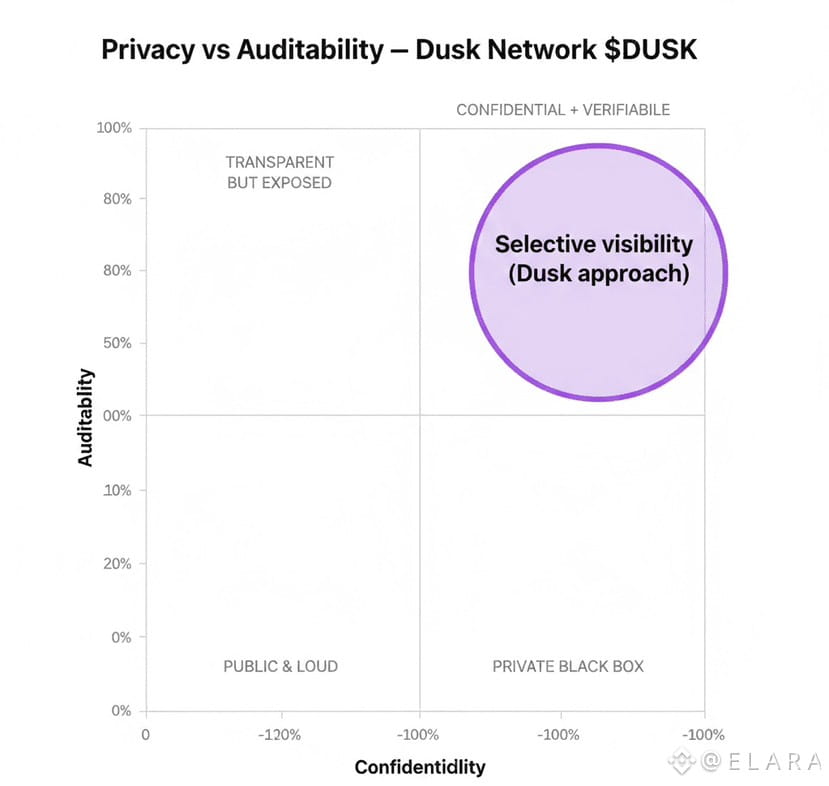

Regulators demand transparency. Financial institutions require confidentiality. These opposing requirements created contradiction preventing blockchain adoption in traditional finance. Bitcoin’s transparent ledger shows every transaction to everyone. Ethereum broadcasts wallet balances publicly. Viewing whale movements causes market manipulation. Regulators monitoring trades see sensitive business information. The architectural choice making blockchain trustless simultaneously makes it unsuitable for regulated securities.

Large asset managers can’t trade publicly. When BlackRock accumulates position in specific stock, revealing every purchase telegraphs strategy to competitors. High-frequency traders frontrun visible orders. Confidential mergers leak through onchain activity. Bitcoin designed for trustless peer-to-peer payments where transparency proves integrity. But traditional securities markets evolved different requirements. They’re regulated markets where certain parties need visibility while others require confidentiality. Blockchain’s all-or-nothing approach fails meeting nuanced requirements that developed over centuries of financial market evolution.

When Dutch Stock Exchange Chose Blockchain Over Tradition

NPEX operates as fully regulated Dutch stock exchange holding Multilateral Trading Facility and European Crowdfunding Service Provider licenses from Netherlands Authority for Financial Markets. Since two thousand eight, they facilitated one hundred two financings raising over two hundred million euros serving seventeen thousand five hundred active investors. Traditional infrastructure worked but imposed limitations through delayed settlement, restricted trading hours, and geographic boundaries.

