In the ever-evolving world of cryptocurrencies, stablecoins have quietly carved out a significant role. Unlike Bitcoin or Ethereum, which can fluctuate wildly in value, stablecoins are pegged to traditional assets like the U.S. dollar, offering stability in an otherwise unpredictable market. Over $250 billion in stablecoins are now circulating, playing a vital part in transactions across the globe. But while they hold promise, the underlying infrastructure often struggles to keep up with their potential. That’s where Plasma comes in—a blockchain designed not just to support stablecoins, but to make them work in a way that’s fast, efficient, and simple.

Imagine you’re sending money to a friend, halfway across the world. You want it to be quick, reliable, and affordable—no long waiting times, no unexpected fees. This is the dream of stablecoins, but traditional blockchains often make it harder to achieve. Plasma, built from the ground up for stablecoin transactions, wants to make that dream a reality.

A Blockchain Built for Speed and Low Costs

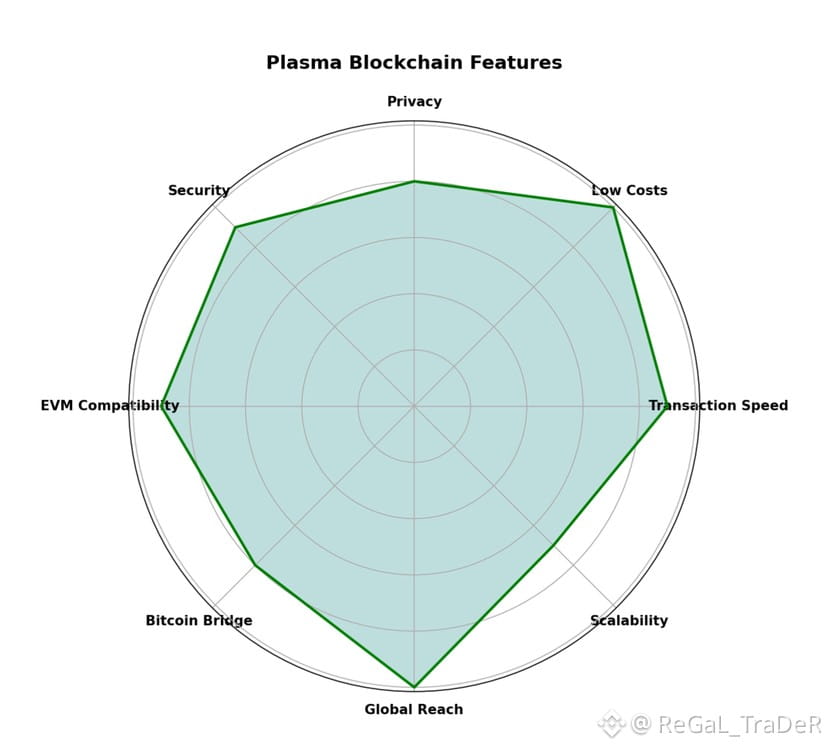

At the core of Plasma is a commitment to providing an infrastructure that can handle real-time, low-cost payments without sacrificing security. Think about it like a highway that’s designed to move traffic efficiently. Plasma offers transactions with over 1,000 per second—so it’s not just fast, it’s designed to handle a lot of traffic, day in and day out. The fees? Well, they’re almost nonexistent. Plasma takes a unique approach where fees are covered by the network itself for certain transactions, meaning you don’t need to hold native tokens just to send or receive money.

This focus on zero-fee transfers is a game-changer, especially for everyday users and small businesses. If you’ve ever sent a cross-border payment and been stung by high fees or delays, you’ll appreciate how Plasma works to eliminate that frustration.

But it doesn’t stop there. Plasma also prioritizes the importance of privacy. In a world where personal data can feel like it’s always up for grabs, Plasma’s built-in confidentiality features help keep transaction details private, while still playing by the rules and ensuring compliance with regulations.

Connecting the Dots

One of the most interesting parts about Plasma is how it makes room for both innovation and stability. It’s fully compatible with Ethereum, which means that developers who are already familiar with Ethereum’s ecosystem can jump in without a steep learning curve. If you’ve already written smart contracts on Ethereum, you can deploy them on Plasma with minimal changes. That’s a huge win for developers who want to build quickly and easily on a blockchain that’s optimized for stablecoins.

But Plasma isn’t just about stablecoins and Ethereum. It also bridges the gap to Bitcoin, which, while often seen as a store of value, hasn’t had the same role in payments. With Plasma’s native Bitcoin bridge, Bitcoin can be transferred onto the network in a secure, low-cost way. It’s a small step, but it brings Bitcoin closer to becoming a tool for everyday transactions—where it can join the stablecoin community and work seamlessly alongside them.

