The global financial ecosystem has reached a definitive turning point. On January 28, 2026, at 14:30 UTC, Binance Futures officially launches the TSLAUSDT Equity Perpetual Contract, effectively merging the world’s most significant equity—Tesla Inc. (TSLA)—with the high-velocity world of digital asset derivatives. This move allows for the continuous, 24/7 monetization of Tesla’s price action, operating beyond the constraints of traditional exchange hours and bridging the gap between the Nasdaq and the crypto-native environment.

By facilitating a USDT-settled derivative with up to 5x leverage, Binance is not just expanding its product suite; it is leading a structural shift toward a unified global market where stocks are traded like tokens. This launch is strategically timed to coincide with Tesla’s Q4 and full-year 2025 financial results and a critical Federal Open Market Committee (FOMC) interest rate decision, creating a high-volatility nexus for global traders.

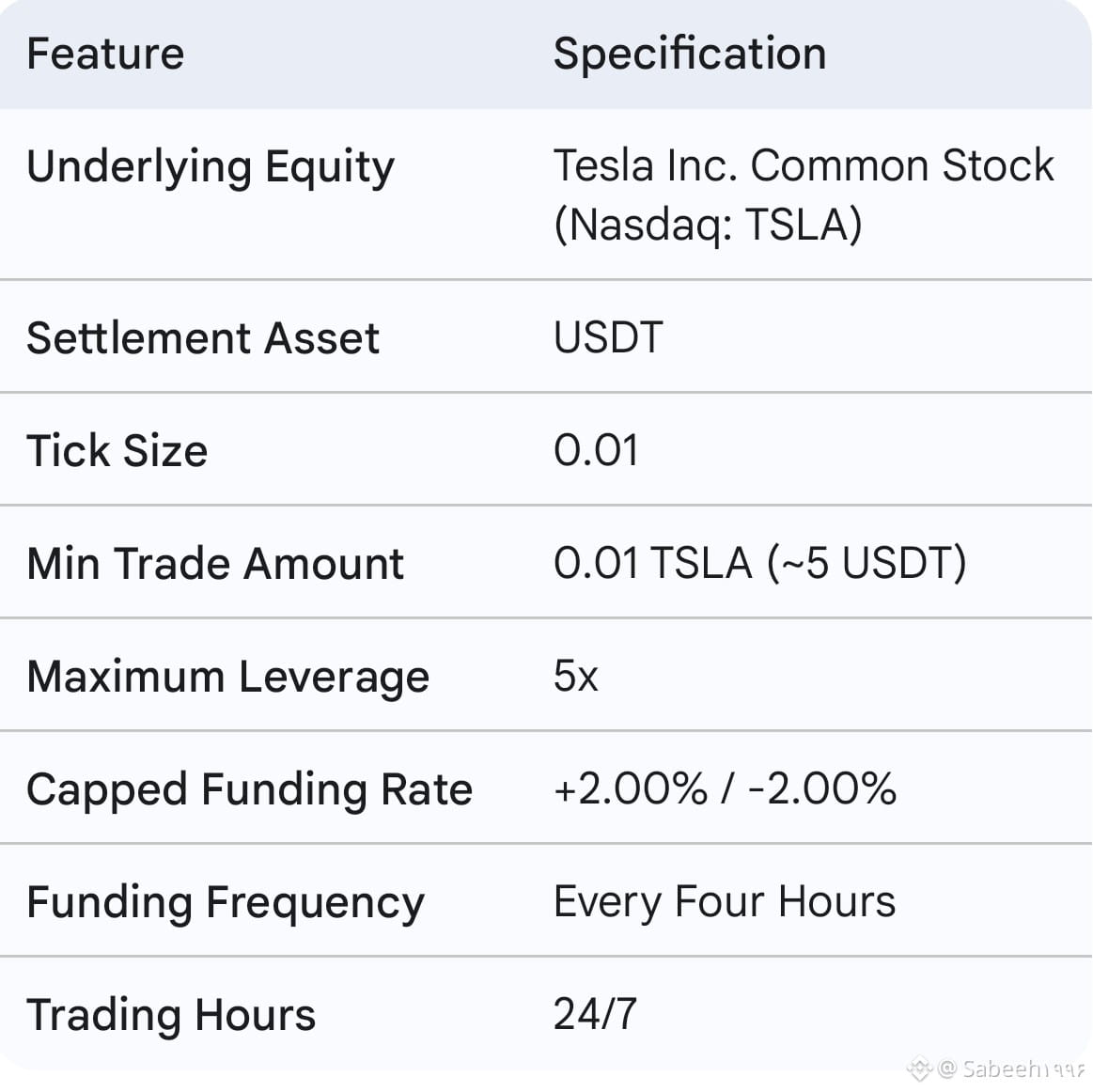

Technical Architecture of the TSLAUSDT Perpetual

The TSLAUSDT contract is engineered to replicate Tesla's price discovery within a crypto-native framework. Unlike the Nasdaq’s limited 6.5-hour trading session, this perpetual offering provides around-the-clock accessibility. This eliminates "gap risk"—the price jumps that occur when news breaks while traditional markets are closed—allowing traders to react instantly to late-night earnings or CEO communications

Key Contract Specifications

A defining feature is the support for Multi-Assets Mode, which allows users to collateralize their TSLAUSDT positions using a variety of assets, including Bitcoin (BTC), Ethereum (ETH), and BNB. For instance, a trader holding BTC can use it as margin to take a position on Tesla's stock without liquidating their core holdings, though a 5% value "haircut" is applied to such collateral for risk management.