Mark van der Plas, NPEX CEO, recognized blockchain could solve these limitations. Twenty four seven trading, instant settlement, fractional ownership, global access. But regulatory requirements persist. AFM supervision, MiFID II compliance, market integrity protections remain mandatory. The exchange needed blockchain efficiency without sacrificing regulatory standing. Traditional blockchains offered either complete transparency incompatible with confidential trading or privacy preventing regulatory oversight. NPEX selected Dusk after evaluating options. The partnership announced tokenizing all assets under management exceeding three hundred million euros representing genuine regulated securities trading onchain.

The Architectural Solution Nobody Else Built

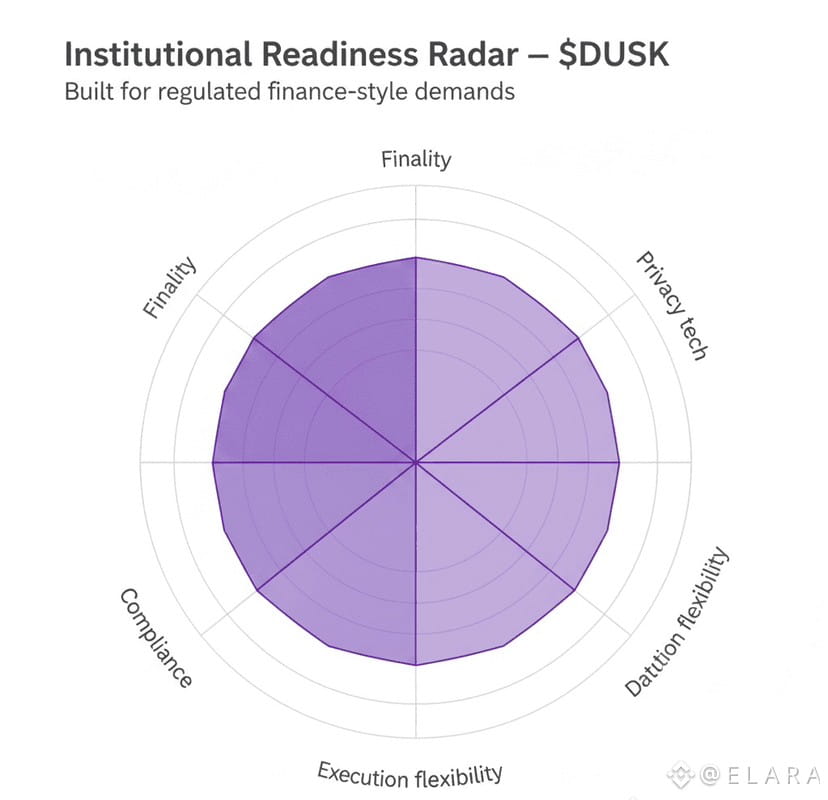

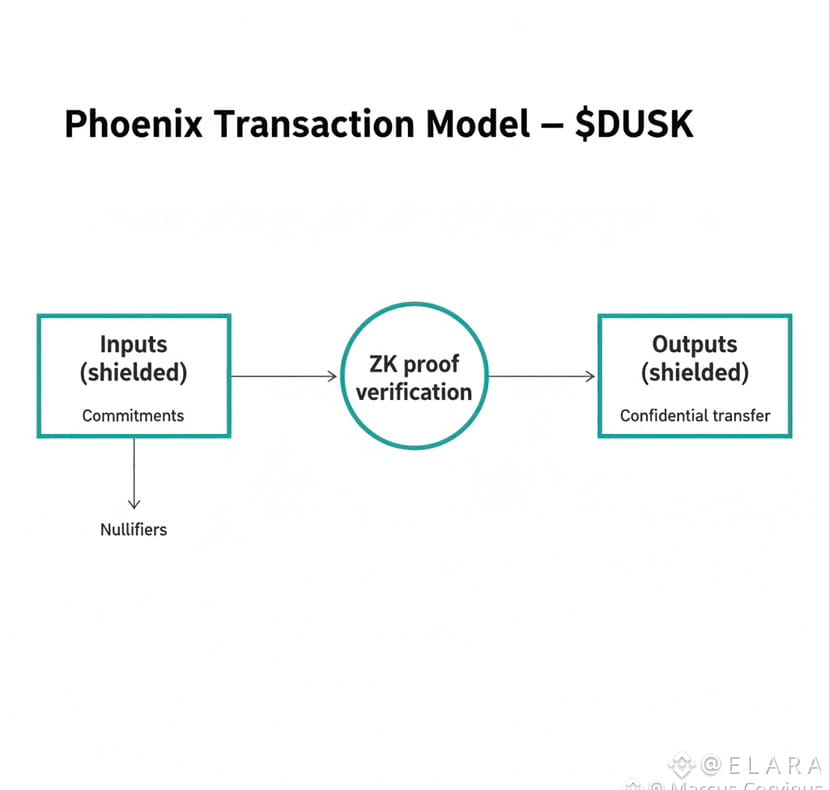

Dusk employs dual transaction models solving privacy versus transparency contradiction. Phoenix transactions provide complete confidentiality through zero-knowledge proofs. Balances remain hidden. Transaction amounts stay private. Participants remain pseudonymous. The system proves transactions valid without revealing details. This satisfies institutions requiring confidential trading where competitors, frontrunners, and market manipulators can’t observe activity. Phoenix works like cash. You know you received payment. The payer knows they sent it. Nobody else sees transaction unless you choose revealing it.

Moonlight transactions operate transparently like traditional blockchain. Balances visible. Transaction amounts public. Participants identifiable. This satisfies regulatory requirements where authorized parties need observing activity for compliance, market surveillance, and investor protection. The architecture allows users switching between models based on specific needs. Issue securities through Moonlight providing transparency regulators require. Trade through Phoenix maintaining confidentiality institutions demand. Convert between models when circumstances change. The flexibility matches how real financial markets operate where different activities require different disclosure levels.

