The formal integration of Sentient (SENT) into the Binance spot market on January 22, 2026, represents a milestone in the evolution of decentralized artificial intelligence, signaling a shift from experimental "DeFAI" protocols to institutional-grade intelligence infrastructure. This event, occurring at 12:00 UTC, facilitated the immediate opening of trading pairs including SENT/USDT, SENT/USDC, and a localized SENT/TRY pair on Binance TR, providing deep liquidity to a project aimed at dismantling the centralized monopolies currently governing artificial general intelligence (AGI). The Sentient protocol, characterized by its Global Research and Intelligence Directory (The GRID), seeks to establish an "Open AGI" economy that leverages blockchain technology to ensure that intelligence remains a verifiable public good rather than a siloed corporate asset.

Institutional Context and Launch Mechanics

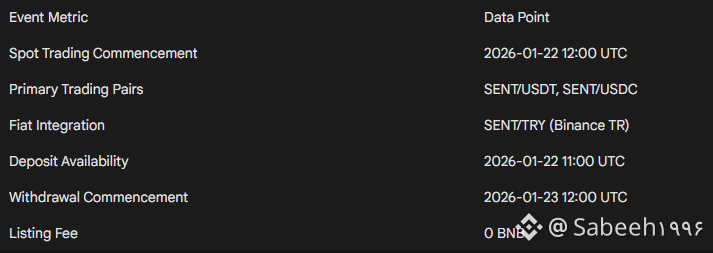

The market debut of the SENT token on Binance was the culmination of a multi-stage rollout designed to capture early adopter sentiment while providing a structured transition for participants. The process initiated with a Pre-TGE Prime Sale on the Binance Wallet on January 19, 2026, allowing eligible users with Binance Alpha Points to gain early access to the token prior to the official Token Generation Event (TGE). This was followed by a strategic observation period within the Binance Alpha ecosystem, where the token served as a focal point for pre-listing community engagement and volume monitoring.

Spot Listing Parameters and Trading Environment

Upon the transition to the spot market, Binance applied the "Seed Tag" designation to SENT. This classification is reserved for innovative projects that exhibit higher-than-average volatility and risk profiles compared to established digital commodities. To maintain access to Seed Tag assets, the platform mandates that users pass a specialized risk assessment quiz every 90 days, ensuring a baseline of market literacy regarding the unique failure modes of early-stage AI protocols.

The inclusion of the TRY pair reflects Binance's commitment to localized liquidity in high-adoption regions, though the protocol notes that TRY is strictly a fiat representative and does not carry the same on-chain properties as synthetic digital currencies. Furthermore, the migration of SENT from the Alpha selection pool to the spot market involved a batch transfer process where Binance automatically moved balances to users' Spot Accounts within 24 hours of the listing.

Architectural Philosophy: The Open AGI Mandate

Sentient addresses the "ClosedAI" problem—the concentration of power in a few corporate labs that control the data, algorithms, and compute resources of the most advanced AI models. The protocol argues that closed-source AGI presents a societal risk because it lacks transparency and creates a "black box" environment where decision-making processes are opaque to users.

The OML Framework

To counter this centralization, Sentient operates under the "OML" framework, which stands for Open, Monetizable, and Loyal.

Open: AI models and artifacts must be auditable and transparent, allowing for community oversight and permissionless innovation.

Monetizable: Every model call triggers a revenue stream distributed via on-chain contracts to trainers, deployers, and validators, solving the economic "tragedy of the commons" that historically hindered open-source AI.

Loyal: Intelligence artifacts are "owned" by and aligned with the interests of the communities that build and utilize them, ensuring upgrades and governance are decided by a decentralized autonomous organization (DAO).

The project's vision of "Loyal AI" is rooted in the belief that AGI should benefit humanity collectively. This objective is supported by the Sentient Foundation, guided by a steering committee of experts in AI research, blockchain engineering, and decentralized finance.

Technical Foundation: The GRID and Artifact Registry

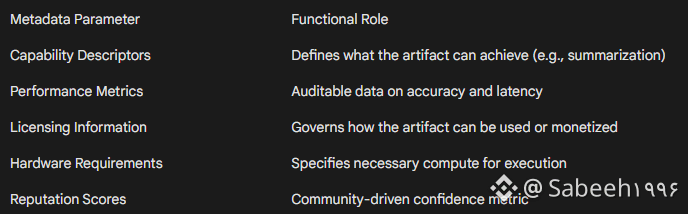

The Global Research and Intelligence Directory (The GRID) serves as the primary coordination layer for the Sentient network. Unlike traditional AI providers that host monolithic models, the GRID functions as a decentralized registry for modular units of intelligence referred to as "artifacts".

