Hello everyone 👋

What’s your outlook on BTCUSDT right now?

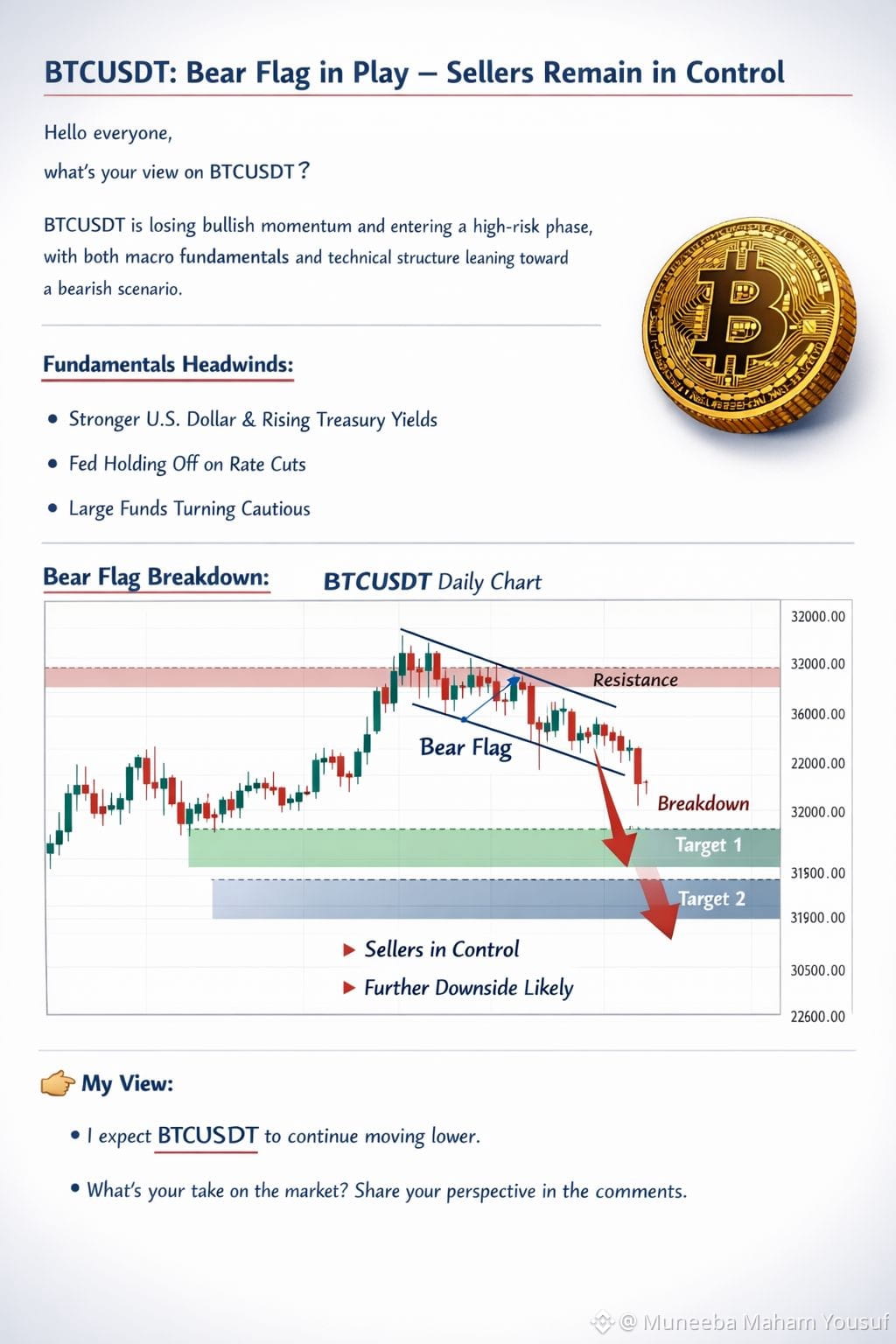

$BITCOIN is clearly losing bullish strength and is stepping into a high-risk zone, where both macro conditions and technical structure are pointing toward a bearish continuation.

Macro & Fundamental Pressure

From a fundamental perspective, the crypto market is dealing with pressure from multiple fronts. A stronger U.S. dollar combined with high U.S. Treasury yields continues to divert short-term capital away from risk assets like Bitcoin. On top of that, expectations that the Federal Reserve will delay rate cuts are keeping liquidity tight, which isn’t ideal for crypto markets.

At the same time, overall sentiment remains cautious. Institutional players and large funds appear to be slowing down capital deployment, choosing to hold cash as uncertainty across global markets persists.

Technical Breakdown

Technically, BTCUSDT recently saw a strong impulsive sell-off, followed by a weak and corrective bounce. This price action has resulted in a Bear Flag formation on higher timeframes, a well-known bearish continuation pattern.

As long as price stays capped below the upper boundary of the bear flag, sellers remain firmly in control. Repeated rejection from this area increases the probability of another breakdown, potentially driving price toward lower liquidity zones.

👉 My Personal View

I expect BTCUSDT to continue moving lower, unless we see a clear invalidation of the bear flag structure.

What’s your take on the current market structure?

Drop your thoughts in the comments — bullish or bearish, let’s discuss 🙏📊🥰