A Growing Network

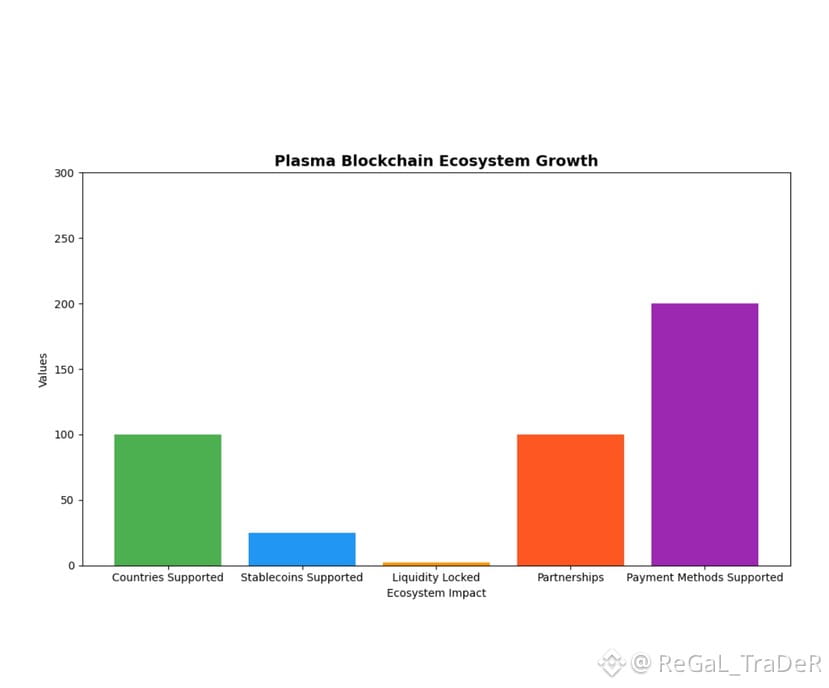

As Plasma continues to grow, its impact is becoming more and more visible. The network supports more than 25 stablecoins, and it’s not just a handful of people using it—Plasma’s ecosystem reaches over 100 countries, enabling transactions in over 100 currencies and more than 200 payment methods. It’s becoming an international player, connecting diverse financial systems and making them work together more smoothly.

This isn’t just about numbers; it’s about deep liquidity. At launch, Plasma had over $2.5 billion in stablecoins locked into its ecosystem. For users and businesses alike, that’s reassurance that their transactions won’t be delayed or stifled due to a lack of liquidity. Plasma’s growing partnerships also reflect the demand for a stable, scalable infrastructure that can handle high volumes of transactions.

But even with this momentum, Plasma isn’t immune to the challenges of growing a global network. Expanding the infrastructure to support trillions of transactions, maintaining high security as the user base grows, and ensuring that the network remains decentralized are not small tasks. The project still faces hurdles, particularly as it works to expand its reach into new markets and scale its system for even larger volumes.

A Quiet Revolution

While Plasma’s technological innovations are impressive, its true value lies in the quiet revolution it is helping to shape. It’s not about flashy headlines or rapid, unchecked growth; it’s about creating something sustainable, something that works for people. Whether it’s enabling micropayments in developing countries or supporting large-scale financial services, Plasma is steadily building a foundation for a global financial system that’s more open and accessible.

The journey ahead for Plasma is one of steady expansion, technical refinement, and continued collaboration with both the crypto and traditional finance sectors. While the road may have challenges, the potential for stablecoins to become a truly global currency is undeniable. Plasma’s focus on stability, speed, and cost-efficiency positions it as a key player in this ongoing transformation.

Looking Ahead

It’s hard not to feel a sense of quiet excitement as we look ahead. Plasma’s vision—an interconnected, low-cost financial ecosystem driven by stablecoins—is one that could eventually redefine how we think about money in a digital world. It won’t happen overnight, and there will be bumps along the way. But with every step, Plasma is helping to lay down the tracks for a future where money moves as freely and easily as information does today.

As we watch this technology unfold, it’s clear that Plasma’s thoughtful, focused approach could help make stablecoins a more reliable part of our financial lives. It’s not about grandiose promises or wild speculation—it’s about providing real, practical solutions for the challenges we face today, with a steady eye on the future.

And as the blockchain space continues to evolve, we’re reminded that sometimes, the most significant changes come from the quiet innovators working behind the scenes, making sure the infrastructure that powers our financial world is stable, efficient, and ready for what’s to come.