Moonlight transactions operate transparently like traditional blockchain. Balances visible. Transaction amounts public. Participants identifiable. This satisfies regulatory requirements where authorized parties need observing activity for compliance, market surveillance, and investor protection. The architecture allows users switching between models based on specific needs. Issue securities through Moonlight providing transparency regulators require. Trade through Phoenix maintaining confidentiality institutions demand. Convert between models when circumstances change. The flexibility matches how real financial markets operate where different activities require different disclosure levels.

Emanuele Francioni, Dusk CEO, explained the approach balancing privacy with accountability. The phrase “private by default, accountable when required” captures philosophy. Financial institutions conducting business deserve confidentiality protecting competitive advantages and preventing manipulation. But when regulators investigating misconduct or courts resolving disputes, authorized parties must access relevant information. Zero-knowledge technology enables selective disclosure impossible with traditional blockchain architecture. Cryptographic proofs demonstrate compliance without revealing underlying data. Authorized parties holding proper credentials can decrypt specific information while general public remains unable viewing confidential details.

The Citadel tool implements zero-knowledge KYC and AML removing onboarding hurdles from digital asset investing while maintaining compliance. Traditional KYC requires revealing personal information to multiple parties creating privacy risks and data management burden. Citadel uses zero-knowledge proofs letting users prove identity attributes without disclosing actual data. You demonstrate being accredited investor without showing financial statements. You prove geographic eligibility without revealing specific location. You confirm absence from sanctions lists without exposing personal details. This reconciles privacy with regulatory compliance meeting GDPR, DORA, MiFID II, and MiCA requirements simultaneously.

When Chainlink Connected Regulated Markets Cross-Chain

November thirteenth twenty twenty five Dusk and NPEX announced adopting Chainlink interoperability and data standards bringing regulated European securities onchain into broader Web3 economy. Chainlink CCIP serves as canonical interoperability layer for tokenized assets issued by NPEX on DuskEVM. The integration enables securities issued under European regulation composing across multiple blockchain ecosystems. Financial assets receive primary issuance on Dusk meeting compliance requirements then become accessible or settled in DeFi environments across chains through CCIP bridges maintaining regulatory integrity.

