Plasma is changing the way stablecoin payments work in Web3. At its core, it’s a Layer 1 blockchain built just for stablecoin settlement—fast, cheap, and dependable. With EVM support through Reth, developers can plug right in without a headache. PlasmaBFT brings sub-second finality, which means transactions pretty much settle instantly. And here’s something users love: gasless USDT transfers. No more surprise fees, just smooth payments.

The Paymaster feature takes care of gas at the protocol level, so users don’t even have to think about fees on stablecoin moves. Developers can deploy contracts using familiar tools like Hardhat and Foundry, no migration drama. On the security side, Plasma regularly anchors its state to the Bitcoin network. That keeps things neutral and makes censorship a lot harder.

But Plasma isn’t just about blockchain—it’s about connecting to the real world. Rain cards let you spend at millions of merchants. Oobit ties the network to over 100 million Visa outlets. EURØP, a euro stablecoin, follows MiCA rules, so big institutions can use it for euro payments without worrying about compliance.

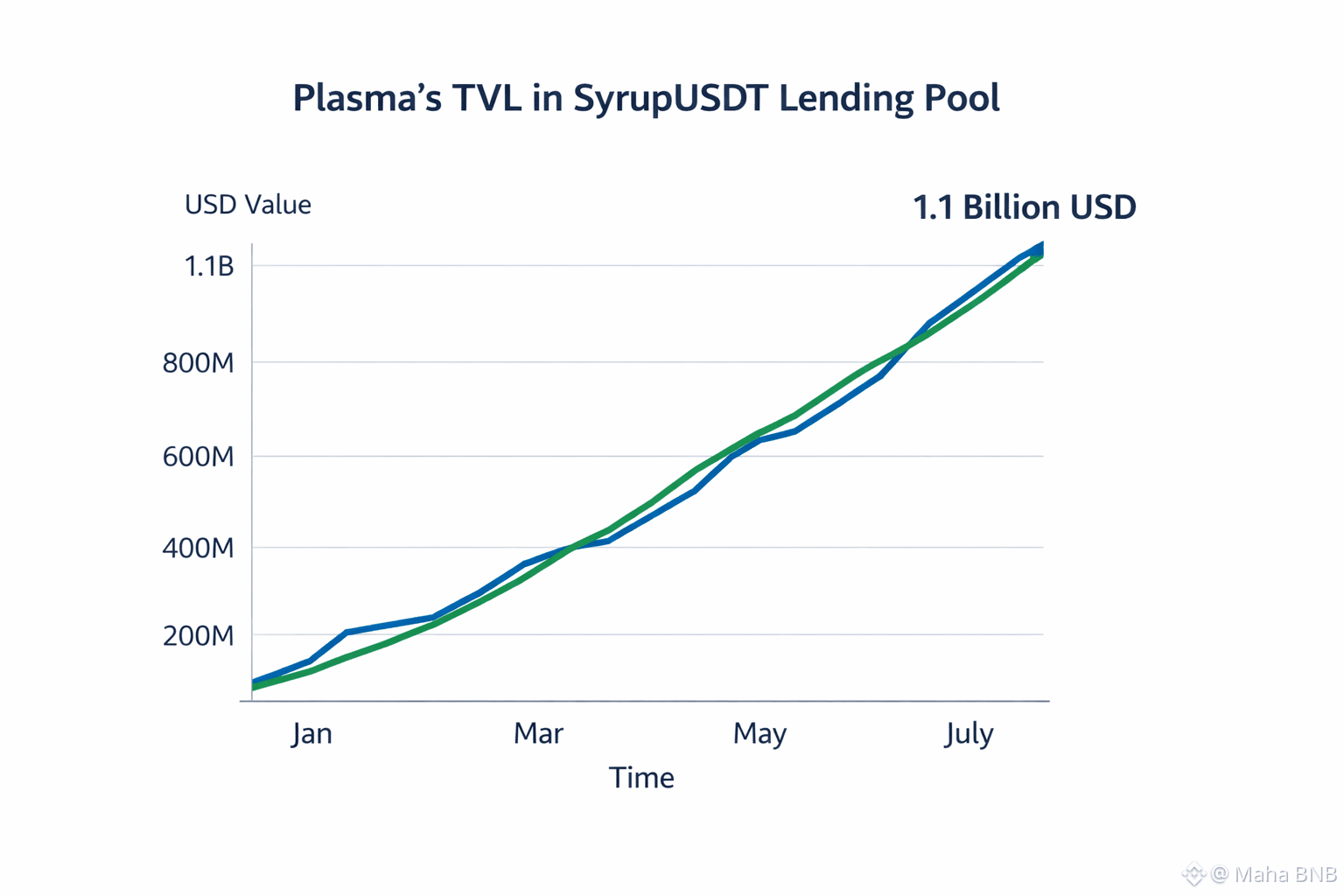

The numbers speak for themselves. SyrupUSDT’s lending pool on Maple Finance has $1.1 billion locked in. That’s mostly institutional money, and it shows trust. Plasma supports more than 25 stablecoins and ranks fourth worldwide for USDT holdings, with stablecoin deposits hitting $7 billion.