Fundamental Realities: Tesla’s 2025 Performance

The TSLAUSDT launch occurs as Tesla transitions from hypergrowth into a mature operational phase. Data from 2025 reflects a year of volume contraction and intensifying competition.

Vehicle Deliveries and Market Share

Tesla delivered 1,636,129 vehicles in 2025, an 8.6% decline from the previous year. This marked the first time Tesla has seen two consecutive years of volume decline. Crucially, 2025 saw the Chinese automaker BYD officially overtake Tesla as the world’s leading manufacturer of battery-electric vehicles (BEVs), selling 2,256,714 units compared to Tesla's 1.63 million.

In Q4 2025, vehicle production reached 434,358 units, contributing to a full-year total of 1,654,667 vehicles, which represents a 6.7% year-over-year decline. Vehicle deliveries for the quarter were 418,227 units, bringing full-year deliveries to 1,636,129, reflecting a larger YoY decrease of 8.6%. In contrast, the energy segment showed strong growth, with energy storage deployments hitting 14.2 GWh in Q4 and 46.7 GWh for the full year, marking a significant 113% year-over-year increase

The decline was particularly acute in Europe, where Tesla sales slipped 27% to 238,656 units while BYD saw a 268% jump in registrations in the region. Despite these automotive headwinds, Tesla's Energy Storage division has emerged as a high-margin bright spot, more than doubling deployments to 46.7 GWh in 2025.

The Pivot to Autonomy and "Reasoning AI"

Tesla’s valuation premium is increasingly tied to its "AI Narrative." On January 22, 2026, Tesla officially removed human safety monitors from its robotaxi fleet in Austin, Texas, marking the start of truly unsupervised public rides.

The Robotaxi Economic Model

In Austin, Tesla has introduced dynamic fare pricing. A short trip of less than a mile costs approximately $2.10, while an 11-mile journey is priced at roughly $13.71. Tesla aims to eventually operate these vehicles at a cost of just 20 cents per mile, significantly undercutting traditional ride-hailing services like Uber.

FSD Version 14: The Reasoning Breakthrough

The latest software iteration, FSD v14, represents a fundamental shift. Described as "the last big piece of the puzzle," this version introduces Reasoning AI and advanced reinforcement learning. Key improvements include:

Object Avoidance: Refined ability to swerve around road hazards like fallen branches or animal carcasses with human-like fluidity.

Lane Dynamics: More courteous highway behavior, such as moving back to the right lane after passing.

Monetization Shift: Effective February 14, 2026, Tesla will stop selling FSD as a one-time purchase, moving exclusively to a $99/month subscription model.

Macroeconomic Catalyst: The FOMC and Interest Rates

The TSLAUSDT perpetual is inherently sensitive to the Federal Reserve's decisions. On January 28, 2026, the FOMC is widely expected to pause its rate-cutting cycle, keeping the federal funds rate in the 3.5% to 3.75% range.

High interest rates pose a dual challenge for Tesla: they dampen consumer demand for auto loans and increase the discount rate applied to future earnings, which disproportionately impacts the present value of high-growth tech stocks. The Fed announcement is scheduled for 2:00 PM ET, followed by a press conference by Jerome Powell at 2:30 PM ET, just as the TSLAUSDT pair enters its first hours of live trading.

Market Sentiment and Technical Indicators

As TSLAUSDT begins trading, analysts show a wide dispersion in outlook, reflecting the debate over Tesla’s true identity.

Analyst Targets: Third-party predictions for 2026 range from a bearish $25 (GLJ Research) to a bullish $600 (Wedbush). Morgan Stanley maintains an equal-weight stance with a target of $425.

Technical Levels: As of late January 2026, the stock is consolidating. The 50-day Simple Moving Average (SMA) sits at $442.32, while the long-term 200-day SMA is at $373.82.

Support & Resistance: Immediate resistance is seen at $450, while a failure to hold $380 could signal deeper trouble if earnings margins compress further.

Relative Strength: The RSI(14) is currently near 44.38, indicating the stock is in neutral territory before the earnings breakout.

Risk Management for Traders

The introduction of 5x leverage on an asset as volatile as Tesla requires disciplined risk management. Market participants expect high volatility, with the options market pricing in a directional move of 6% to 12% following the earnings report. Traders using Multi-Assets Mode must also monitor the volatility of their collateral (e.g., BTC or ETH), as a simultaneous drop in both the collateral value and the TSLA price can rapidly accelerate margin requirements.

As the world's most debated company enters the crypto-derivative fold, the TSLAUSDT pair on Binance offers a sophisticated, 24/7 tool for global investors to navigate the high-stakes transition from automotive manufacturing to the frontier of AI and robotics.