📈 Tom Lee: BTC and ETH growth is inevitable

Money is in gold for now, crypto is moving sideways.

Once the hype around precious metals fades, liquidity will flow back into BTC and ETH.

🗣️🗣️ History 👇👇

For decades, gold and silver have been the go-to assets during uncertainty. War, inflation, currency weakness — people run to metals.

But in the last 15 years, a new contender stepped in: Bitcoin.

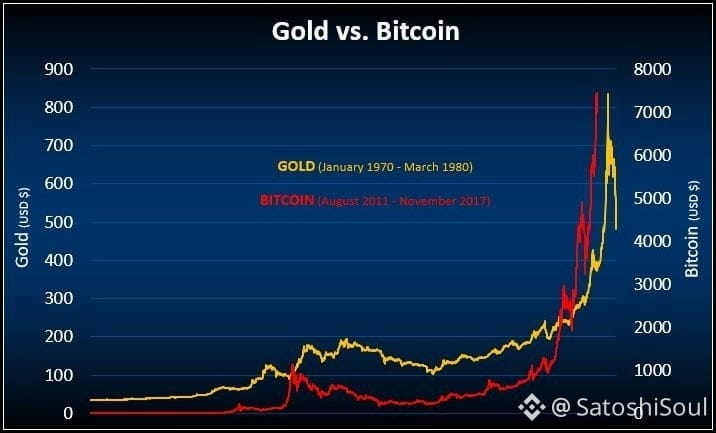

Bitcoin vs. Gold Correlation

Bitcoin and gold have long been compared as stores of value, with many considering Bitcoin the “digital gold” of the modern era. While gold has served as a monetary standard for millennia, Bitcoin introduces an innovative alternative with its decentralized, digital structure.

★WHY GOLD PRICES ARE RISING GLOBALLY IN 2026:🐎🐎

In 2026, gold has solidified its reputation as the ultimate "safe bet," reaching historic highs that have caught the attention of savers and investors globally. This week, the international spot price of gold shattered previous records, climbing past $5,500 per ounce.

Here is a breakdown of why this "gold rush" is happening in 2026:

GLOBAL Uncertainty AND "SAFE HAVENS"

CENTRAL BANKS ARE STOCKPILING

A WEAKENING US DOLLAR

INTEREST RATES AND INFLATIONINFLATION

⛔If you had to choose one asset to hold for the next 10 years,would it be Bitcoin, Gold, or Silver — and why?

#btc #GOLD_UPDATE $BTC

🤔 Capital rotation or another expectations trap?