---$RIVER

One of the biggest mistakes traders make is believing that time in the market equals skill.

It doesn’t.

Skill is revealed in how you manage open trades, not how many hours you stare at charts.

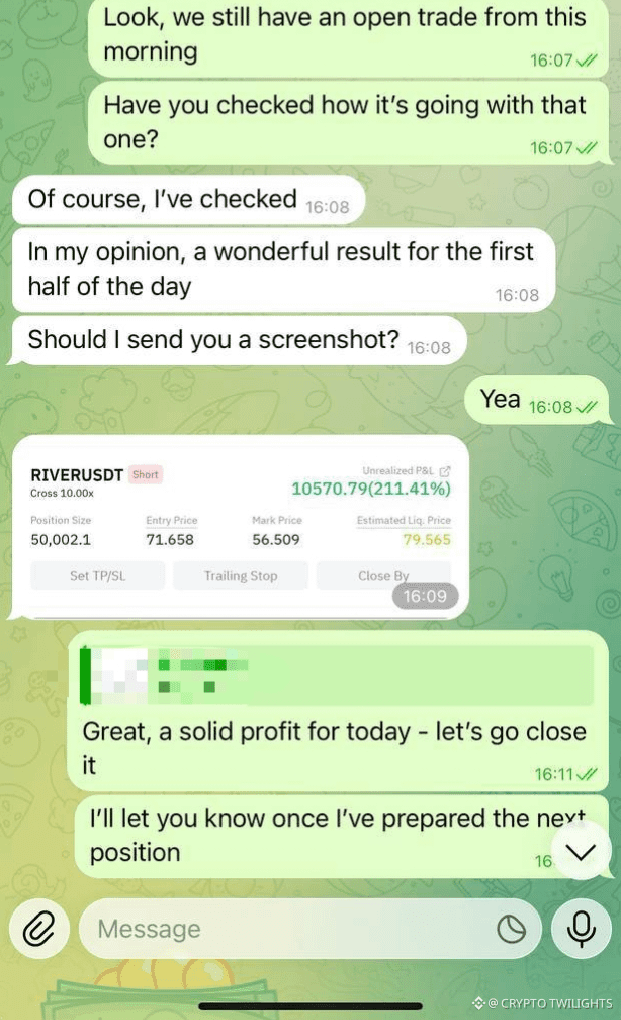

Look at the picture.

An open position from the morning.

A clear direction.

Strong unrealized profit.

And most importantly — a calm conversation around it.

That calmness is not accidental.

Good Trades Don’t Need Drama

Notice how the trade was handled.

No panic.

No excitement.

No rush to brag.

Just a simple check: “How is the open trade doing?”

That’s how professionals operate.

They don’t babysit trades emotionally.

They monitor them logically.

This is exactly where strategy matters more than indicators.

Why This Trade Was Already a Win

The moment a trade reaches a healthy profit zone, the objective changes.

It’s no longer about: “How much more can we make?”

It becomes: “How do we protect what the market has already given?”

My strategy is built around this mindset.

When the market offers a solid move early in the day, we respect it.

We don’t force more trades out of greed.

A good first half of the day is often enough.

Strategy Is About Knowing When to Stop

Most traders fail not because they can’t make profit —

they fail because they don’t know when to stop.

After a clean move, the strategy said: “This is solid for today.”

And that decision matters more than chasing extra percentage.

Closing a trade in strength is not weakness.

It’s discipline.

Unrealized Profit Is a Test, Not a Reward

The numbers shown in the picture look impressive.

But numbers alone don’t mean success.

Unrealized profit tests your patience.

It tests your ego.

It tests your discipline.

My strategy passes this test by keeping things simple: • Follow the plan

• Respect the session

• Close when conditions are met

No second guessing.

Confidence Comes From Repetition

The reason there’s no stress in this trade is simple.

This process has been repeated many times.

Confidence doesn’t come from one lucky trade.

It comes from doing the same right thing again and again.

That’s why even with a large position size, emotions stay controlled.

The strategy does the thinking —

the trader just executes.

Preparing the Next Position Is Also Part of Discipline

Another important detail many people miss: After closing, there’s no rush to jump back in.

The focus shifts to: • Reviewing the market

• Waiting for the next clean setup

• Preparing — not forcing — the next position

This patience keeps accounts alive.

Trading is not about constant action.

It’s about timed action.

Strategy Over Ego

Anyone can post a picture of profit.

Very few can consistently close trades without regret.

My strategy doesn’t aim to impress.

It aims to protect capital and compound steadily.

No revenge trades.

No emotional overtrading.

No chasing.

Just execution.

Final Thought

A strong trading day doesn’t mean trading all day.

Sometimes, it means one clean trade and the discipline to stop.

This picture is not about profit numbers.

It’s about decision-making.

And in the long run,

decisions build accounts — not pictures.

That’s what real trading looks like. 📊