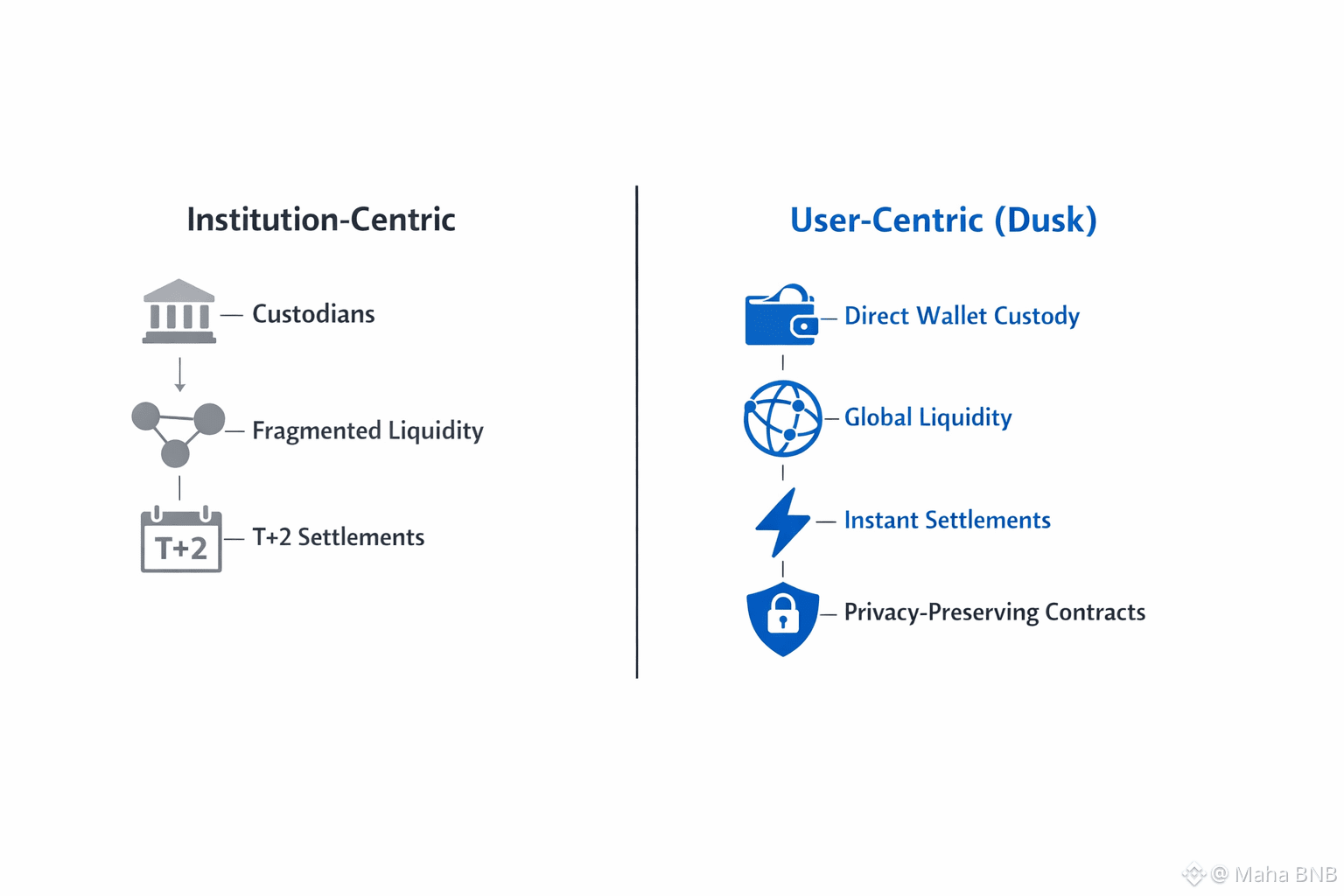

Traditional finance traps assets in custodians’ vaults, and honestly, it just slows everything down and adds risk. Dusk Foundation changes the game with its own layer 1 blockchain. Here, institutions hold their own tokens—no middlemen needed—and built-in privacy features keep everything compliant so global markets can actually work. Since 2018, Dusk’s been building the rails: users manage tokenized securities right from their wallets, skipping the old-school custody headaches but still ticking all the regulatory boxes. This isn’t just a tech upgrade—it’s a real shift. Now, everyday people get access to stuff like bonds and equities, without getting tangled up in legacy systems’ liabilities.

