Stablecoin users are tired of paying high fees and waiting around for transactions to clear. Plasma flips that experience on its head. It’s a Layer 1 blockchain built from the ground up for stablecoin users—think instant, zero-fee USDT transfers, backed by over $7 billion in deposits (check plasma.to for the official numbers). This isn’t just about making things faster; Plasma aims to make stablecoins feel as easy and reliable as digital cash, no matter where you are in the world.

What really sets Plasma apart? It’s laser-focused on stablecoin payments. The network runs on PlasmaBFT consensus, pushing out over 1,000 transactions every second with block times under a second. That’s the kind of speed and reliability you usually only see in traditional banking, not blockchains. You can send money across borders without headaches, and it just works.

Privacy matters, too. Plasma bakes in confidential transactions, so your everyday transfers stay secure. The network already supports more than 25 stablecoins and operates in over 100 countries. With connections to 200+ payment methods, you’re not boxed in—spend, move, or swap your stablecoins however you want.

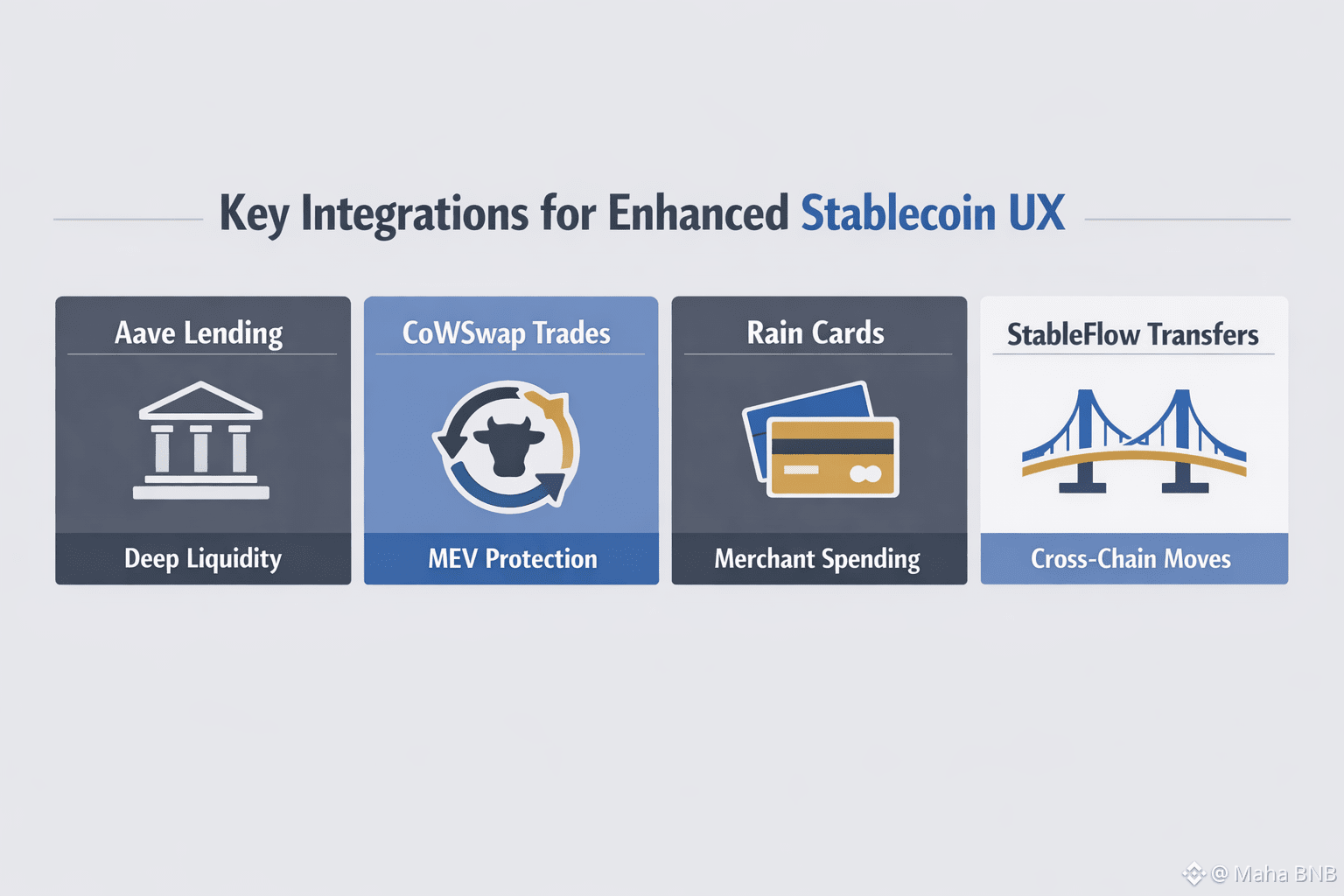

On-chain liquidity? Plasma doesn’t mess around. At launch, users locked over $2 billion in stablecoins. That deep liquidity means trades go through with barely any slippage, which is a huge win for anyone using DeFi. Integrations with Aave and Fluid (you’ll see them mentioned in Plasma’s docs and social channels) let you borrow, lend, and earn yield—all from within the network. The whole thing is designed for speed and low costs, so stablecoin users actually get what they’ve always wanted.