Artifact Classification and Metadata

Artifacts on the GRID include language models, autonomous agents, specialized datasets, and software tools. These components are identified by canonical IDs and accompanied by metadata that enables the network to route queries efficiently.

The GRID already hosts over 110 partners and integrates diverse intelligences, including Open Deep Search for multi-step information synthesis and the ROMA meta-agent framework for orchestrating teams of specialized agents.

Verifiable Trust and Privacy Primitives

A central challenge in decentralized AI is ensuring that an AI model actually executed a task without tampering. Sentient utilizes "Verifiable Trust Primitives" to solve this, including Model Fingerprinting and Trusted Execution Environments (TEEs). Model Fingerprinting uses cryptographic signatures to prove ownership and detect unauthorized copies, while TEEs provide hardware-enforced isolation for secure AI execution and data privacy.

Economic Design and SENT Tokenomics

The SENT token is the native utility currency of the ecosystem, designed to coordinate the decentralized AGI economy. The total supply is fixed at a mathematically significant $34,359,738,368$ tokens.

Supply Allocation and Incentives

The distribution of SENT tokens prioritized community ownership and long-term development stability.

To ensure alignment, the team's allocation is subject to a one-year cliff followed by a six-year linear vesting schedule. Similarly, investor tokens are locked for one year before being released over four years. Annual token emissions are capped at 2%, directed into a Community Emission Pool to reward GRID artifacts and protocol incentive programs.

Community Participation and Airdrops

The project is fundamentally community-driven, with over 65% of the total token supply allocated to users and builders. The Season 1 airdrop distributed tokens to contributors across the "Early," "Advanced," and "Sentient AGI" levels, with over 290,000 unique beta testers engaged during the closed beta.

Airdrop Claiming and Billions Verification

Eligible users began claiming SENT tokens on January 22, 2026, through the official claim portal. The claiming process requires approximately $3 worth of Ethereum (ETH) in the user's wallet to cover transaction fees. A mandatory step for claiming is the "Billions" proof-of-uniqueness, which requires a one-time selfie to generate a zero-knowledge proof (ZKP) that the participant is a unique human. This system verifies humanness without storing the original image, adhering to the project's core principles of privacy and sovereignty.

Binance Yield and Trading Campaigns

Beyond spot trading, the integration of SENT into the Binance ecosystem included several promotional campaigns and earn services.

SENT Simple Earn: Flexible Products were listed on January 22, 2026, allowing users to earn daily rewards with instant redemption.

60.7 Million SENT Prize Pool: A major campaign from January 23 to February 6, 2026, featuring an "All User Trade Mission" and a "Trading Volume Tournament".

Trading Power-Up Challenge: A referral and trading promotion with a 10.5 million SENT prize pool, running through February 2026.

Margin and Futures: SENT was added as a borrowable asset on Cross and Isolated Margin, and the SENTUSDT Perpetual Contract launched with up to 40x leverage.

Market Performance and Strategic Outlook

Upon listing, the SENT token experienced significant price action, surging 13% to a peak of $0.0215, reaching a market capitalization of approximately $155 million. While initial momentum was euphoric, the price corrected to the $0.024–$0.026 range by late January, reflecting typical post-listing volatility.

Looking forward, the project's roadmap for 2026 focuses on "Season 2" launch, activating core utility by rewarding builders for verifiable work on the GRID and potentially developing a sovereign blockchain to support decentralized governance. While Sentient faces stiff competition from centralized giants and established protocols like Bittensor (TAO), its focus on composable AI artifacts and verifiable trust primitives provides a unique value proposition in the "Open AGI" race.

Conclusion

The introduction of Sentient (SENT) to Binance marks a high-stakes experiment in the democratization of artificial intelligence. By combining a decentralized coordination layer (The GRID) with a privacy-first identity framework (Billions), the protocol has established a scalable environment for community-owned AI. As the ecosystem moves into its second season, its sustainability will depend on transforming market liquidity into long-term developer engagement and real-world adoption of its open intelligence services.