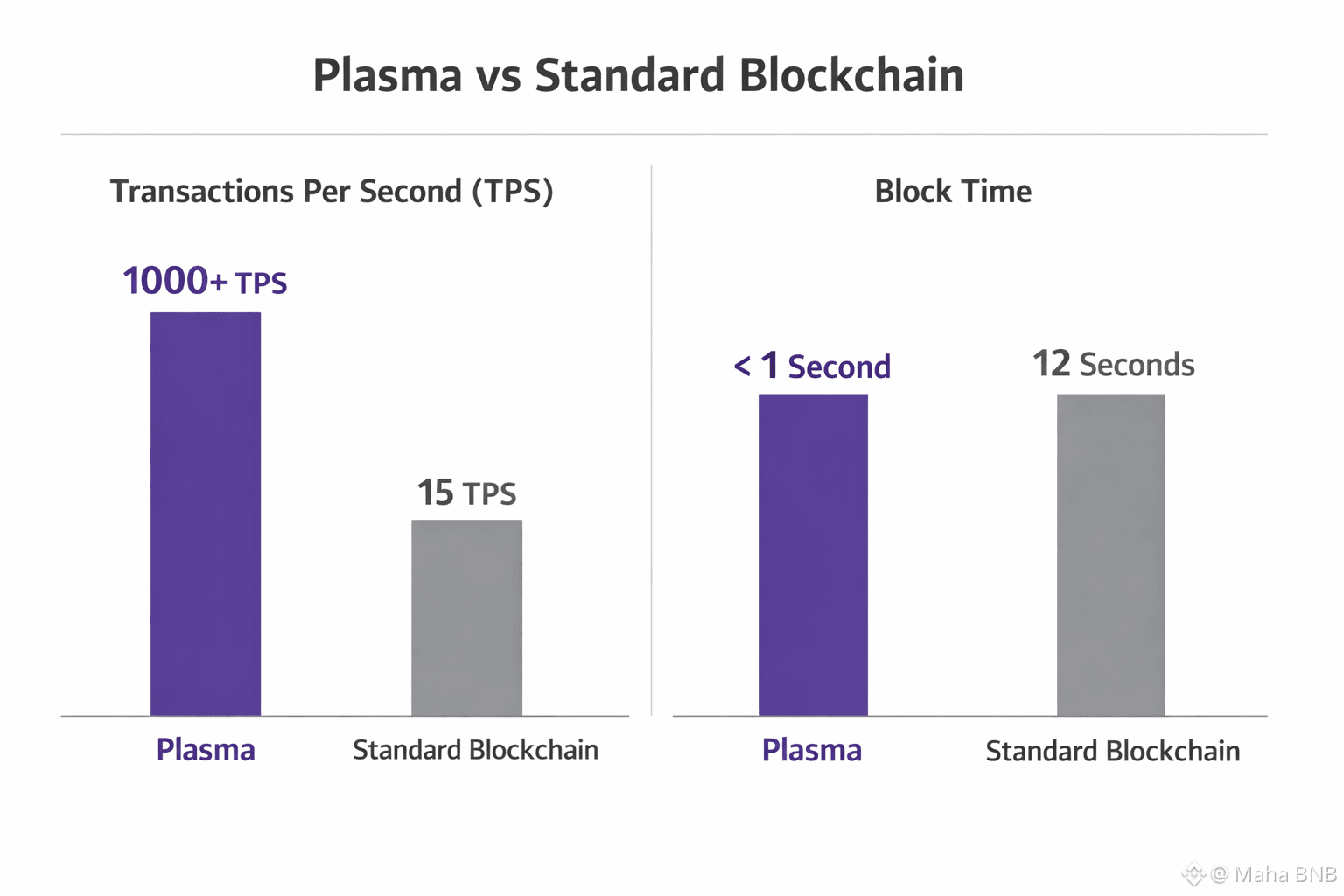

Speed isn’t a problem—Plasma handles more than 1,000 transactions per second, and block times stay under a second. It’s available in over 100 countries, supports 100+ currencies, and hooks into more than 200 local payment methods.

The backing is serious: Paolo Ardoino from Tether, Scott Bessent (a nominee for U.S. Treasury Secretary), Chris Giancarlo (former CFTC Chair), and David Sacks (Crypto and AI Czar) all lend their expertise. They help steer Plasma’s strategy and keep it on track.

Plasma targets both everyday users in high-growth markets and big institutions in finance and payments. Crypto-collateralized stablecoins keep value steady through DeFi, which is a big shift from old-school fiat systems.

You get instant payments with stablecoins, and there’s a Learn Center packed with guides on global payments, savings, and how stablecoins actually work. Privacy gets top billing too, with a clear policy protecting user data.

More than 100 partnerships, especially in the MENA region, help drive fast adoption. In places where money moves quickly, Plasma fits right in. Stablecoins offer more than just a digital bank transfer—they’re faster, cheaper, and borderless.

Anchoring to Bitcoin keeps data locked down tight. Full EVM support means developers can build without breaking the bank. New builders face lower barriers, so the ecosystem keeps growing. Key uses right now? Transfers and lending—core areas in DeFi.

Compliant stablecoins like EURØP make it easy for institutions to get involved, especially for cross-border payments. For regular users, zero-gas stablecoin transfers make daily transactions painless.

Plasma consistently processes over 1,000 TPS, with blocks confirmed in under a second. The Paymaster system removes the hassle of gas fees for users, changing how people experience payments.