Johann Eid, Chainlink Labs Chief Business Officer, described collaboration defining blueprint for regulated markets operating natively onchain. The significance extends beyond technical integration. Tokenized equities issued on regulated Dutch exchange can trade on Ethereum, settle on Solana, or compose in DeFi protocols while maintaining compliance status throughout. Previous attempts at securities tokenization created isolated systems where assets existed only on single blockchain limiting liquidity and composability. CCIP’s burn-and-mint model removes dependence on third-party liquidity pools ensuring accurate efficient token movements without slippage.

Chainlink DataLink delivers official exchange data from NPEX onchain serving as exclusive onchain data oracle solution for platform. Data Streams provides low-latency high-frequency price updates supporting institutional trading applications requiring real-time market information. Through this integration, Dusk and NPEX become data publishers for regulatory-grade financial information making it available to smart contracts with transparency, auditability, and reliability institutions require. Smart contracts can now query verified pricing data, trading volumes, and market statistics directly from licensed exchange rather than relying on unverified external sources.

The DUSK token itself gains cross-chain capability through Cross-Chain Token standard enabling transfers between Ethereum and Solana while preserving regulatory status. Token holders access unified liquidity regardless which network they operate on. Institutional users managing tokenized securities across multiple chains avoid fragmented liquidity and complicated bridging processes. The integration demonstrates how compliant assets can achieve composability benefits DeFi offers while maintaining regulatory framework traditional finance requires. It’s no longer either compliance or composability. Dusk architecture enables both.

The Digital Euro Partnership Completing Infrastructure

Quantoz Payments, NPEX, and Dusk released EURQ marking first time MTF licensed stock exchange utilizes electronic money tokens through blockchain. EURQ designed as MiCAR compliant digital euro enabling regulated finance at scale. This represents first collaboration where licensed exchange, EMT provider, and blockchain foundation combined forces. Trading tokenized securities requires settlement medium. Traditional markets use fiat through banking system with intermediaries and delays. Cryptocurrency markets use native tokens lacking regulatory clarity. EURQ provides regulated digital currency matching tokenized securities’ compliance level enabling institutional participation impossible with unregulated settlement media.

DuskEVM Bringing Institutional Smart Contracts

DuskEVM launching as Layer Two provides EVM compatibility while maintaining Layer One’s privacy and compliance features. Developers deploy Solidity contracts gaining access to Dusk’s institutional user base and regulatory infrastructure. Financial institutions gain confidential smart contracts impossible on public chains. Trading algorithms remain private preventing frontrunning. Portfolio compositions stay hidden avoiding copycat strategies. But authorized parties holding credentials can audit contracts verifying compliance or investigating disputes.

Hyperstaking unleashes programmability introducing account abstraction where smart contracts implement custom logic handling stakes. This enables privacy-preserving staking, delegation, liquid staking, and yield boosting. Institutional investors requiring custom arrangements matching specific mandates implement logic through smart contracts. The Zedger protocol focusing on privacy-preserving compliant asset tokenization represents culmination of architectural decisions. Complete system combines confidential transactions, regulatory compliance, cross-chain interoperability, regulated settlement currency, and programmable smart contracts addressing barriers preventing traditional finance embracing blockchain.

Dusk roadmap includes trust-minimized clearance combining traditional and blockchain systems for atomic efficient settlements. The solution brings twenty four seven trading and fractional ownership to brokers, market makers, and institutional investors. Transactions settle atomically eliminating counterparty risk. Trading continues around the clock. Fractional ownership lowers minimums enabling broader participation. Benefits come without sacrificing regulatory framework. Custodian integration with selected banks enables institutions using network implementing clearance for securities and digital cash meeting security and compliance requirements while enabling blockchain benefits.