Dusk’s tech is modular. That means you can snap on features—like privacy or EVM compatibility—without breaking things. DuskEVM, the execution layer, lets developers deploy Solidity contracts just like they would on Ethereum, but they settle on Dusk’s base layer for extra security and speed. Mainnet went live in January 2026, and since then, teams have started rolling out apps that actually respect the rules while working with real-world assets. Unlike a lot of blockchains that get stuck in their ways, Dusk keeps things flexible. New modules, no drama, no forks. That’s crucial when regulations keep moving the goalposts.

Privacy isn’t an afterthought here—it’s built in. Dusk uses Hedger, combining zero-knowledge proofs with homomorphic encryption, so you can choose: keep your transactions public, or flip the switch for full privacy. Private mode hides everything from amounts to identities, but you can still let auditors see what they need. Regulators get enough access to verify compliance, but not so much that all your info is out there. It fits right in with frameworks like MiCA. After seven years of building, Dusk finally solves the age-old problem: protecting sensitive financial info while still staying on the right side of the law. In practice, this stops front-running and gives institutions the privacy edge they need to jump in.

Dusk’s consensus is designed for finance—no waiting around for confirmations. Transactions settle in seconds. Bulletin boards act as a shared ledger, so reconciling complex deals is simple. The system isn’t chasing DeFi hype volumes; it’s tailored for businesses that need audit trails and reliability. Smart contracts take care of compliance, and institutions get instant settlement—no more T+2 delays. Users can access everything from stocks to commodities and keep full control of their assets.

