving lending and microfinance. Many people in emerging markets lack access to formal loans because banks cannot verify creditworthiness without extensive documentation. Traditional platforms often require KYC processes that are too burdensome.

Dusk enables the creation of decentralized lending platforms that can verify and process loans while keeping sensitive information private. Borrowers can access credit without disclosing unnecessary personal data, and lenders can evaluate risk using secure, confidential mechanisms.

From my perspective, this has enormous potential. It allows financial services to reach populations that were previously excluded, empowers small businesses, and creates a foundation for community driven financial ecosystems. With DUSK the utility token, these platforms can ensure fair and transparent operations, while maintaining confidentiality for all parties involved.

Cross Border Payments and Remittances

Another compelling use case is cross-border payments. Many people in emerging markets rely on remittances to support families, but traditional channels are slow, expensive, and often require users to share sensitive financial details.

I’ve observed how Dusk can transform this scenario. By leveraging its privacy focused network, individuals can transfer value securely and cost effectively across borders, with minimal exposure of personal or financial information. Transactions are fast, low cost, and confidential, which is critical in regions where financial surveillance or fraud is a concern.

This also opens the door for community-driven remittance networks, where local participants can interact using decentralized protocols. $DUSK centivizes participation, reduces reliance on intermediaries, and allows communities to retain control over their economic interactions. From my perspective, this model has the potential to redefine how people send and receive money globally.

Stablecoins and Local Currency Integration

Stablecoins are another critical component for DeFi in emerging markets, where local currency volatility can be extreme. However, integrating stablecoins into financial systems requires privacy and compliance to build trust.

Dusk allows for private, compliant stablecoin systems, enabling users to transact in value stable tokens without exposing sensitive data. This is especially important for small businesses, local markets, and individual users who need reliable digital currency for day to day transactions.

From my perspective, DUSK a base token can facilitate these ecosystems by providing liquidity, security, and incentive structures. This combination of privacy and stability creates a foundation for robust financial networks in regions that have been historically underserved.

Empowering Local Economies

Dusk’s technology has implications beyond individual users. By enabling privacy-preserving financial ecosystems, entire communities can benefit. Local markets can implement digital payment systems that are secure, private, and efficient, boosting commerce and reducing reliance on cash.

I’ve seen how privacy focused platforms increase trust in digital finance. When people know their transactions are confidential, they are more likely to adopt new technologies. Dusk provides this trust while also enabling innovation, such as community lending pools, cooperative investment models, and localized DeFi projects.

For me, this is what sets Dusk apart from other networks. It doesn’t just provide tools; it enables real-world economic impact in emerging regions, helping to lift communities and foster financial independence.

Governance and Community Participation

An essential feature of Dusk is its governance model, which allows communities to participate in decision making. In emerging markets, this can empower local users to shape the rules and structures of financial ecosystems that affect their lives.

I’ve observed how decentralized governance encourages participation and accountability. By using DUSK governance token, community members can vote on proposals, manage lending pools, and make decisions about network parameters, creating a system that is responsive to local needs.

This combination of governance, privacy, and financial utility makes Dusk a platform that is not only technically innovative but also socially meaningful. From my perspective, empowering local communities in this way ensures that adoption is sustainable and aligned with user needs.

Educational Tools and Adoption

For emerging markets, adoption of DeFi requires more than technology, it requires education and awareness. Dusk supports this through integrated educational resources, tutorials, and community programs that teach users about financial literacy, blockchain, and privacy.

I’ve seen firsthand how these educational initiatives increase adoption. When users understand the benefits and mechanisms of the platform, they are more likely to participate confidently and responsibly. DUSK incentivizes learning and engagement, creating a virtuous cycle of education, usage, and ecosystem growth.

From my perspective, combining technical infrastructure with educational support is critical for long-term success. It ensures that users are empowered, not just enabled, and that financial inclusion is meaningful rather than superficial.

Real World Case Studies

Several pilot programs have demonstrated Dusk’s potential in emerging markets. Community lending pools, private remittance networks and local stablecoin programs have all benefited from the network’s privacy preserving design.

I’ve followed these projects closely and noticed a common trend: privacy leads to trust, trust leads to adoption, and adoption strengthens communities. These outcomes reinforce the idea that financial inclusion is not just about access, it’s about creating systems that people feel safe and confident using.

The combination of technical robustness, community governance, and $DUSK-based incentives ensures that these ecosystems are sustainable. For me, these case studies illustrate the tangible impact that privacy preserving DeFi can have in real world scenarios.

Challenges and Future Directions

Of course, building privacy preserving DeFi in emerging markets is not without challenges. Regulatory uncertainty, digital literacy, and infrastructure limitations can slow adoption.

However, Dusk is uniquely positioned to address these challenges through adaptive governance, educational programs, and secure, low cost transactions. By prioritizing privacy without sacrificing usability, the platform creates an environment where users can experiment safely and developers can innovate responsibly.

From my perspective, the future of financial inclusion depends on networks that balance privacy, accessibility and compliance. Dusk offers a roadmap for achieving this balance, making it a critical player in the evolution of global DeFi.

Conclusion

After exploring the potential of @Dusk and $DUSK , I am convinced that the platform offers a unique solution for emerging markets. By combining privacy, DeFi utility, and community governance, it empowers individuals and communities to participate in financial ecosystems safely and confidently.

The DUSK token is more than just a medium of exchange, it aligns incentives, supports governance, and enables sustainable adoption. Privacy preserving DeFi applications on Dusk can unlock financial inclusion, stimulate local economies, and build trust in digital finance where it is needed most.

For me, Dusk represents a new paradigm in global finance: one where technology, privacy, and community converge to create meaningful impact. By focusing on emerging markets, the network demonstrates how blockchain can go beyond speculation to solve real world problems and empower those who have been historically underserved.