As of early January 2026, BNB Chain continues to rank among the top 3 blockchains globally for stablecoin liquidity, alongside Ethereum and Tron.

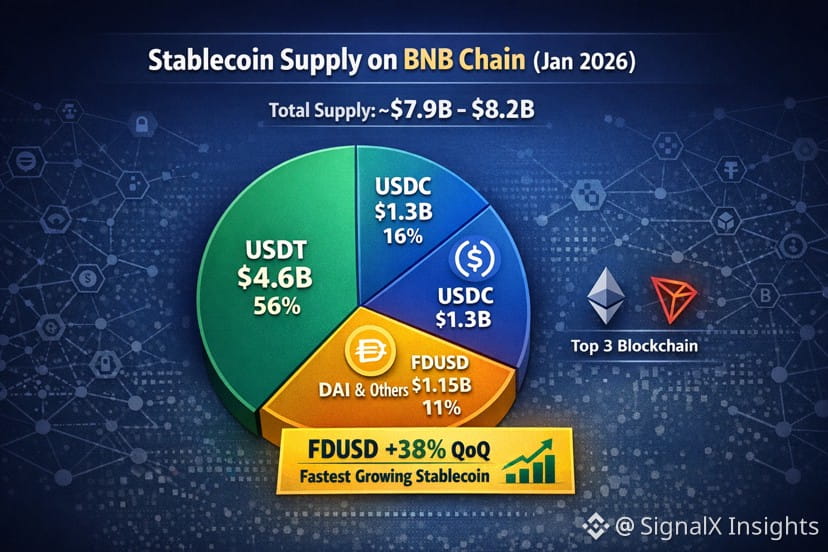

The total circulating stablecoin supply on BNB Chain is estimated at ~$7.9–8.2B, showing strong capital retention despite broader market volatility.

Stablecoin Composition on BNB Chain

Current on-chain distribution highlights a clear hierarchy:

• USDT: ~$4.6B (56–58% dominance)

• USDC: ~$1.3B (~16%)

• FDUSD: ~$1.15B (~14%)

• DAI & other stables: ~$0.9B (11–12%)

📌 Key insight:

FDUSD is the fastest-growing stablecoin on BNB Chain, with supply up ~38% QoQ, largely driven by Binance-native integrations and deep liquidity support across major pairs.

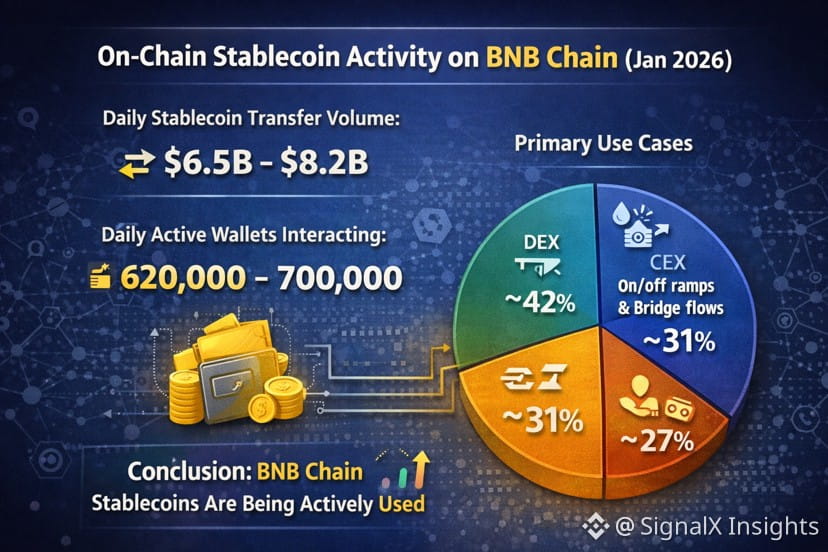

On-Chain Flow & Usage Metrics

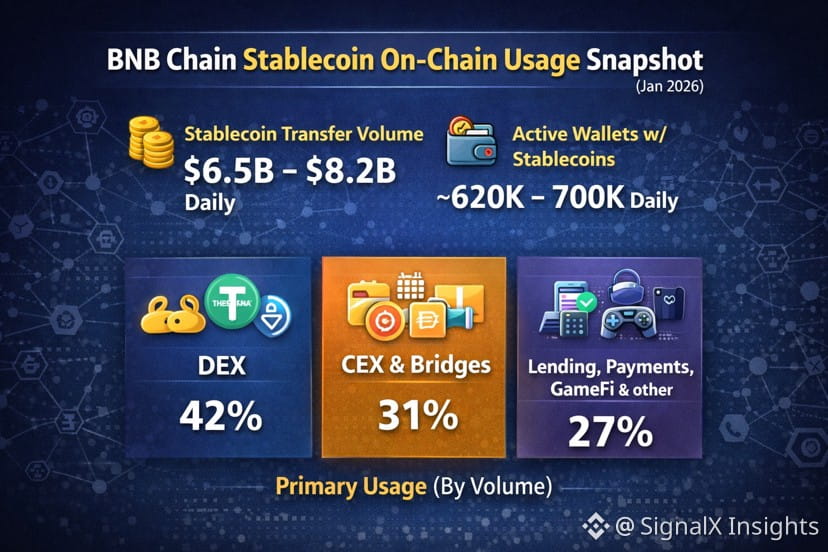

• Daily stablecoin transfer volume: $6.5B – $8.2B

• Daily active wallets interacting with stablecoins: ~620K – 700K

• Primary use cases (by volume):

• DEX activity (PancakeSwap, THENA, etc.): ~42%

• CEX on/off ramps & bridge flows: ~31%

• Lending, payments, GameFi & others: ~27%

This distribution shows that BNB Chain stablecoins are being actively used, not passively parked.

Liquidity Behavior & Market Implications

• Stablecoin balances on DEX pools have increased ~12% MoM, signaling pre-positioning for spot and yield strategies

• Exchange inflows remain stable, with no abnormal spikes → low panic selling pressure

• Wallet clustering data shows mid-sized wallets ($10K–$250K) driving most stablecoin flow, not whales

📉📈 This suggests retail + semi-pro capital is preparing, not exiting.

What This Means for BNB Chain

Stablecoin data confirms that BNB Chain remains a high-velocity capital network:

• Liquidity is deep

• Usage is broad

• Capital is rotational, not dormant

As long as stablecoin supply holds above $7.5B, BNB Chain maintains a strong base for DeFi, trading, and new narratives.

In short:

Stablecoins on BNB Chain aren’t leaving — they’re waiting.