Stablecoins need rock-solid security, especially when they’re moving billions around. That’s exactly what Plasma brings to the table. By anchoring everything to Bitcoin, Plasma creates a Layer 1 that lets DeFi actually deliver on its promises—speed, security, and no nonsense.

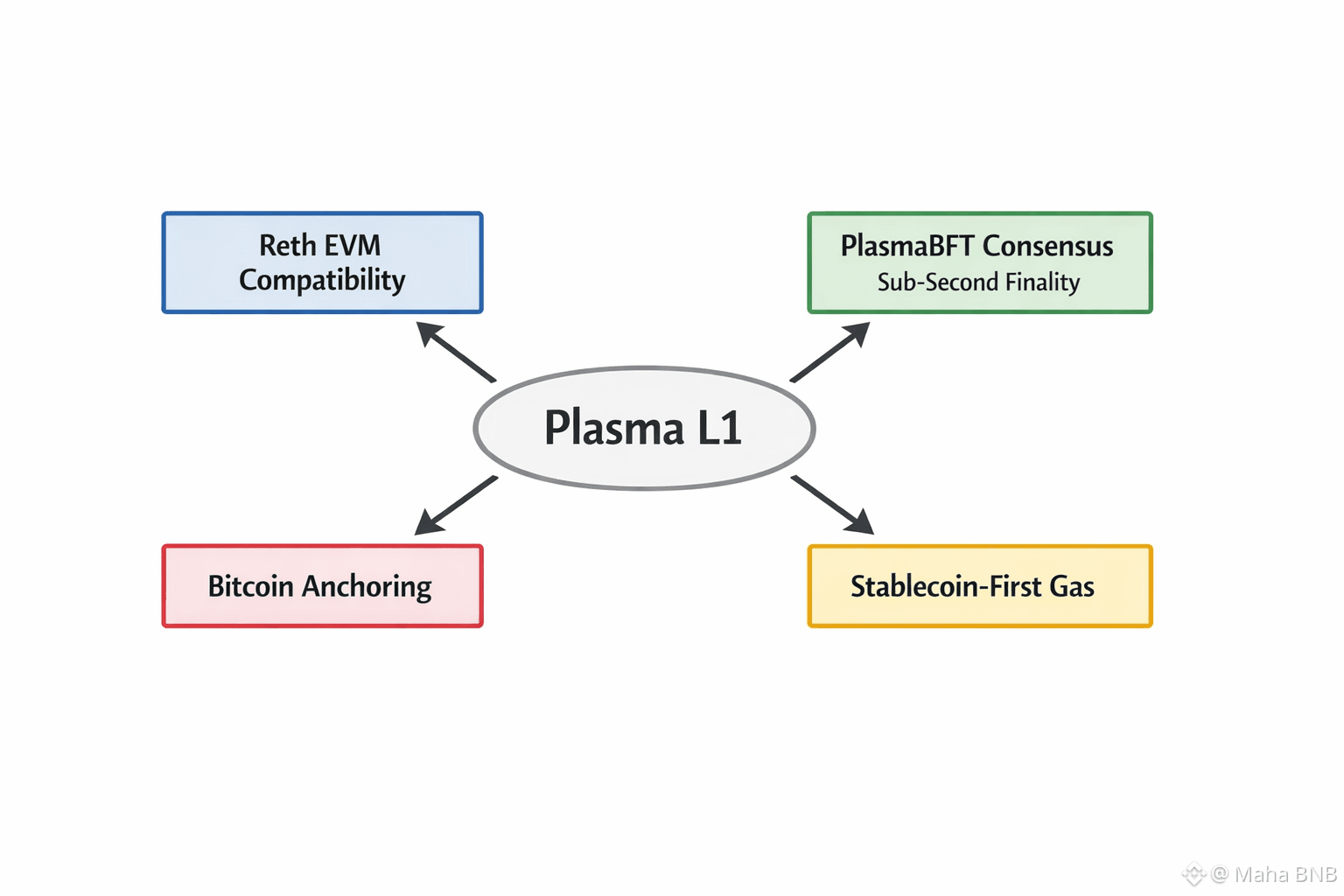

At the core, Plasma runs on Reth, which means it’s fully EVM compatible. Developers can take their Ethereum code and just drop it in, using all the familiar tools they already know. The difference is PlasmaBFT consensus—it locks in blocks in under a second, so you get lightning-fast transactions. We’re talking over 1,000 transactions a second, which is perfect for high-volume stablecoin activity.