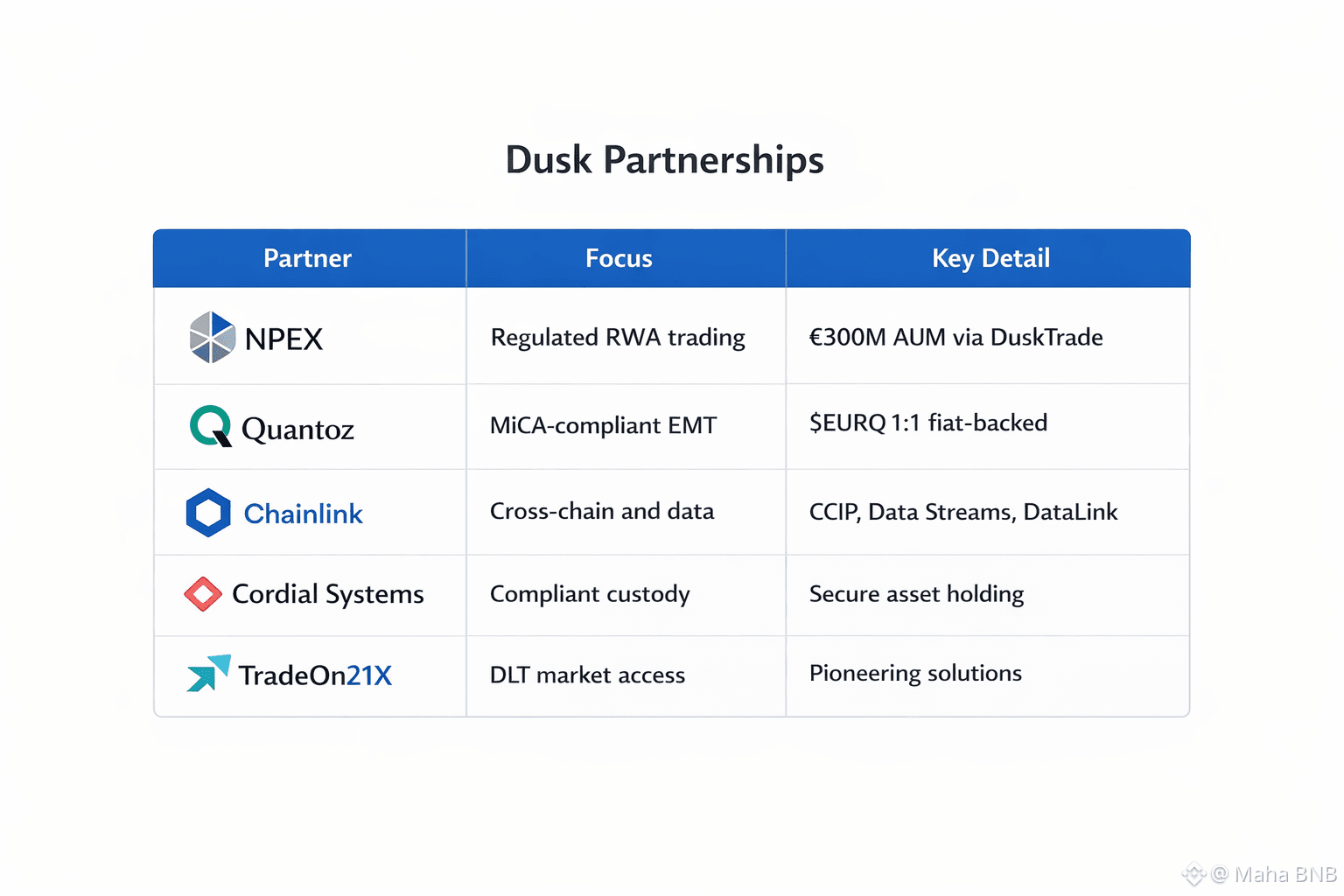

Partnerships push the ecosystem forward. NPEX, a big Dutch exchange with €300 million under management, is co-building DuskTrade for regulated asset trading. It’s launching in 2026, and there’s already a waitlist. Quantoz brings $EURQ, a euro-backed e-money token that follows MiCA rules, so you can transact on-chain in euros under EU law. Chainlink hooks up Dusk with cross-chain features and real-time pricing data. Custody and compliance partners like Cordial Systems and TradeOn21X round out the picture, making sure the basics—like safe storage and market access—are covered.

Liquid staking with Sozu boosts network utility. Right now, TVL sits at 26.6 million, with staking rewards around 29.75% APR. Fees are straightforward: 0.25% on deposits, 10% on rewards. You can secure the network without locking up your assets, which fits Dusk’s whole user-first mindset. Tools like Dusk Explorer let people peek into private transactions when needed, building trust. And yes, Dusk warns users to steer clear of impersonators and stick to official channels.

Dusk stands apart from traditional, institution-focused models by giving users direct wallet custody of asset-backed tokens. Issuers tap into global liquidity without chopping it up across different custodians. No custodians means institutions dodge extra liabilities, and automated compliance keeps things tight. This opens the door for regular people to mix and match services from both traditional and crypto worlds. So, whether it’s real estate or art, tokenization makes it accessible—and you still get privacy.

When you look at the competition: Ethereum is open but too transparent for most institutions. Solana’s fast, but it doesn’t solve privacy for finance. Dusk sits in the sweet spot: modular, compliant, and private. It’s built to handle the tidal wave of tokenized assets on the horizon. With integrations like Chainlink, Dusk moves assets across chains with real-time data, cutting down on risk.

Developers get a head start thanks to EVM compatibility—no need to learn new tricks. They can focus on real-world assets, like money market funds. Community events, like AMAs with CTO Hein Dauven, help everyone stay sharp on privacy and RWAs. Dusk shows up at FinTech talks, keeps the roadmap flexible, and anticipates new rules like DORA, which demand resilience. That’s been part of Dusk’s DNA from the start.

Risks in on-chain finance persist, but Dusk mitigates via design. Selective disclosure ensures audits without leaks. As asset managers deploy full-scale, Dusk's rails support secure scaling. Tokenization isn't abstract; it's practical infrastructure unlocking illiquid assets worldwide.

Dusk redefines finance by centering users, with privacy as the enabler. It transforms custody from a burden to a feature, paving on-chain paths for global capital. Institutions evolve, users empower, markets unify.