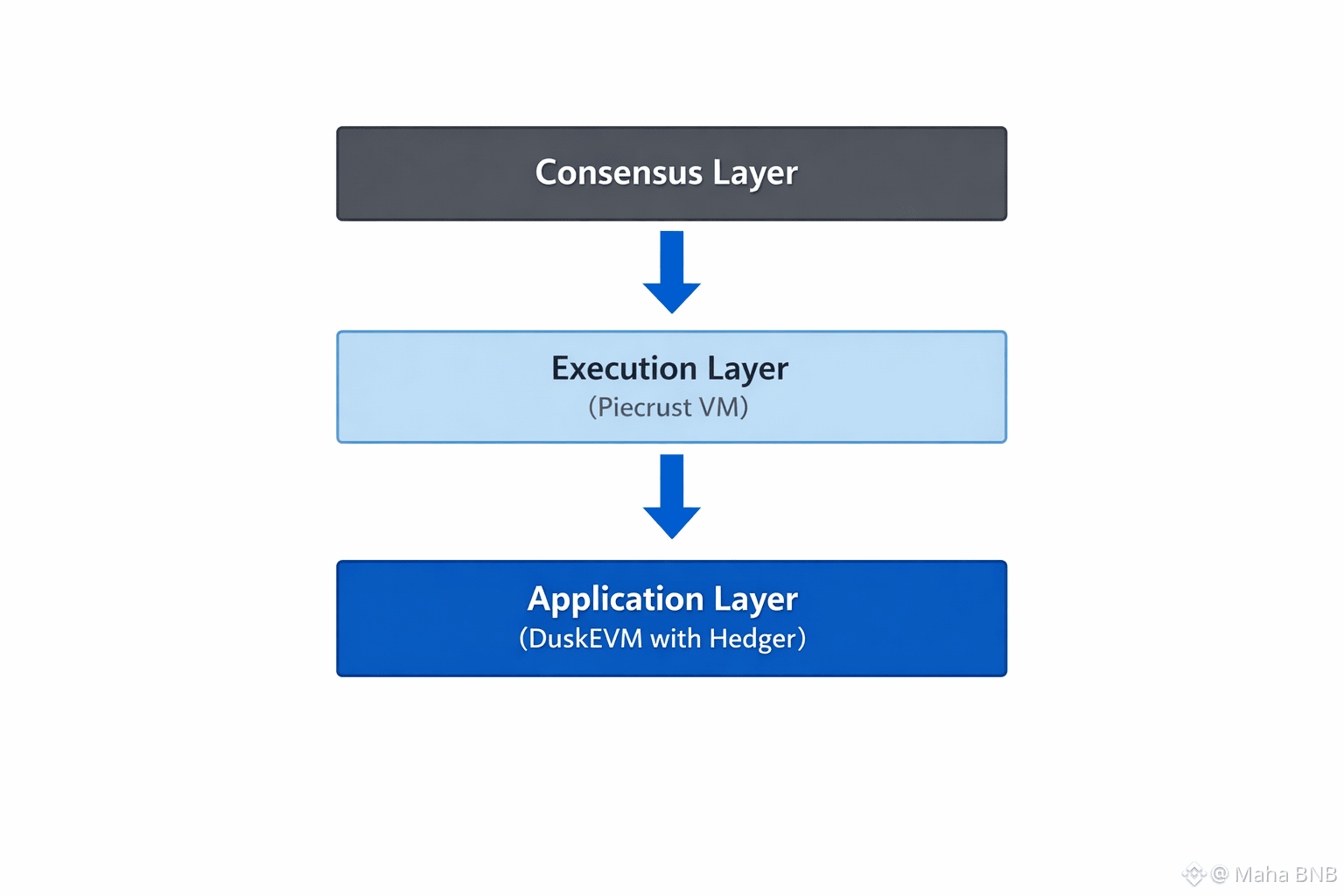

Dusk isn’t just another blockchain—it’s a Layer 1 built from the ground up for regulated finance. Privacy isn’t an afterthought here; it’s right at the center, but auditability sticks around too. Institutions get to build DeFi apps that follow the rules. Real-world assets? They move on-chain without the usual friction. The modular setup splits consensus, execution, and application layers, which makes the whole thing way more scalable. And if you’re a developer, you get to work with tools you already know.