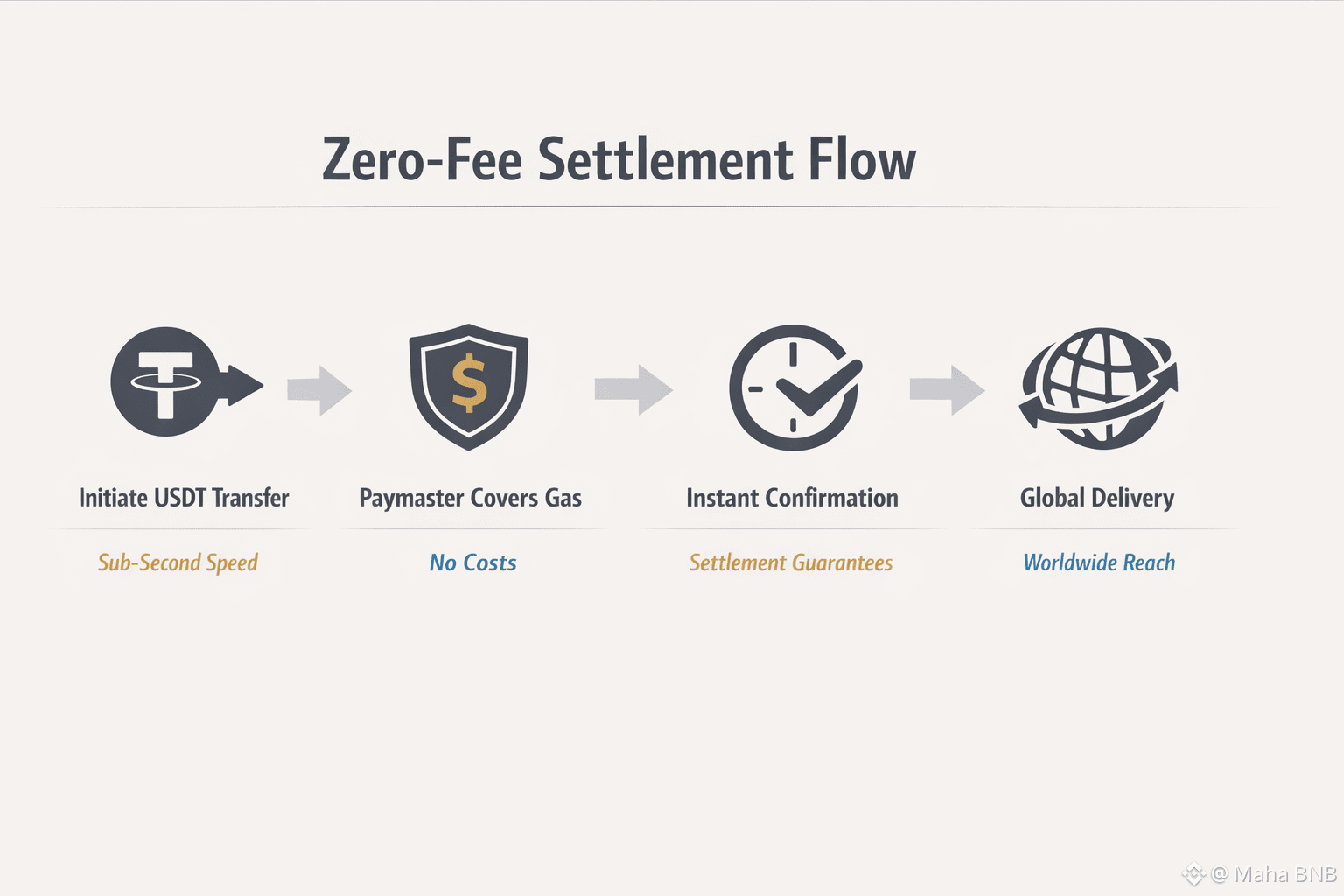

The real game-changer, though, is zero-fee transfers. Plasma’s paymaster system covers gas for USDT moves, so you don’t need native tokens just to send money. It’s a simple fix that makes wallets way friendlier, especially for folks who just want to send or spend without jumping through hoops.

Here’s what stands out for stablecoin users on Plasma:

- Transfers settle in under a second—no more waiting.

- Zero fees on USDT, so regular payments stop eating into your balance.

- EVM compatibility, so you can use your existing wallets.

- Bitcoin-secured bridges for safe cross-chain moves.

- Support for 100+ currencies worldwide.

Whether you’re sending money home or paying a merchant, those perks take the stress out of moving money.

Now, about the XPL token. While you can transfer stablecoins for free, XPL is what keeps Plasma’s network secure. Validators stake it, users pay advanced transaction fees with it, and it’s central to how Plasma stays resilient. If you’re curious about XPL’s role or price, the trade widget on plasma.to breaks it down.

Plasma didn’t stop at the basics. Partnerships with platforms like CoWSwap (for MEV-protected trades) and Rain (enabling card payments at over 150 million merchants) make the user experience even smoother. StableFlow, another feature, lets users move up to $1 million across chains with zero slippage—huge for anyone dealing with big amounts.

All this isn’t just hype. With support from big names like Tether’s CEO and over 100 partnerships, Plasma is scaling fast. It’s already the fourth-largest network by USDT balance, proving that people are hungry for better payment rails.

If you use stablecoins and you’re frustrated with the usual pain points, Plasma actually fixes them. No confusing steps, no surprise fees—just a platform built to make your money move the way you want.

So, imagine sending USDT anywhere in the world, instantly, with no fees. Would that change how you think about remittances? And for those chasing better stablecoin yields, how much easier could DeFi feel with Plasma handling the heavy lifting?