Whether Privacy Becomes Compliance Advantage

The fundamental question Dusk poses asks whether privacy becomes competitive advantage or regulatory liability in institutional blockchain adoption. Traditional view holds privacy and compliance as opposing requirements. More privacy means less compliance. More compliance means less privacy. This binary thinking prevented institutional adoption despite blockchain’s clear efficiency advantages over legacy infrastructure. Institutions wanting blockchain benefits couldn’t accept privacy sacrifices. Regulators demanding oversight couldn’t accept confidential systems preventing surveillance.

Dusk’s architecture challenges this binary demonstrating privacy and compliance as complementary rather than contradictory. Zero-knowledge proofs enable proving compliance without revealing confidential information. Selective disclosure provides regulatory oversight without broadcasting details to competitors. Dual transaction models allow choosing appropriate transparency level for specific circumstances. The technical capabilities match how sophisticated markets actually operate where different participants have different information rights based on roles and relationships.

We’re seeing institutional interest translating into actual adoption through NPEX partnership. Real securities trading on regulated exchange using blockchain infrastructure. Not experimental proof of concept. Not limited pilot program. Full exchange operations with three hundred million euros assets moving onchain. The AFM supervision continues. MiFID II compliance persists. Investor protections remain. But settlement happens instantly. Trading occurs continuously. Fractional ownership enables broader participation. The benefits come without regulatory compromise.

The five hundred eighty three percent price surge in thirty days during early twenty twenty six reflects market recognizing significance. DUSK token broke multi-month downtrend with expanding volume and higher lows signaling shift from accumulation to expansion phase. But technical strength alone doesn’t explain sustained interest. The fundamental narrative around compliant privacy for real-world assets attracts institutional attention creating genuine utility demand rather than speculative momentum. Long-term investors holding significant positions demonstrate conviction in vision rather than trading volatility.

When Architecture Determines Adoption

Traditional blockchain projects built infrastructure then searched for use cases. Dusk identified specific institutional requirements then built architecture meeting those needs. The difference shows in adoption patterns. Most blockchains remain dominated by speculation and DeFi experimentation. Institutions watch from sidelines unable adopting technology requiring unacceptable compromises. Dusk attracts regulated exchanges, licensed banks, and institutional investors because architecture specifically addresses their concerns rather than hoping they’ll adapt to crypto-native assumptions.

The NPEX partnership validates approach. Licensed stock exchange choosing blockchain platform represents endorsement impossible obtaining through marketing or speculation. Regulatory approval from Netherlands Authority for Financial Markets demonstrates technical and legal framework meeting institutional standards. The seventeen thousand five hundred active investors trusting exchange with capital show retail confidence follows institutional adoption when proper safeguards exist. This progression mirrors traditional finance evolution where institutional infrastructure enables retail participation rather than retail experimentation eventually attracting institutions.

The roadmap extending through twenty twenty six includes ETF launch, full Zedger implementation, MiCA CEX operation, and expanded custodian integration. Each milestone represents genuine institutional adoption requiring years of legal, regulatory, and technical work. Projects promising disrupting traditional finance typically struggle navigating regulatory requirements preventing actual deployment. Dusk spent years building relationships with regulators, exchanges, banks, and custodians creating foundation enabling compliant deployment rather than hoping adoption happens despite regulatory uncertainty.

The question remaining asks whether specialized architecture serving institutional needs captures significant market share from general-purpose blockchains or remains niche solution. Ethereum and Bitcoin established network effects making them default choices despite limitations for specific use cases. Dusk optimized for regulated securities creates better institutional experience but starts without established liquidity or developer ecosystem. Whether optimization for specific use case overcomes general-purpose network advantages determines blockchain specialization viability. The answer shapes how traditional finance embraces distributed ledger technology over coming decade. Dusk provides test case for whether purpose-built institutional infrastructure outcompetes retrofit attempts making retail-first blockchains serve professional markets. The next two years determine which approach wins.