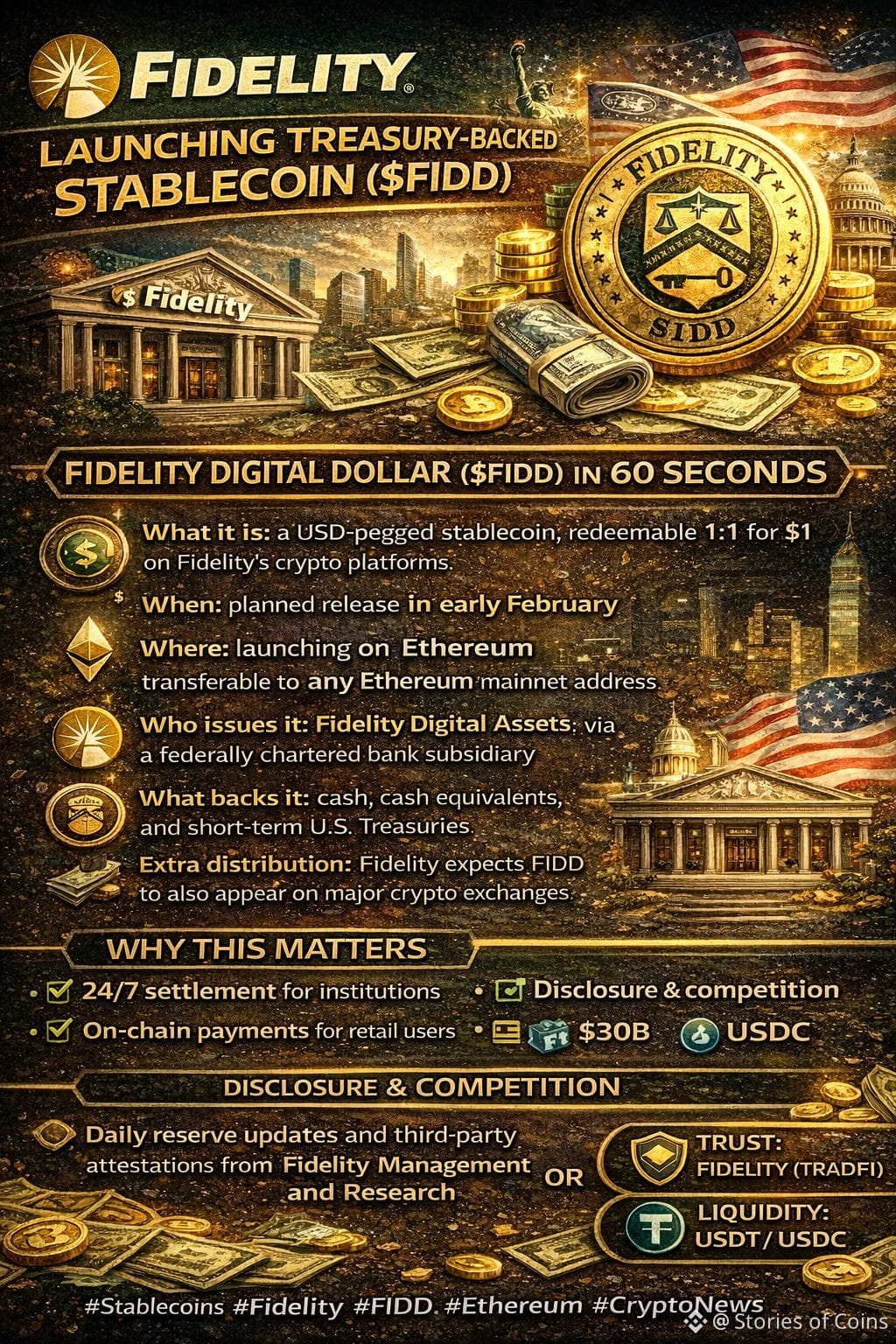

🚨 I am Storiesofcoins — Fidelity (an asset manager with around 6 trillion USD under management) is launching a Treasury-backed stablecoin called FIDD, and this is one of the clearest signals that stablecoins are becoming mainstream finance infrastructure.

🧑Fidelity Digital Dollar (FIDD) in 60 seconds

What it is: a USD-pegged stablecoin, redeemable 1:1 for 1 USD on Fidelity crypto platforms

When: planned release in early February

Where: launching on Ethereum, transferable to any Ethereum mainnet address

Who issues it: Fidelity Digital Assets via a federally chartered bank subsidiary

What backs it: cash, cash equivalents, and short-term U.S. Treasuries

Extra distribution: Fidelity expects FIDD to also appear on major crypto exchanges (no specific names stated)

🧠 Why this matters to you

Stablecoins are evolving from a trading tool into payment and settlement rails.

Fidelity’s angle is straightforward:

🕒 24/7 settlement for institutions

🛒 on-chain payments for retail users

💸 lower-cost payments and settlement infrastructure

Translation: a TradFi giant is treating on-chain dollars as infrastructure, not a side feature.

🛡️ The trust layer: disclosure and attestations

Fidelity says it will provide:

📊 daily disclosure of issuance and reserve values

✅ regular third-party attestations

🧾 reserves managed by Fidelity Management and Research

This is the regulated stablecoin playbook: win with transparency and institutional operations.

⚔️ The real competition

Fidelity is stepping into a stablecoin market around 308 billion USD, dominated by USDT and USDC.

And this is happening as regulation pushes stablecoins toward full-reserve, payment-like behavior.

🎯 My takeaway

Money rails scale quietly, then suddenly.

Fidelity launching FIDD is the kind of quiet move that can reshape liquidity, settlement habits, and the stablecoin hierarchy over time.

💬 Question for you

If you had to hold a digital dollar long-term, what matters more:

✅ brand trust (Fidelity, TradFi)

or

✅ existing liquidity (USDT, USDC)

#stablecoin #Fidelity #FIDD #Ethereum #CryptoNews