There is so many confusion with funding fee, here let me break it down for you.

But I also hope that Binance will put realized P/L on each futures open position by traders so they won’t caught into the liquidation because of the high negative funding fee that sometimes reduced the liquidity without realizing it & you didn’t check each hour, happened to me. Like other exchange they are very clear with P/L of funding fee, imagine if you hold $RIVER for 2 days shorting and then your funding fee just reduced your liquidity, if is on put on each transaction at least help a lot of people to understand more @Binance Margin. $FRAX

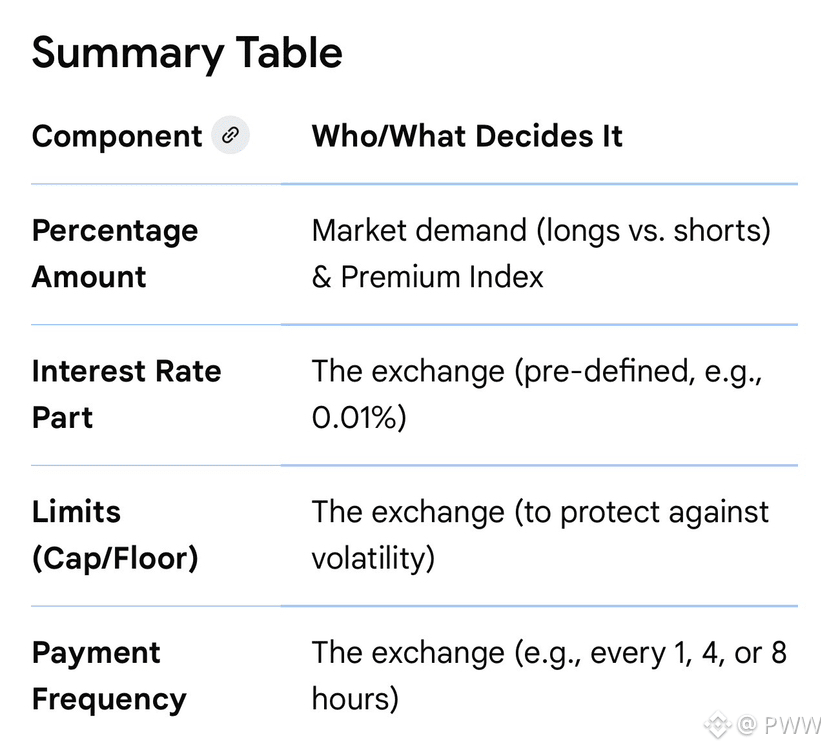

Here is a breakdown of who and what decides the funding rate, for trader that still confused.

The funding fee percentage on crypto futures markets is primarily decided by market demand, which drives the difference between the perpetual futures price and the underlying spot price. While the mechanism is automated by the exchange, the actual rate is a result of market forces, specifically the balance between long and short positions.

1. Market Forces (Primary Deciders)

The main driver of the funding rate is the market sentiment, which determines the Premium Index—the difference between the contract price and the spot price.

* Bullish Market (Positive Rate): If more traders are longing, the futures price rises above the spot price. The market dictates a positive rate, forcing long positions to pay short positions to align the prices.

* Bearish Market (Negative Rate): If more traders are shorting, the futures price falls below the spot price. The market dictates a negative rate, forcing short positions to pay long positions.

2. The Exchange (Formula Setters)

Crypto exchanges (e.g., Binance, Bybit, Coinbase) establish the formula, the interest rate component, and the frequency of payments, but they generally do not manually set the daily rate based on opinion.

* Interest Rate Component: Exchanges typically set a small, fixed interest rate (often 0.01%–0.03% per interval) to account for borrowing costs.

* Caps and Floors: Exchanges set upper and lower limits (e.g., ±0.375% or higher depending on the exchange) to prevent extreme, manipulated rates, particularly during high volatility.

3. Arbitrageurs (Enforcers)

Arbitrageurs are market participants who act as a bridge between the spot and futures markets. If the funding rate becomes too high or low, it creates a profit opportunity, incentivizing them to take the opposite side to earn the fees. This arbitrage activity forces the futures price back in line with the spot price. I also included table to make it easy for everyone to fully grasp them.