The story starts back in 2018. Dusk set its sights on global financial markets from the beginning. Its edge? Privacy that actually meets compliance. Zero-knowledge proofs keep data under wraps. Homomorphic encryption lets you share only what’s needed. So, transactions stay private but verifiable. If a regulator needs to check something, they get access—without exposing everything. Users control their own credentials. Identity checks become decentralized, locked in as unchangeable assets.

Behind all this is the Citadel protocol, powering those zero-knowledge features. You can share certificates that prove compliance without ever revealing the actual data. No more relying on central servers either. People finally have control over their info. The Phoenix transaction model brings in nullification factors and single-use public keys, which keeps the network’s state lean. Balances and addresses stay hidden. Asset movement stays private by design, so outside tracking just doesn’t work.

The Piecrust virtual machine takes WebAssembly and makes it fly. Verifying zero-knowledge proofs happens fast—kernel-level support for the Poseidon hash speeds everything up. Even basic devices can run complex checks in a snap. The network reaches consensus using Secure Byzantine Agreement, with cryptographic randomness picking who validates blocks. There’s no forking, no waiting—finality lands right when the block is created. Digital assets settle instantly.

In the second week of January, DuskEVM goes live. This means Ethereum smart contracts can run right on Dusk’s own Layer 1. Settlements happen on-chain, regulated DeFi gets room to grow, and apps for real-world assets fit right in. The Hedger module adds privacy to the EVM, mixing zero-knowledge proofs with homomorphic encryption so transactions stay private but still auditable. Regulated finance just fits.

Hedger Alpha is already live. Institutions are actually testing confidential transfers right now. Data stays private, compliance stays solid, audits work through selective disclosure. Financial operations run smoother, and risk drops.