What sets Plasma apart? It’s all about a stablecoin-first design, direct security from Bitcoin, and a network that’s ready for both retail and institutional players.

With $1.1 billion in lending pools, support for 25+ stablecoins, and $7 billion in deposits, Plasma has earned trust at scale. Its global reach—100+ countries, 200+ payment methods—makes it easy for anyone, anywhere, to jump in.

Expert guidance from Tether’s CEO, Treasury and CFTC leaders, and crypto innovators keeps Plasma pushing forward. Retail users in fast-moving markets get instant payments, while financial institutions tap into an infrastructure that’s neutral and reliable. Crypto-backed stablecoins keep DeFi stable, even as the space evolves.

Plasma’s educational resources cut through the jargon, covering everything from CBDCs to the real benefits of stablecoins. With so much flexibility and a focus on compliance, Plasma is ready for global use.

The MENA focus takes advantage of rapid money flows, and partnerships amplify the network effect. Instant payments are the new normal for users.

Every periodic anchor to Bitcoin locks in security. EVM tools like Foundry make development easy and cheap, so the ecosystem flourishes.

On Maple, SyrupUSDT leads with $1.1 billion in TVL, proving demand is real and growing. Over 25 stablecoins integrate, with Plasma ranking fourth in USDT holdings and $7 billion in stablecoins deposited.

Coverage? Over 100 countries, 100+ currencies, and 200+ payment methods. Over 1,000 TPS, sub-second blocks, and gasless USDT transfers.

The Paymaster system delivers zero gas fees for stablecoin transactions. Rain and Oobit open up merchant access, while Visa expands reach. EURØP, under MiCA, brings euro stablecoin compliance to Europe.

Plasma’s got heavy hitters backing it—Ardoino, Bessent, Giancarlo, Sacks. It’s built for both retail and institutions, running on Reth EVM, PlasmaBFT finality, and Bitcoin-level security.

All of it puts Plasma at the front of the pack for stablecoin payments in Web3.