Bitcoin anchoring takes Plasma’s neutrality to another level. By tying its security to Bitcoin’s decentralized network, Plasma dodges censorship and builds more trust. No single group gets too much control, so there’s less risk for stablecoin holders. You get settlements that are reliable and tamper-proof.

One of the best parts? Gasless USDT transfers. Users can send USDT without paying in some native token—the fees come straight out of the stablecoin itself. That makes life a lot easier, especially for people who need to move money around all the time, whether it’s for payments or trading.

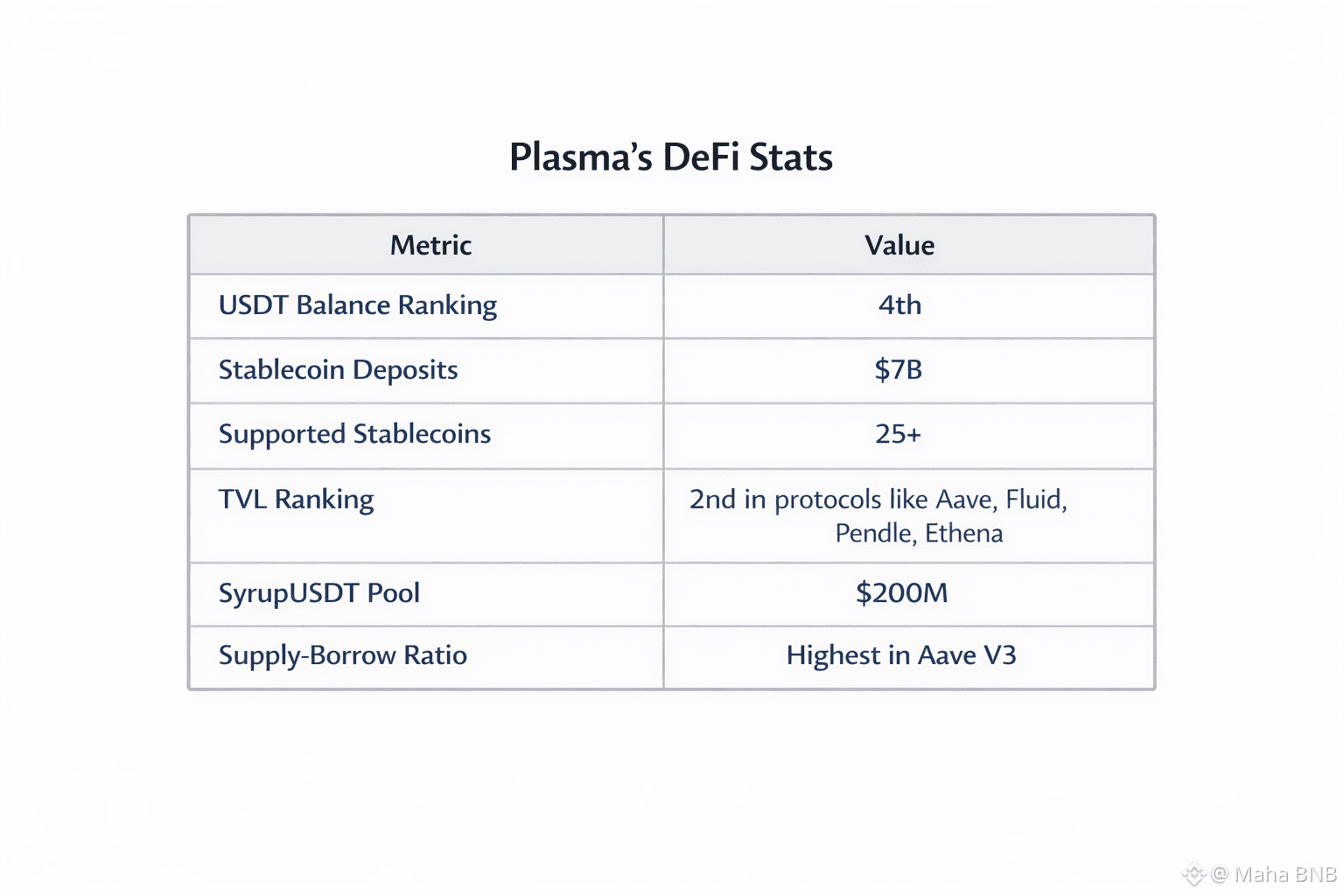

Right now, Plasma sits fourth in the world by USDT balance, holding $7 billion in stablecoins. It supports over 25 different stablecoins, covering everything from hedging to remittances. With infrastructure in more than 100 countries, supporting over 100 currencies and 200+ payment methods, Plasma actually makes borderless finance possible.