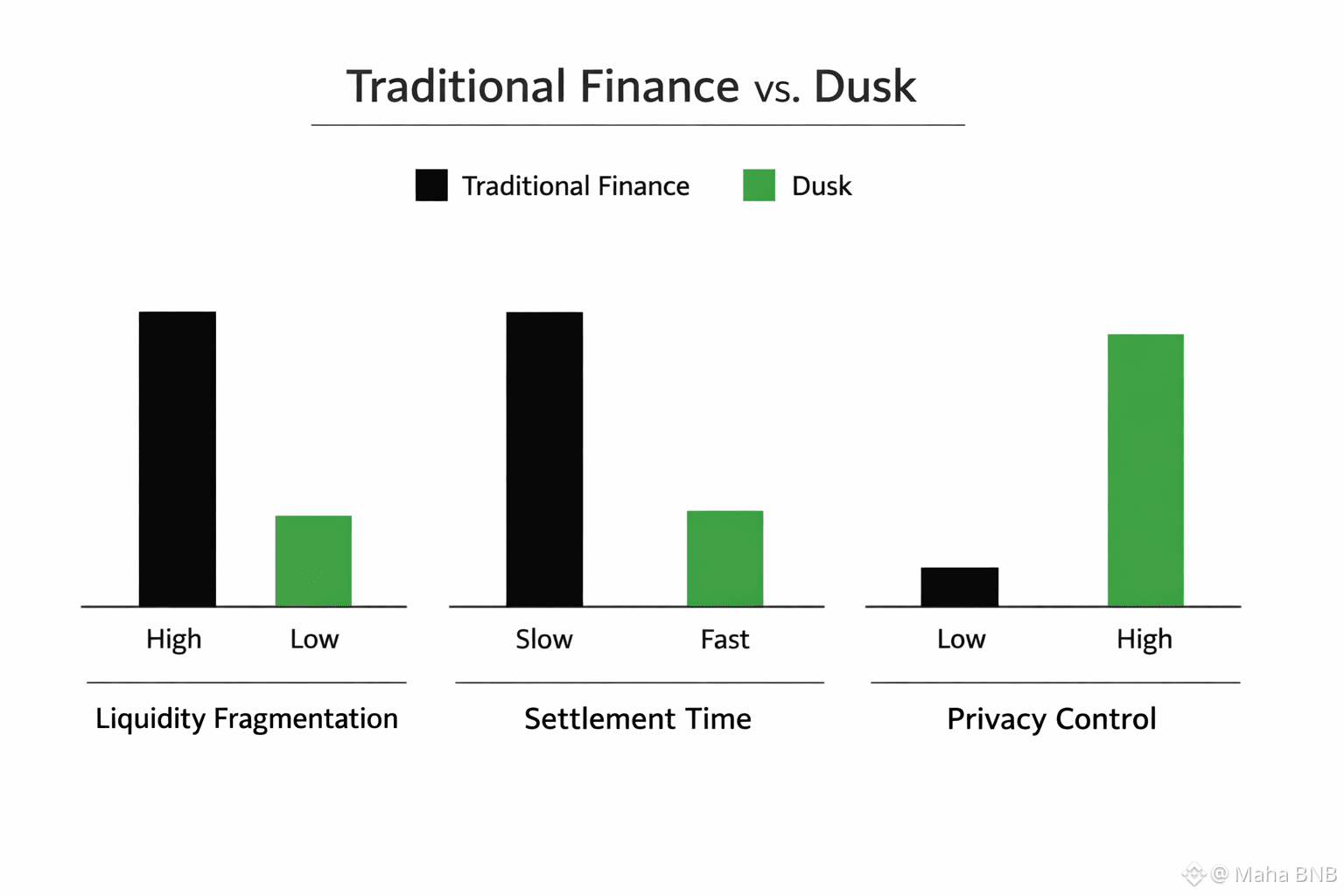

Looking ahead, DuskTrade is on track for 2026. It’s Dusk’s first big real-world asset application, built with NPEX—a Dutch exchange holding all the key licenses (MTF, Broker, ECSP). Over €300 million in tokenized securities move on-chain. A compliant trading platform emerges. Investments get tokenized and secure, liquidity pools aren’t split up, and access goes global.

Dusk’s ecosystem keeps growing through partnerships. Quantoz brings in €EURQ, a MiCA-compliant E-Money Token fully backed by euros. So, transparency is baked in and institutions get new use cases. NPEX adds €300 million in assets under management. Tokenized securities stay compliant. Chainlink hooks into Dusk via CCIP, with Data Streams and DataLink supporting real-world assets. Cross-chain stuff just works.

Cordial Systems delivers compliant custody. TradeOn21X brings DLT-TSS into the mix. Licensed institutions finally have a bridge to blockchain, so regulated securities actually trade on-chain. Fintech just keeps moving forward, and Dusk is right there, closing the gap between old-school and new finance.

Businesses can tap financing through smart contracts. Trades happen automatically. Expensive processes get outsourced. Institutions clear and settle payments instantly, with compliance happening in the background. Global liquidity pools open up, and users can hold institutional assets in their own wallets. Self-custody isn’t just an option—it’s the norm. Markets become more diverse and accessible to anyone.

Smart contracts turn into actual products. Tokens follow privacy rules. Global regulations get respected, and local laws fit in. Trades settle instantly. Bulletin boards provide the source of truth. No more fragmented liquidity. Custodians fade out. Access becomes universal.

Dusk opens the door to economic inclusion. Assets once reserved for big institutions now reach everyone. Privacy-first tech brings real-world assets on-chain. Traditional finance meets blockchain. Users get more control, institutions cut costs, and businesses scale up.

Dusk’s edge? Compliant on-chain markets. Tokenized money market funds and securities trade in private, with audit trails sticking around. Regulated DeFi scales. Privacy tech keeps getting sharper—seven years of refining shows. Private yet verifiable transfers become the standard.

The modular architecture adapts as needed: consensus keeps things secure, execution makes everything efficient, and the application layer pushes new ideas. Developers can stick with Ethereum tools, making the transition smooth.

Real-world adoption isn’t a hope—it’s happening. Licensed exchanges bring tokenized securities on-chain. Compliant privacy draws in institutions. DeFi evolves, but this time, it’s regulated.

Dusk is changing how financial infrastructure works. Privacy isn’t optional; it’s built-in. Compliance isn’t forced; it’s natural. And for the first time, global markets can come together on-chain.