🚨 FED WILL START U.S. DOLLAR INTERVENTION IN THE NEXT 24 HOURS!!

For The First Time Since 2011, The Federal Reserve Is Preparing For A Market-Stabilizing Currency Operation.

This Is Not Routine. 🚫

This Is A Structural Event With Global Consequences.

🧠Forget Short-Term Headlines.

Forget Noise Around Tariffs Or Temporary Narratives.

The Real Story Is Happening Inside The Currency System.

👉WHAT IS ACTUALLY HAPPENING

The U.S. Is Stepping In To Support The Japanese Yen.

And The Only Way To Do That Is By Weakening The U.S. Dollar.

This Is Not Speculation. ⚠️

This Is How Currency Intervention Works.

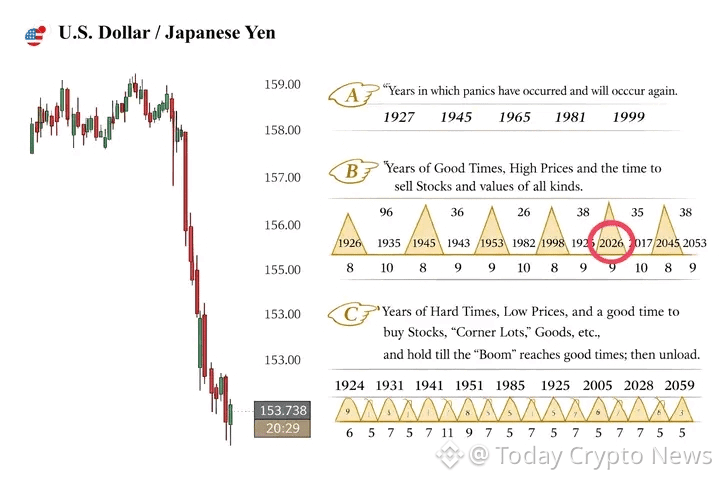

Japan’s Bond Yields Are At Multi-Decade Highs

The Yen Has Been Under Sustained Pressure

USD/JPY Reached Extreme Stress Levels

When Currency Markets Reach This Point,

Central Banks Do Not Wait.

They Act.

THE SIGNAL MOST PEOPLE MISSED

Last Week, The New York Fed Conducted Rate Checks On USD/JPY.

Historically, This Is The Final Step Before Direct Intervention.

No Official Announcement Was Needed.

Markets Reacted Immediately.

Because History Remembers.🧠

THIS HAS HAPPENED BEFORE

In 1985, The Plaza Accord Changed Everything.

The U.S. Dollar Was Too Strong.

Exports Were Collapsing.

Trade Imbalances Were Exploding.

So The U.S., Japan, Germany, France, And The UK Coordinated.

Dollars Were Sold

Foreign Currencies Were Bought

USD Was Intentionally Devalued

The Result Was Historic.

Dollar Index Fell Nearly 50%

USD/JPY Collapsed From 260 To 120

The Yen Effectively Doubled

Markets Did Not Fight It.

👉They Followed It.

We Saw A Similar Playbook In 1998.

Japan Alone Failed.

U.S. And Japan Together Succeeded.

Coordination Changes Everything.

WHAT THIS MEANS FOR MARKETS

When The U.S. Sells Dollars And Buys Yen:

The Dollar Weakens

Global Liquidity Improves

Asset Prices Begin To Reprice

This Is Textbook Macro Mechanics.

It Sounds Bullish On The Surface.

But Timing Matters.

THE RISK MOST PEOPLE ARE IGNORING

Stocks Are Already At All-Time Highs.

Gold Is Already At All-Time Highs.

Risk Appetite Is Stretched.

At The Same Time,

Hundreds Of Billions Are Still Trapped In The Yen Carry Trade.

When The Yen Strengthens Too Quickly:

Leverage Gets Forced Out

Risk Assets Sell First

Volatility Explodes

We Saw This In August 2024.

A Small BOJ Signal

Yen Spiked

Bitcoin Fell Over 20% In Days

Hundreds Of Billions Were Wiped Out

Yen Strength Is Short-Term Risk ⚠️

Dollar Weakness Is Long-Term Opportunity

TWO PHASES, TWO DIFFERENT TRADES

Short Term:

Volatility

Forced Liquidations

Risk-Off Moves

Medium To Long Term:

Higher Liquidity

Currency Debasement

Asset Repricing

This Is How Macro Cycles Transition.

🧠FINAL THOUGHT

⚠️This Is Not A Prediction. ⚠️

This Is A Historical Pattern Repeating.

Currency Intervention Does Not Create Calm.

It Creates Change.

And Change Always Starts With Volatility.

Those Who Understand This Will Be Positioned.

Those Who Ignore It Will React Too Late.

Stay Focused.

Stay Disciplined.

Stay Ahead