DeFi protocols love Plasma because it’s built for stablecoins. Aave V3 markets on Plasma have the world’s highest supply-to-borrow ratio for stablecoins. Plasma also ranks second in TVL across big protocols like Aave, Fluid, Pendle, and Ethena. The syrupUSDT pool alone has $200 million, making onchain liquidity hard to beat.

Fluid deployment is all about capital efficiency. Payments, card issuers, fintech builders—they use Fluid to earn, swap, and borrow without locking up too much collateral. This setup makes it easy to scale up without unnecessary costs.

CoWSwap has joined up for MEV-protected trades. That means traders can swap, send, or bridge assets with zero gas fees, all while staying protected from value extraction—even when the market’s wild.

So, why does this matter? Traditional finance is slow and expensive. Plasma’s tech makes DeFi fast enough to go toe-to-toe with centralized finance, which is exactly what institutions want if they’re wary of blockchain risks.

Here’s how it works: You start a transaction on Plasma. PlasmaBFT locks it in almost instantly, then anchors the block to Bitcoin for extra security. Stablecoin gas covers the fees behind the scenes, so users don’t even notice.

Enterprises are jumping in, too. Confirmo processes $80 million every month across e-commerce, trading, forex, and payroll—all with zero gas for merchants. This lets businesses plug crypto into their legacy systems without friction.

StableFlow lets you transfer up to $1 million from networks like Tron to Plasma with basically no slippage or fees. This kind of liquidity stands up to what you’d see on big centralized exchanges and supports serious operations.

NEAR Intents let you settle and swap across 125+ assets, all onchain, at good rates. Builders can run complex trades with no middlemen involved.

And with Rain, you can spend Plasma USDT at over 150 million merchants worldwide. That’s how you get from holding crypto to actually using it in the real world.

Plasma’s backers give it serious credibility—names like Paolo Ardoino from Tether, Scott Bessent, Chris Giancarlo, and David Sacks are helping steer the ship.

Over 100 partnerships are driving the ecosystem forward, making Plasma a real hub for stablecoins and boosting adoption everywhere.

In DeFi, Plasma turns stablecoins into productive assets. High supply-borrow ratios in lending markets show capital isn’t just sitting around; it’s working efficiently. Protocols like Pendle and Ethena build yield strategies right on top of this.

Anchoring to Bitcoin solves some of blockchain’s deepest security issues and helps keep things decentralized—something regulators and enterprises both care about.

For developers, EVM compatibility means fewer headaches. You build stablecoin apps with Reth, deploy fast, and scale up thanks to PlasmaBFT’s performance.

Plasma also tackles stablecoin fragmentation. Unified settlement cuts down cross-chain risks and opens the door for more innovation in yield farming and liquidity.

For enterprises, tools like Confirmo and Rain finally bridge the gap with traditional finance, making compliant crypto integration possible.

As stablecoin volumes explode, Plasma’s design keeps everything running smooth. Sub-second blocks handle even the biggest spikes, all while costs stay low.

Retail users aren’t left out either—over 200 payment methods mean people in emerging markets can jump in, even where old-school banks fall short.

Plasma’s all about real utility, not just speculation. Its stablecoin-first features line up incentives for people who actually want to use these assets long term.

Details about governance aren’t public yet, but with this roster of backers, you can bet there’s strong strategic oversight guiding Plasma forward.

Compared to general L1s, Plasma's stablecoin optimizations yield superior efficiency. Bitcoin anchoring adds a layer of proven security absent in many competitors.

This tech convergence propels DeFi forward. Institutions gain trusted rails; developers access robust tools.

Plasma embodies the evolution of blockchain finance. Secure, fast, and stablecoin-centric, it paves the way for mainstream adoption.